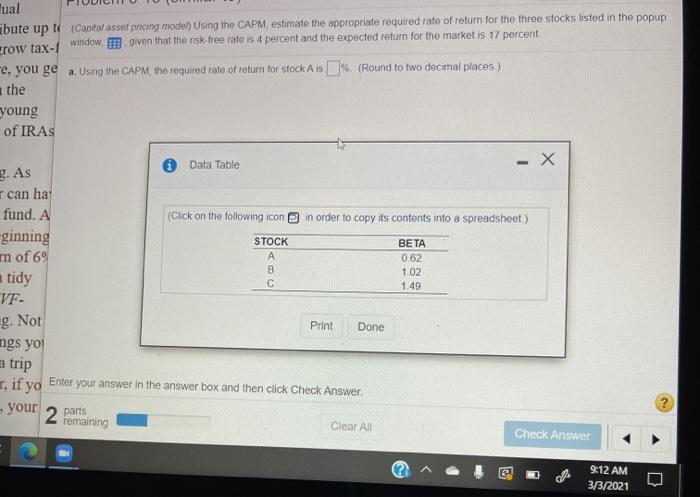

Question: ual Ebute up t (Capital asset pricing model) Using the CAPM estimate the appropriate required rate of return for the three stocks listed in the

ual Ebute up t (Capital asset pricing model) Using the CAPM estimate the appropriate required rate of return for the three stocks listed in the popup Erow tax-1 window given that the risk-free rate is 4 percent and the expected return for the market is 17 percent e. you ge a Using the CAPM the required rate of return for stock Ais (Round to two decimal places) the young of IRAS Data Table - X g. As r can hay (Click on the following icon in order to copy its contents into a spreadsheet) fund. A ginning mn of 69 tidy VF- STOCK A C BETA 0.62 1.02 1.49 g. Not Print Done mgs yol a trip 1. if yo Enter your answer in the answer box and then click Check Answer. - your 2 remaining parts Clear All Check Answer 9:12 AM 3/3/2021 J

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts