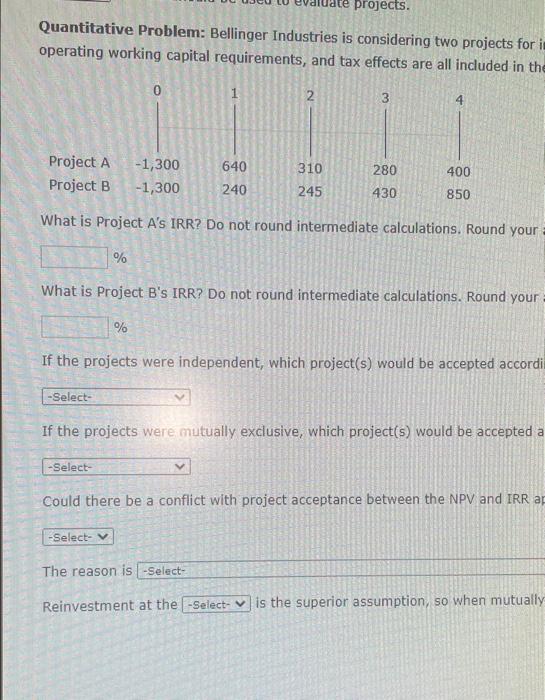

Question: uate projects. Quantitative Problem: Bellinger Industries is considering two projects for i operating working capital requirements, and tax effects are all included in the 0

uate projects. Quantitative Problem: Bellinger Industries is considering two projects for i operating working capital requirements, and tax effects are all included in the 0 2 2 3 Project A Project B -1,300 -1,300 280 400 640 240 310 245 430 850 What is Project A's IRR? Do not round intermediate calculations. Round your % What is Project B's IRR? Do not round intermediate calculations. Round your % If the projects were independent, which project(s) would be accepted accordi -Select- If the projects were mutually exclusive, which project(s) would be accepted a -Select- Could there be a conflict with project acceptance between the NPV and IRR ar -Select- The reason is -Select- Reinvestment at the -Select- is the superior assumption, so when mutually ects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects after-tax cash flows are shown on the time in below. Deprecation, ded in these cash flows. Both projects have 4 year lives, and they have risk characteristics similar to the firm's were project Delfinger's WACCH

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts