Question: ucturing Charges at Intel. Intel Corporation's cons statement appears in Exhibit 6.16 consolidated income LO 6-6 Note 15, which follows, explains the source of the

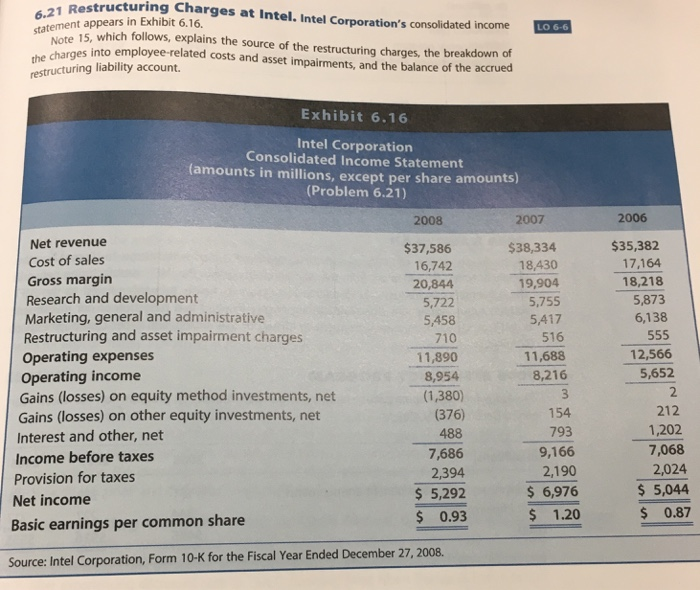

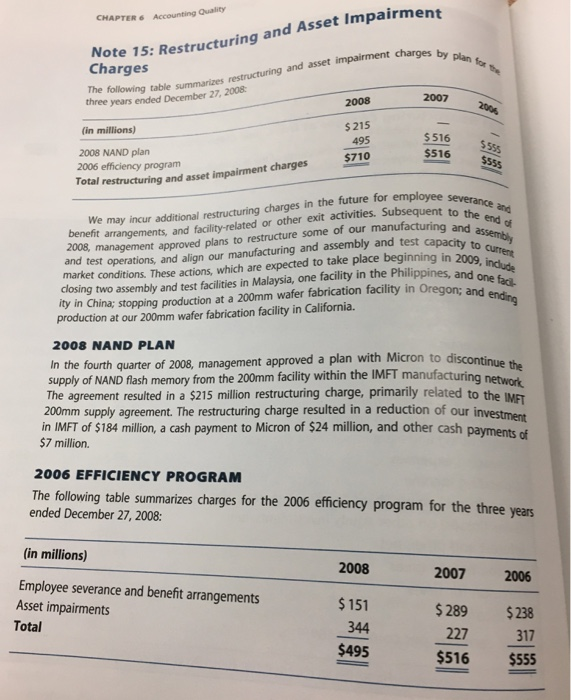

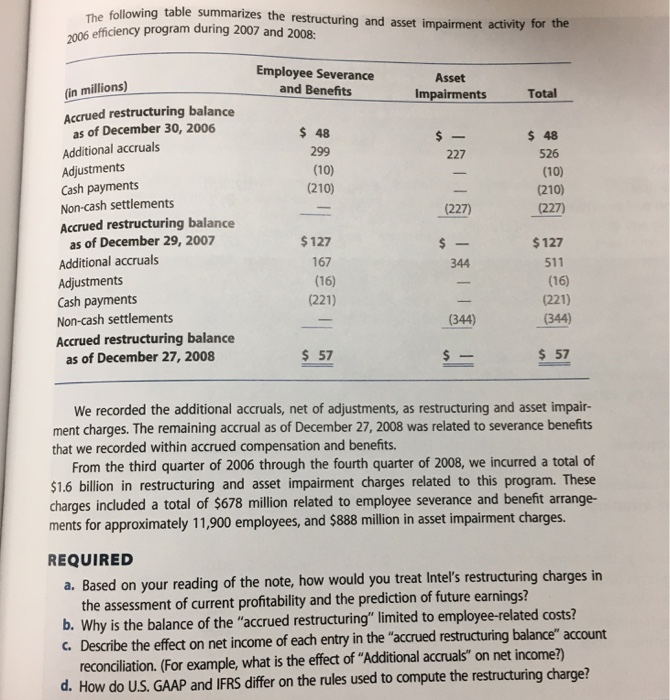

ucturing Charges at Intel. Intel Corporation's cons statement appears in Exhibit 6.16 consolidated income LO 6-6 Note 15, which follows, explains the source of the restructuring charges, the breakdown of charges into employee-related costs and asset impairments, and the balance of the accrued restructuring liability account. Exhibit 6.16 Intel Corporation Consolidated Income Statement (amounts in millions, except per share amounts) (Problem 6.21) 2008 2007 2006 Net revenue $37,586 $38,334 $35,382 17,164 18,218 5,873 6,138 Cost of sales 16,742 20,844 18,430 19,904 Gross margin Research and development Marketing, general and administrative Restructuring and asset impairment charges Operating expenses Operating income Gains (losses) on equity method investments, net Gains (losses) on other equity investments, net Interest and other, net Income before taxes Provision for taxes 5,755 5,417 516 11,688 8,216 5,722 5,458 710 11,890 8,954 (1,380) (376) 12,566 5,652 2 212 1,202 7,068 2,024 $5,044 s0.87 154 793 488 9,166 7,686 2,394 $5,292 0.93 2,190 $ 6,976 $ 1.20 Net income Basic earnings per common share Source: Intel Corporation, Form 10-K for the Fiscal Year Ended December 27, 2008. The following table summarizes the restructuring and asset impairment activity for the efficiency program during 2007 and 2008: Employee Severance and Benefits Asset in millions) Impairments Total Accrued restructuring balance as of December 30, 2006 Additional accruals Adjustments Cash payments Non-cash settlements Accrued restructuring balance s 48 299 (10) (210) s 48 526 (10) (210) (227) 227 (227) as of December 29, 2007 Additional accruals Adjustments Cash payments Non-cash settlements Accrued restructuring balance $127 167 (16) (221) $127 344 (16) (221) (344) (344) as of December 27, 2008 $ 57 S 57 We recorded the additional accruals, net of adjustments, as restructuring and asset impair- ment charges. The remaining accrual as of December 27, 2008 was related to severance benefits that we recorded within accrued compensation and benefits From the third quarter of 2006 through the fourth quarter of 2008, we incurred a total of $1.6 billion in restructuring and asset impairment charges related to this program. These charges included a total of $678 million related to employee severance and benefit arrange- ments for approximately 11,900 employees, and $888 million in asset impairment charges REQUIRED a. Based on your reading of the note, how would you treat Intel's restructuring charges in the assessment of current profitability and the prediction of future earnings? b. Why is the balance of the "accrued restructuring" limited to employee-related costs? . Describe the effect on net income of each entry in the "accrued restructuring balance" account reconciliation. (For example, what is the effect of "Additional accruals" on net income?) d. How do U.S. GAAP and IFRS differ on the rules used to compute the restructuring charge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts