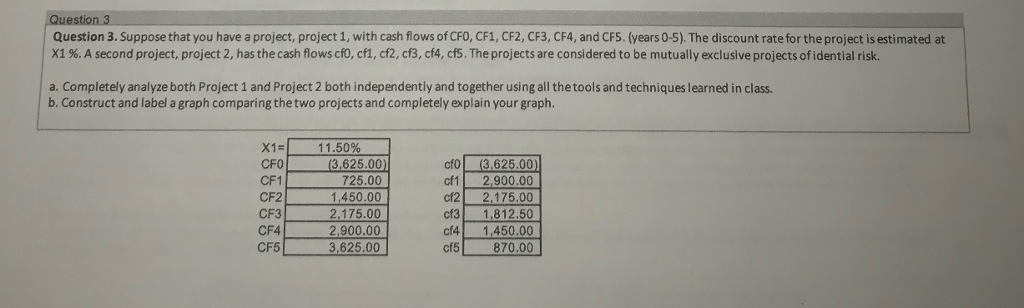

Question: ues Question 3. Suppose that you have a project, project 1, with cash flows of CFO, CF1, CF2, CF3, CF4, and CF5. (years 0-5). The

ues Question 3. Suppose that you have a project, project 1, with cash flows of CFO, CF1, CF2, CF3, CF4, and CF5. (years 0-5). The discount rate for the project is estimated at X1 % A second project, project 2, has the cash flows cf0, cf, cf2, cf3, c14, cf5. The projects are considered to be mutually exclusive projects of idential risk a. Completely analyze both Project 1 and Project 2 both independently and together using all thetools and techniques learned in class b. Construct and label a graph comparing thetwo projects and completely explain your graph X1-1 11.50% CF0 CF1 CF2 CF3 CF4 CF5 (3.625.00) cfo (3,625.00) 2,900.00 725.00 1,450.00 2.175.00 2.900.00 3,625.00 cf1 cf2 2,175.00 cf3 1,812.50 cf4 1450.00 cf 870.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts