Question: a. Create SPACE Matrix, supported by four related matrixes. b. Recommend a strategy that the company should adopt and justify the reason. Explain your recommendation

a. Create SPACE Matrix, supported by four related matrixes. b. Recommend a strategy that the company should adopt and justify the reason. Explain your recommendation not exceeding 150 words.

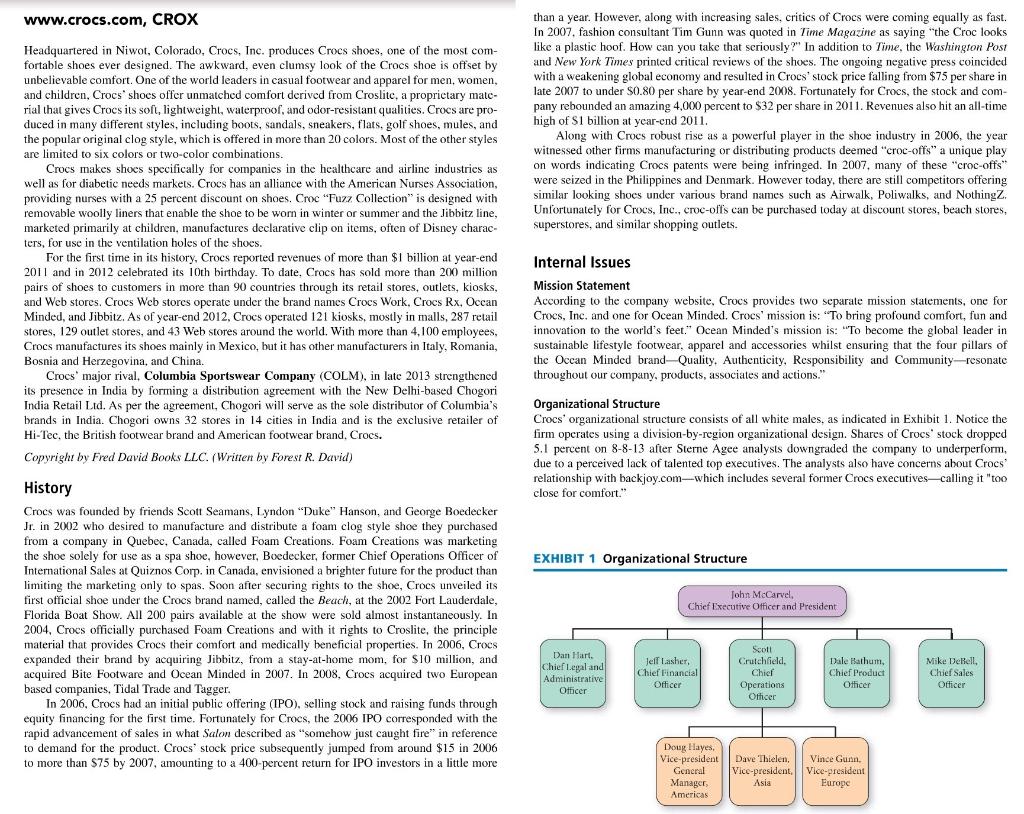

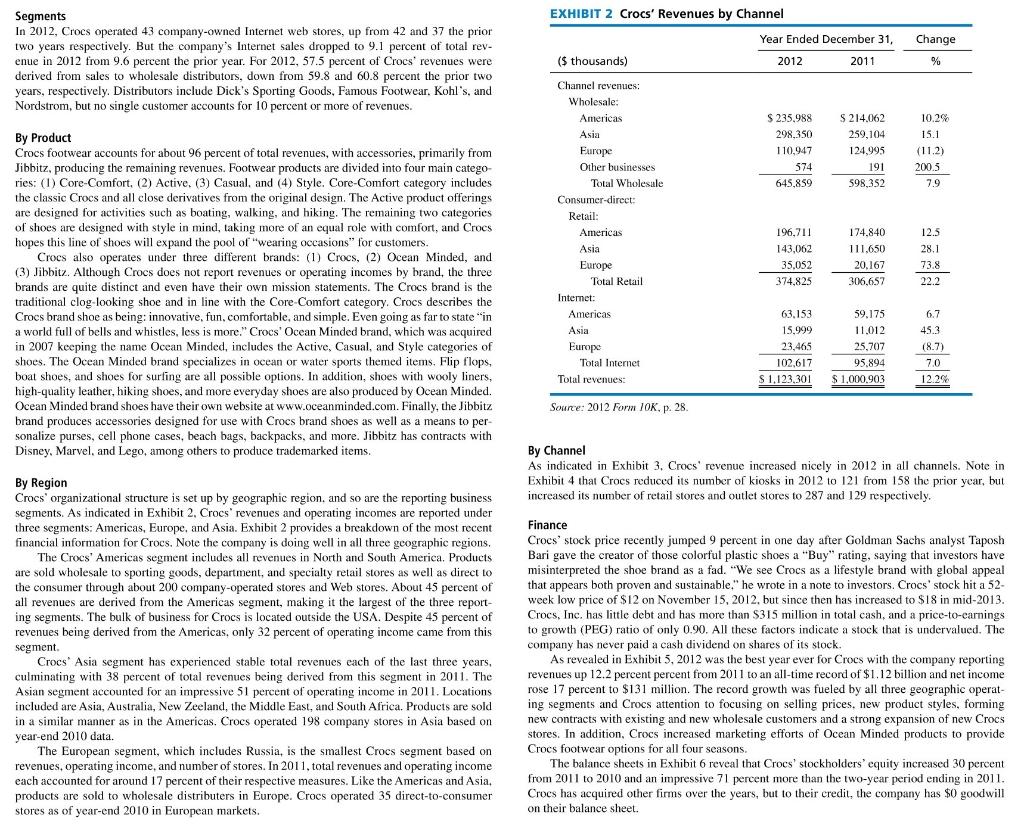

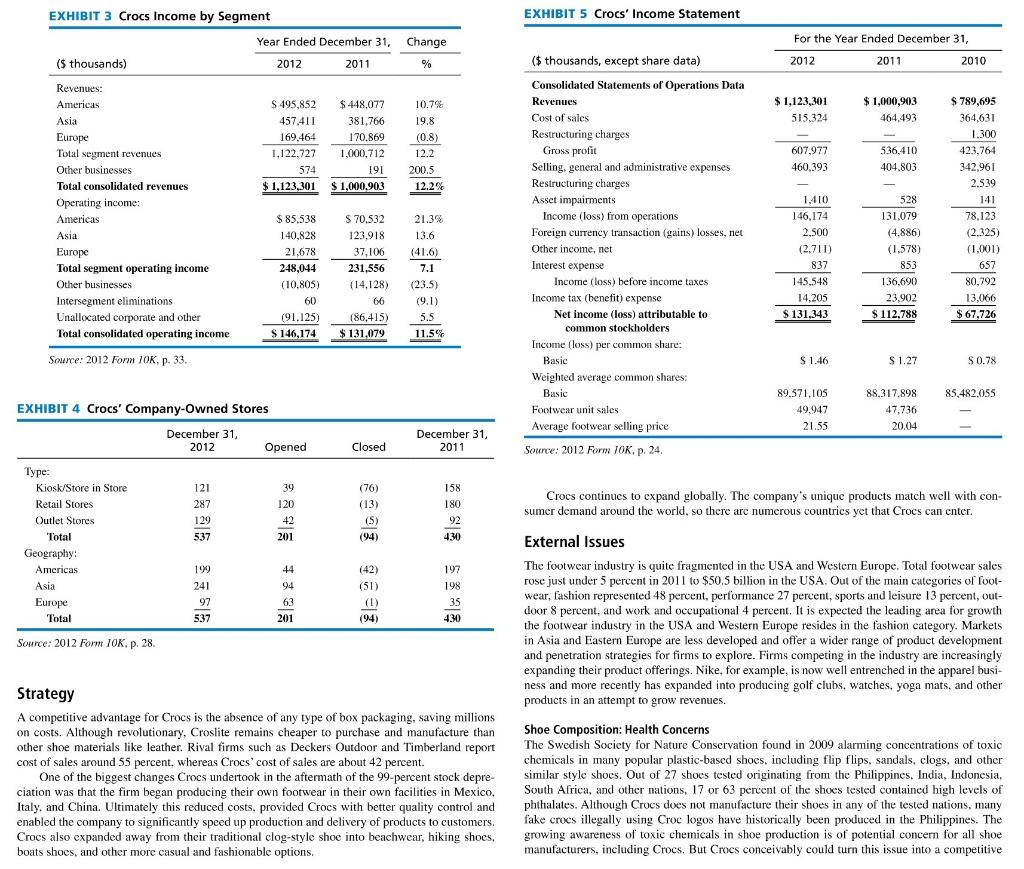

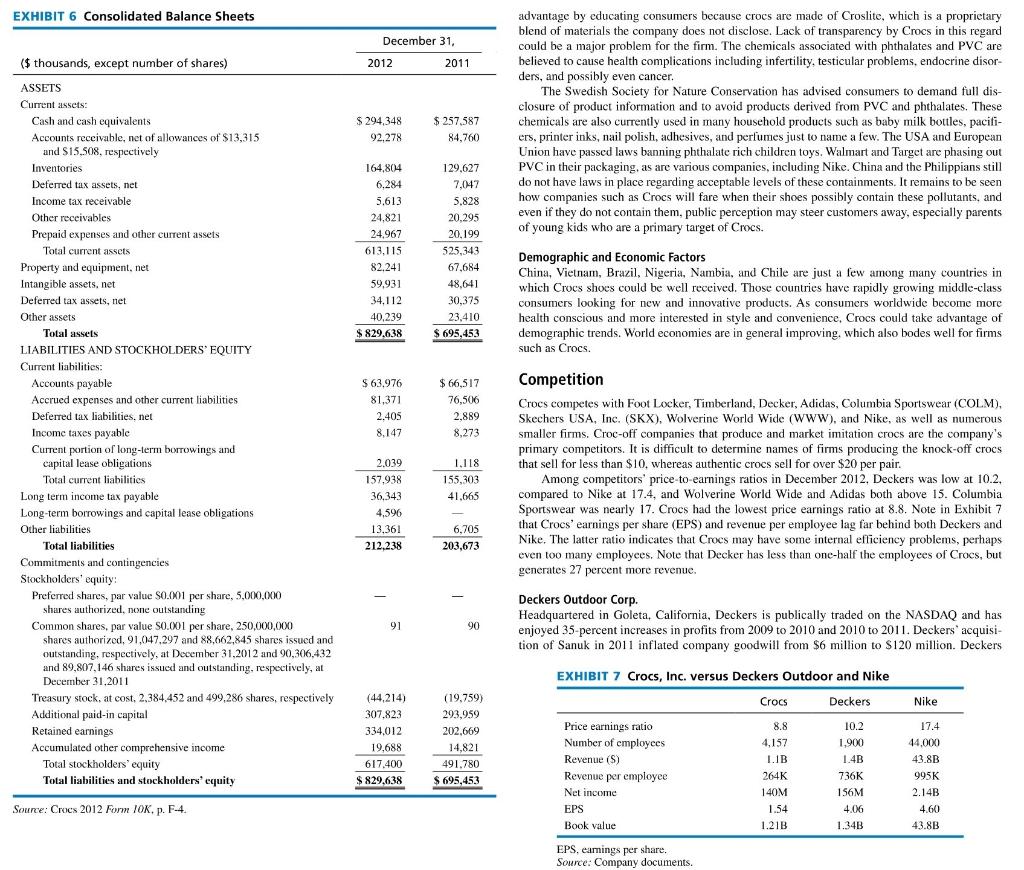

www.crocs.com, CROX than a year. However, along with increasing sales, critics of Crocs were coming equally as fast. In 2007, fashion consultant Tim Gunn was quoted in Time Magazine saying "the Croc looks like a plastic hoof. How can you take that seriously?" In addition to Time, the Washington Post and New York Times printed critical reviews of the shoes. The ongoing negative press coincided with a weakening global economy and resulted in Crocs' stock price falling from $75 per share in late 2007 to under $0.80 per share by year-end 2008. Fortunately for Crocs, the stock and com- pany rebounded an amazing 4,000 percent to $32 per share in 2011. Revenues also hit an all-time high of S1 billion at year-end 2011. Along with Crocs robust rise as a powerful player in the shoe industry in 2006, the year witnessed other firms manufacturing or distributing products deemed "croc-offs" a unique play on words indicating Crocs patents were being infringed. In 2007, many of these "croc-offs** were seized in the Philippines and Denmark. However today, there are still competitors offering similar looking shoes under various brand names such as Airwalk, Poliwalks, and NothingZ. Unfortunately for Crocs, Inc., croc-offs can be purchased today at discount stores, beach stores, superstores, and similar shopping outlets. Headquartered in Niwot, Colorado, Crocs, Inc. produces Crocs shoes, one of the most com- fortable shoes ever designed. The awkward, even clumsy look of Crocs shoe is offset by unbelievable comfort. One of the world leaders in casual footwear and apparel for men, women, and children, Crocs' shoes offer unmatched comfort derived from Croslite, a proprictary mate- rial that gives Crocs ils soft, lightweight, waterproof, and odor-resistant qualities. Croes are pro- duced in many different styles, including boots, sandals, sneakers, flats, golf shoes, mules, and the popular original clog style, which is offered in more than 20 colors. Most of the other styles are limited to six colors or two-color combinations. Crocs makes shoes specifically for companies in the healthcare and airline industries as well as for diabetic needs markets. Crocs has an alliance with the American Nurses Association, providing nurses with a 25 percent discount on shoes. Croc "Fuzz Collection" is designed with removable woolly liners that enable the shoe to be worn in winter or summer and the Jibbitz line, marketed primarily at children, manufactures declarative clip on items, often of Disney charac- ters, for use in the ventilation holes of the shoes. For the first time in its history, Crocs reported revenues of more than $1 billion at year-end 2011 and in 2012 celebrated its 10th birthday. To date. Crocs has sold more than 200 million pairs of shoes to customers in more than 90 countries through its retail stores, outlets, kiosks, and Web stores. Crocs Web stores operate under the brand names Crocs Work, Crocs Rx, Occan Minded, and Jibbitz. As of year-end 2012, Crocs operated 121 kiosks, mostly in malls, 287 retail stores, 129 outlet stores, and 43 Web stores around the world. With more than 4,100 employees, Crocs manufactures its shoes mainly in Mexico, but it has other manufacturers in Italy, Romania, Bosnia and Herzegovina, and China. Crocs major rival, Columbia Sportswear Company (COLM), in late 2013 strengthened its presence in India by forming a distribution agreement with the New Delhi-based Chogori India Retail Lid. As per the agreement, Chogori will serve as the sole distributor of Columbia's brands in India. Chogori owns 32 stores in 14 cities in India and is the exclusive retailer of Hi-Tec, the British footwear brand and American footwear brand. Crocs. Copyright by Fred David Books LLC. (Written by Forest R. David) Internal Issues Mission Statement According to the company website, Crocs provides two separate mission statements, one for Crocs, Inc. and one for Ocean Minded. Crocs' mission is: "To bring profound comfort, fun and innovation to the world's feet." Ocean Minded's mission is: "To become the global leader in sustainable lifestyle footwear, apparel and accessories whilst ensuring that the four pillars of the Occan Minded brand-Quality. Authenticity. Responsibility and Community-resonate throughout our company, products, associates and actions." Organizational Structure Crocs' organizational structure consists of all white males, as indicated in Exhibit 1. Notice the firm operates using a division-by-region organizational design. Shares of Croes' stock dropped 5.1 percent on 8-8-13 after Sterne Agee analysts downgraded the company to underperform, due to a perceived lack of talented top executives. The analysts also have concerns about Cro relationship with backjoy.com-which includes several former Crocs executives-calling it too close for comfort." EXHIBIT 1 Organizational Structure John McCarvel Chief Executive Officer and President History Crocs was founded by friends Scott Seamans, Lyndon "Duke" Hanson, and George Boedecker Jr. in 2002 who desired to manufacture and distribute a foam clog style shoe they purchased from a company in Quebec, Canada, called Foam Creations. Foam Creations was marketing the shoe solely for use as a spa shoe, however, Boedecker, former Chief Operations Officer of International Sales at Quiznos Corp. in Canada, envisioned a brighter future for the product than limiting the marketing only to spas. Soon after securing rights to the shoe, Crocs unveiled its first official shoe under the Crocs brand named, called the Beach, at the 2002 Fort Lauderdale, Florida Boat Show. All 200 pairs available at the show were sold almost instantaneously. In 2004, Crocs officially purchased Foam Creations and with it rights to Croslite, the principle material that provides Crocs their comfort and medically beneficial properties. In 2006, Crocs expanded their brand by acquiring Jibbitz, from a stay-at-home mom, for $10 million, and acquired Bite Footware and Ocean Minded in 2007. In 2008. Crocs acquired two European based companies, Tidal Trade and Tagger. In 2006. Crocs had an initial public offering (IPO), selling stock and raising funds through equity financing for the first time. Fortunately for Crocs, the 2006 IPO corresponded with the rapid advancement sales in what Salon described as "somehow just caught fire in reference to demand for the product. Croes' stock price subsequently jumped from around $15 in 2006 to more than $75 by 2007, amounting to a 400-percent return for IPO investors in a little more Dan Hart Chief Legal and Administrative Officer Jell Lasher, Chief Financial Scott Crutchfield Chief Operations Officer Dale Bathum Chief Product Officer Mike Deltell, Chief Sales Officer Otficer Doug Hayes, Vice-president General Manager, Americas Dave 'Thielen, Vince Gunn. Vice-president, Vice-president Asia Europe EXHIBIT 2 Crocs' Revenues by Channel Year Ended December 31, Segments In 2012, Crocs operated 43 company-owned Internet web stores, up from 42 and 37 the prior two years respectively. But the company's Internet sales dropped to 9.1 percent of total rev- enue in 2012 from 9.6 percent the prior year. For 2012, 57.5 percent of Crocs' revenues were derived from sales to wholesale distributors, down from 59.8 and 60.8 percent the prior two years, respectively. Distributors include Dick's Sporting Goods, Famous Footwear, Kohl's, and Nordstrom, but no single customer accounts for 10 percent or more of revenues. Change % ($ thousands) 2012 2011 10.2% 15.1 $ 235,988 298,350 110.947 574 645.859 S 214.062 259,104 124.995 191 598,352 (11.2) 200.5 7.9 Channel revenues: Wholesale: Americas Asia Europe Other businesses Total Wholesale Consumer-direct Retail: Americas Asia Europe Total Retail Internet: Americas Asia Europe Total Internet Total revenues: 196,711 143,062 35,052 374.825 174,840 111.650 20.167 306,652 12.5 28.1 73.8 By Product Crocs footwear accounts for about 96 percent of total revenues, with accessories, primarily from Jibbitz, producing the remaining revenues. Footwear products are divided into four main catego ries: (1) Core-Comfort. (2) Active. (3) Casual, and (4) Style. Core-Comfort category includes the classic Crocs and all close derivatives from the original design. The Active product offerings are designed for activities such as boating, walking, and hiking. The remaining two categories of shoes are designed with style in mind, taking more of an equal role with comfort, and Crocs hopes this line of shoes will expand the pool of wearing occasions" for customers. Crocs also operates under three different brands: (1) Crocs (2) Ocean Minded, and (3) Jibbitz. Although Crocs does not report revenues operating incomes by brand, the three brands are quite distinct and even have their own mission statements. The Crocs brand is the traditional clog looking shoe and in line with the Core Comfort category. Crocs describes the Crocs brand shoe as being innovative, fun, comfortable, and simple. Even going as far to state in a world full of bells and whistles, less is more." Crocs' Ocean Minded brand, which was acquired in 2007 keeping the name Ocean Minded, includes the Active, Casual, and Style categories of shoes. The Ocean Minded brand specializes in ocean or water sports themed items. Flip flops, boat shoes, and shoes for surfing are all possible options. In addition, shoes with wooly liners, high-quality leather, hiking shoes, and more everyday shoes are also produced by Ocean Minded. Ocean Minded brand shoes have their own website at www.oceanminded.com. Finally, the Jibbitz brand produces accessories designed for use with Crocs brand shoes as well as a means to per sonalize purses, cell phone cases, beach bags, backpacks, and more. Jibbitz has contracts with Disney, Marvel, and Lego, among others to produce trademarked items. 222 59,175 63,153 15.999 23,465 102,617 $ 1,123,301 6.7 45.3 (8.7) 11.012 25,707 95.894 $ 1.000.902 70 12.20 Source: 2012 Form 10K p. 28 By Channel As indicated in Exhibit 3. Crocs' revenue increased nicely in 2012 in all channels. Note in Exhibit 4 that Crocs reduced its number of kiosks in 2012 to 121 from 158 the prior year, but increased its number of retail stores and outlet stores to 287 and 129 respectively, By Region Crocs' organizational structure is set up by geographic region, and so are the reporting business segments. As indicated in Exhibit 2. Crocs' revenues and operating incomes are reported under three segments: Americas, Europe, and Asia. Exhibit 2 provides a breakdown of the most recent financial information for Crocs. Note the company is doing well in all three geographic regions. The Crocs' Americas segment includes all revenues North and South America. Products are sold wholesale to sporting goods, department, and specialty retail stores as well direct the consumer through about 200 company-operated stores and Web stores. About 45 percent of all revenues are derived from the Americas segment, making it the largest of the three report ing segments. The bulk of business for Crocs is located outside the USA. Despite 45 percent of revenues being derived from the Americas, only 32 percent of operating income came from this segment Crocs Asia segment has experienced stable total revenues each of the last three years, culminating with 38 percent of total revenues being derived from this segment in 2011. The Asian segment accounted for an impressive 51 percent of operating income in 2011. Locations included are Asia, Australia, New Zeeland, the Middle East, and South Africa. Products are sold in a similar manner as in the Americas. Crocs operated 198 company stores in Asia based on year-end 2010 data. The European segment, which includes Russia, is the smallest Crocs segment based on revenues, operating income, and number of stores. In 2011, total revenues and operating income each accounted for around 17 percent of their respective measures. Like the Americas and Asia, products are sold to wholesale distributers in Europe. Crocs operated 35 direct-to-consumer stores as of year-end 2010 in European markets. Finance Crocs' stock price recently jumped 9 percent one day after Goldman Sachs analyst Taposh Bari gave the creator of those colorful plastic shoes a "Buy rating, saying that investors have misinterpreted the shoe brand as a fad. "We see Crocs as a lifestyle brand with global appeal that appears both proven and sustainable," he wrote in a note to investors. Crocs' stock hit a 52- week low price of $12 on November 15, 2012, but since then has increased to $18 in mid-2013. Crocs, Inc. has little debt and has more than $315 million in total cash, and a price-to-carnings to growth (PEG) ratio of only 0.90. All these factors indicate a stock that is undervalued. The company has never paid a cash dividend on shares of its stock, As revealed in Exhibit 5, 2012 was the best year ever for Crocs with the company reporting revenues up 12.2 percent percent from 2011 to an all-time record of $1.12 billion and net income rose 17 percent to $131 million. The record growth was fueled by all three geographic operat- ing segments and Crocs attention to focusing on selling prices, new product styles, forming new contracts with existing and new wholesale customers and a strong expansion of new Crocs stores. In addition, Crocs increased marketing efforts of Ocean Minded products to provide Crocs footwear options for all four seasons. The balance sheets in Exhibit 6 reveal that Crocs' stockholders' equity increased 30 percent from 2011 to 2010 and an impressive 71 percent more than the two-year period ending in 2011. Crocs has acquired other firms over the years, but to their credit, the company has $0 goodwill on their balance sheet. EXHIBIT 5 Crocs' Income Statement For the Year Ended December 31, 2012 2011 2010 ($ thousands, except share data) $1,123,301 515,324 $ 1,000,903 464,493 Consolidated Statements of Operations Data Revenues Cost of sales Restructuring charges Gross profit Selling, general and administrative expenses Restructuring charges Asset impairments Income (loss) from operations Foreign currency transaction (gains) losses, net Other income, net 607.977 460.393 EXHIBIT 3 Crocs Income by Segment Year Ended December 31, Change ($ thousands) 2012 2011 % Revenues: Americas $ 495,852 $448.077 10.7% Asia 457.411 381.766 19.8 Europe 169.464 170.869 (0.8) Total segment revenues 1,122,727 1,000,712 12.2 Other businesses 574 191 200.5 Total consolidated revenues $ 1,123,301 $1,000,903 12.2% Operating income: Americas $ 85.538 $ 70,532 21.39 Asia 140,828 123,918 13.6 Europe 21.678 37,106 (41.6) . Total segment operating income 248,044 231,556 7.1 Other businesses (10,805) (14,128) (23.5) Intersegment eliminations 60 66 (9.1) Unallocated corporate and other (91.125) (86,415) 5.5 Total consolidated operating income $ 146,174 $ 131,079 11.5% Source: 2012 Form 10K, p. 33. 536,410 404.803 $ 789,695 364.631 1.300 423,764 342.961 **1901 2.539 141 78,123 (2.325) (1,001) 657 1.410 146,174 2,500 (2.711) 837 145.548 Interest expense 528 131,079 (4.886) (1.578) 853 136,690 23.902 $112.788 80,792 14.205 13,066 $ 67,726 $ 131,343 $ 1.46 $ 1.27 Income (loss) before income taxes Income tax (benefit) expense Net income (loss) attributable to common stockholders Income (loss) per common share: Basic Weighted average common shares: Basic Footwear unit sales Average footwear selling price Source: 2012 Form TOK, p. 24 S0.78 85,482.055 EXHIBIT 4 Crocs' Company-Owned Stores December 31, 2012 Opened 89.571.105 49,947 21.55 88.317.898 47.736 20.04 December 31, 2011 Closed 158 121 287 129 537 39 120 42 180 (76) (13) (5) (94) Crocs continues to expand globally. The company's unique products match well with con- sumer demand around the world, so there are numerous countrics yet that Crocs can enter. 92 430 201 Type: Kiosk/Store in Store Retail Stores Outlet Stores Total Geography: Americas Asia Europe Total 197 1992 241 198 44 94 63 201 (42) (51) (1) (94) 97 537 35 430 Source: 2012 Form 10K. p. 28. Strategy A competitive advantage for Crocs is the absence of any type of box packaging, saving millions on costs. Although revolutionary, Croslite remains cheaper to purchase and manufacture than other shoe materials like leather. Rival firms such as Deckers Outdoor and Timberland report cost of sales around 55 percent, whereas Crocs' cost of sales are about 42 percent. One of the biggest changes Crocs undertook in the aftermath of the 99 percent stock depre- ciation was that the firm began producing their own footwear in their own facilities in Mexico, Italy, and China. Ultimately this reduced costs, provided Crocs with better quality control and enabled the company to significantly speed up production and delivery of products to customers. Crocs also expanded away from their traditional clog-style shoe into beachwear, hiking shoes, boats shoes, and other more casual and fashionable options. External Issues The footwear industry is quite fragmented in the USA and Western Europe. Total footwear sales rose just under 5 percent in 2011 to $50.5 billion in the USA. Out of the main categories of foot- wear, fashion represented 48 percent, performance 27 percent, sports and leisure 13 percent, out- door 8 percent, and work and occupational 4 percent. It is expected the leading area for growth the footwear industry in the USA and Western Europe resides in the fashion category. Markets in Asia and Eastern Europe are less developed and offer a wider range of product development and penetration strategies for firms to explore. Firms competing in the industry are increasingly expanding their product offerings. Nike, for example, is now well entrenched in the apparel busi- ness and more recently has expanded into producing golf clubs, watches, yoga mats, and other products in an attempt to grow revenues. Shoe Composition: Health Concerns The Swedish Society for Nature Conservation found in 2009 alarming concentrations of toxic chemicals in many popular plastic-based shoes, including flip flips, sandals, clogs, and other similar style shoes. Out of 27 shocs tested originating from the Philippines, India, Indonesia, South Africa, and other nations, 17 or 63 percent of the shoes tested contained high levels of phthalates. Although Crocs does not manufacture their shoes in any of the tested nations, many fake crocs illegally using Croc logos have historically been produced in the Philippines. The growing awareness of toxic chemicals in shoe production is of potential concern for all shoe manufacturers, including Crocs. But Crocs conceivably could turn this issue into a competitive EXHIBIT 6 Consolidated Balance Sheets December 31, 2012 2011 ($thousands, except number of shares) $ 294,348 92,278 $ 257,587 84,760 164,804 6,284 5.613 24,821 129,627 7,047 5.828 20.295 advantage by educating consumers because crocs are made of Croslite, which is a proprietary blend of materials the company does not disclose. Lack of transparency by Crocs in this regard could be a major problem for the firm. The chemicals associated with phthalates and PVC are believed to cause health complications including infertility, testicular problems, endocrine disor- ders, and possibly even cancer. The Swedish Society for Nature Conservation has advised consumers to demand full dis- closure of product information and to avoid products derived from PVC and phthalates. These chemicals are also currently used in many household products such as baby milk bottles, paciti- ers, printer inks, nail polish, adhesives, and perfumes just to name a few. The USA and European Union have passed laws banning phthalate rich children toys, Walmart and Target are phasing out PVC in their packaging, as are various companies, including Nike. China and the Philippians still do not have laws in place regarding acceptable levels of these containments. It remains to be seen how companies such as Crocs will fare when their shoes possibly contain these pollutants, and even if they do not contain them, public perception may steer customers away, especially parents of young kids who are a primary target of Crocs. Demographic and Economic Factors China, Vietnam, Brazil, Nigeria, Nambia, and Chile are just a few among many countries in which Crocs shoes could be well received. Those countries have rapidly growing middle-class consumers looking for new and innovative products. As consumers worldwide become more health conscious and more interested in style and convenience. Crocs could take advantage of demographic trends. World economies are in general improving, which also bodes well for firms such as Crocs. 24.967 20.199 613,115 82.241 59,931 34,112 40,239 $ 829,638 525,343 67.684 48,641 30,375 23,410 $ 695,453 ASSETS Current assets: Cash and cash equivalents Accounts receivable, net of allowances of $13,315 and S15,508, respectively Inventories Deferred tax assets, net Income tax receivable Other receivables Prepaid expenses and other current assets Total current assets Property and equipment, net Intangible assets, net Deferred tax assets, net Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY ' Current liabilities: Accounts payable Accrued expenses and other current liabilities Deferred tax liabilities, net Income taxes payable Current portion of long-term borrowings and capital lease obligations Total current liabilities Long term income tax payable Long-term borrowings and capital lease obligations ... Other liabilities Total liabilities Commitments and contingencies Stockholders' equity: Preferred shares, par value $0.001 per share, 5,000,000 shares authorized, none outstanding Common shares, par value 0.001 per share, 250,000,000 shares authorized, 91,047,297 and 88,662,845 shares issued and outstanding, respectively, at December 31,2012 and 90,306,432 and 89,807,146 shares issued and outstanding, respectively, at December 31.2011 Treasury stock, at cost, 2,384,452 and 499,286 shares, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive income Total stockholders' equity Total liabilities and stockholders' equity $ 63,976 81,371 2.405 8,147 $ 66,517 76,506 2.889 8,273 1.118 155,303 41.665 2.039 157,938 36,343 4,596 13.361 212,238 Competition Crocs competes with Foot Locker, Timberland, Decker, Adidas, Columbia Sportswear (COLM), Skechers USA, Inc. (SKX), Wolverine World Wide (Www), and Nike, as well as numerous smaller firms. Croc-off companies that produce and market imitation croes are the company's primary competitors. It is difficult to determine names of firms producing the knock-off crocs that sell for less than $10, whereas authentic crocs sell for over $20 per pair. Among competitors' price-to-earnings ratios in December 2012 Deckers was low at 10.2. compared to Nike at 17.4, and Wolverine World Wide and Adidas both above 15. Columbia Sportswear was nearly 17. Crocs had the lowest price earnings ratio at 8.8. Note in Exhibit 7 that Crocs' earnings per share (EPS) and revenue per employee lag far behind both Deckers and Nike. The latter ratio indicates that Crocs may have some internal efficiency problems, perhaps even too many employees. Note that Decker has less than one-half the employees of Croes, but generates 27 percent more revenue. 6,705 203,673 91 90 Deckers Outdoor Corp. Headquartered in Goleta, California, Deckers is publically traded on the NASDAQ and has enjoyed 35-percent increases in profits from 2009 to 2010 and 2010 to 2011. Deckers' acquisi- tion of Sanuk in 2011 inflated company goodwill from $6 million to S120 million. Deckers EXHIBIT 7 Crocs, Inc. versus Deckers Outdoor and Nike Crocs Deckers Nike (44.214) ) 307,823 334,012 19.688 617.400 $ 829.638 (19,759) 293,959 202.669 14,821 491.780 $ 695,453 8.8 4,157 Price earnings ratio Number of employees Revenue (S) Revenue per employee Net income EPS Book value EPS, earnings per share. Source: Company documents. 1.1B 264K 140M 1.54 1.21B 10.2 1,900 1.4B 736K 156M 4.0X6 1.34B 17.4 44,000 43.83 995K 2.14B 4.60 43.83 Source: Crocs 2012 Form 10K, p. 7-4. designs, manufactures, and markets footwear and accessory luxury items ranging apparel to handbags. Deckers designs products for cold weather applications, hiking, amphibious foot- wear, and more. Deckers' popular UGG brand, accounted for 87 percent of 2011 revenues. Under the firm's Teva brand, Deckers offers what the company calls, rugged outdoor travel shoes. Other brands offered include Sanuk, TSUBO, Ahnu and MOZO. These brands produce items ranging from high-end casual footwear to amphibious footwear products. To reduce Deckers' dependence on their UGG brand for revenue, Sanuk was purchased in 2011 for $120 million plus future payments for five years based on revenues the brand generates. Deckers sells its products mainly through third-party retail stores, but they also own outlet stores, and in addition sell from the company website. Deckers products are available world- wide in the United States, Europe, Canada, Australia, Asia, and Latin America. Deckers UGG brand, made with luxury sheepskin, is currently the company's most popular product. main- tain strong sales, Deckers introduces a consistent flow of new product variations in the fall and spring seasons, along with year-round styles. To expand the UGG Brand, Deckers men expanding the brand globally, and creating additional products such as handbags to supple- ment the shoe sales. Pricing for the UGG brand is considered mid- to upper-priced luxury. Teva and Sanuk are the two other principle brands offered by Deckers. The Teva brand has evolved from sports scandals to also include open- and closed-toe outdoor-themed foot- wear. In addition, the Teva brand has evolved to include light hiking, amphibious footwear, and travel shoes. Most recently, Deckers introduced an insulated boot under the Teva brand. Sanuk revolves almost entirely around the surf community Deckers' stock price hit its all-time closing high of $117.66 on October 28, 2011, but from there it has been a steep and rapid decline, down to its lowest level in three years, S28.63 on October 31, 2012. Since then, though, Deckers' stock has been increasing nicely. However, international subsidiary sales declined 14.6 percent. On a combined basis. Skechers retail business sales grew 13.9 percent. Domestic retail sales grew 13.2 percent, and the com- pany added 23 new domestic and 4 new outside-U.S. stores. The Future If Croslite is indeed free of phthalates, then (a) a huge marketing campaign by Crocs may be worthwhile in the future to educate consumers, and (b) numerous health-related specialty areas exist for Croes to develop new products. If Croslite is not free of phthalates, Crocs, Inc. should correct this problem as quickly as possible while the exact composition of its shoes is a secret Crocs could in some manner follow the lead of Nike and Deckers regarding (a) diversifica- tion into accessory items. (b) expansion into other countries, and (c) development of new prod- ucts. There is nothing wrong with being a fast follower, as evidenced by firms such as Samsung doing quite well following Apple's first-mover advantage strategy. The Croslite material perhaps has many undiscovered marketable applications, so the company could devote more resources to research and development to develop innovative new products. It may be in Crocs best interest to take legal action against croc-off imitation shoes, espe- cially against firms that produce nearly identical-looking shoes. Despite this and other external threats, Crocs has performed admirably in recent years, but a clear strategic plan is still needed help assure continued success. Crocs plans to open about 90 new stores in 2013 but analysts question whether this is a desired strategy. Develop a three-year strategic plan for Crocs based on sound strategic-management tools and techniques. is targeting Nike Headquartered in Beaverton, Oregon, Nike specializes in the design and development of foot- wear, apparel, sports equipment, and accessories for men, women, and children worldwide. The company also markets their products to college and professional sports teams. Nike distributes products under the Converse, Chuck Taylor All Star, Hurley, and One Star trademarks, among others. The Hurley brand produces sandals and shoes designed for the surf boarding community, competes directly with Crocs Ocean Minded products, Nike's Cole Haan brand designs reflective shoes for night life and other evening outings best competing with the more stylish brands of shoes Crocs develops. Nike and Crocs both develop and market shoes for golfers. Nike sells its products mainly through retail stores and the company website, but Nike has its own retail stores and outlet stores. To its credit and financial soundness, Nike has goodwill of only $201 million despite numerous acquisitions in Nike's history. Of late, however, Nike has been divesting brands. In late 2012, Nike sold its Cole Haan handbag and shoe brand to private equity firm Apax Partners for $570 million and also sold its Umbro football brand to Iconix Brand Group for $225 million. Skechers USA Headquartered in Manhattan Beach, California, Skechers' Chief Executive Officer Robert Greenberg leads this firm that designs and sells more than 3,000 styles of lifestyle and athletic footwear (oxfords, boots, sandals, sneakers, training shoes, and semi-dressy shoes) for men, women, and children. Skechers also offers fashion and street-focused footwear under the Marc Ecko, Zoo York, and Mark Nason brands. Its shoes are sold through department and specialty stores in more than 100 countries, as well as in some 330 company-owned concept and outlet stores and on its website. Sketchers footwear is manufactured primarily by Chinese contractors. For the third quarter of 2012. Skechers sales grew 4.2 percent $429,4 million from the prior-year quarter, reflecting excellent performance across company-owned retail businesses, domestic wholesale, and international distributors. The company's domestic wholesale sales were up 7.2 percent, reflecting a 9.1-percent increase in pairs shipped, coupled with a strong growth across kids and performance divisions. Sales grew 10.9 percent in the quarter for the company's international distributor, reflecting strong growth across Pan-Asian distribu- tors, Middle East, Indonesia, Philippines, South Korea, Taiwan, New Zealand, and AustraliaStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts