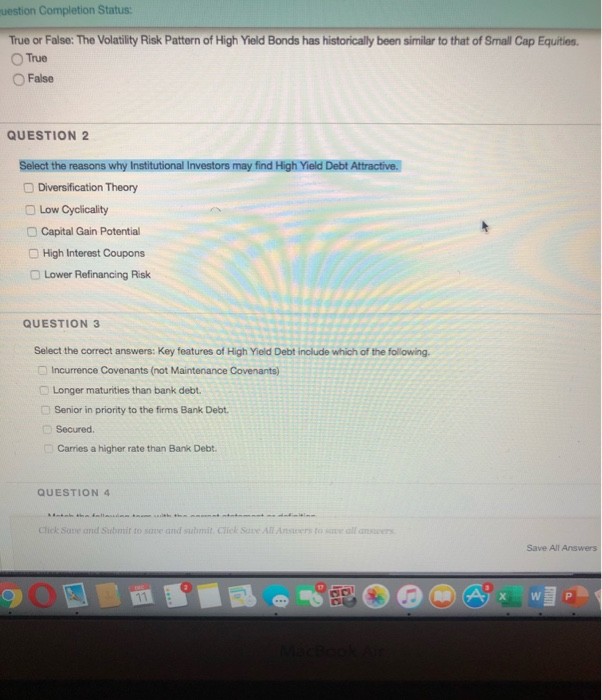

Question: uestion Completion Status: True or False: The Volatility Risk Pattern of High Yield Bonds has historically been similar to that of Small Cap Equities. True

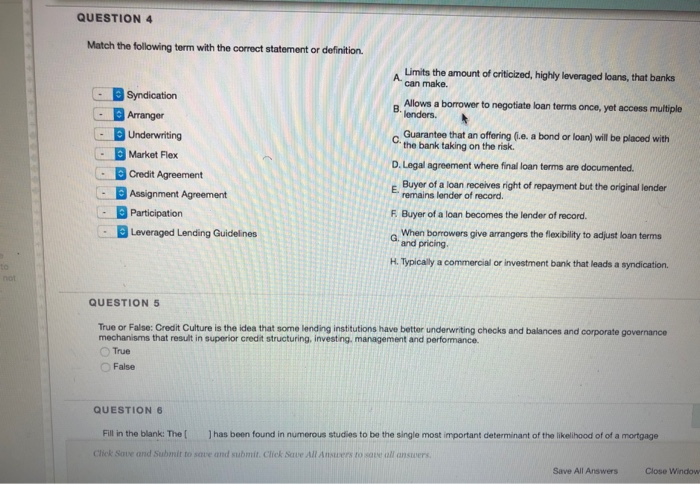

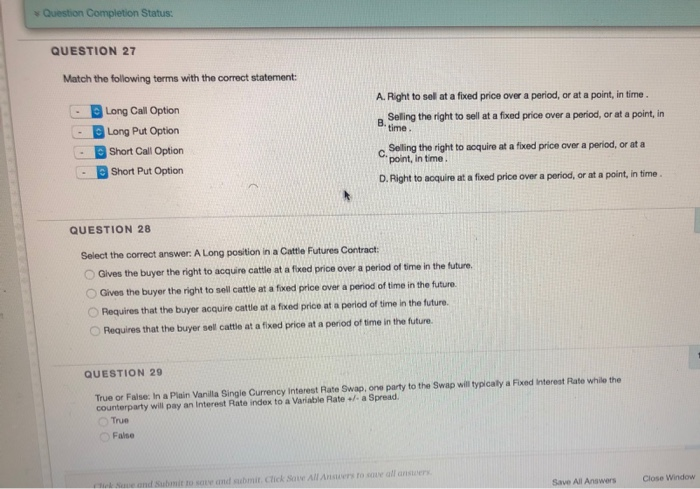

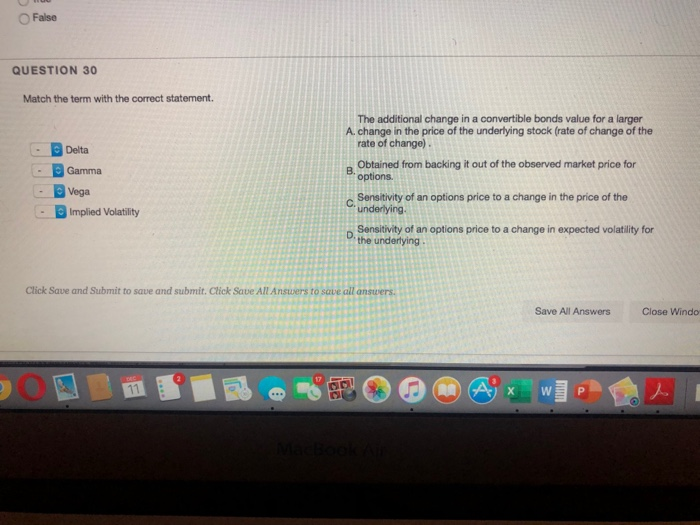

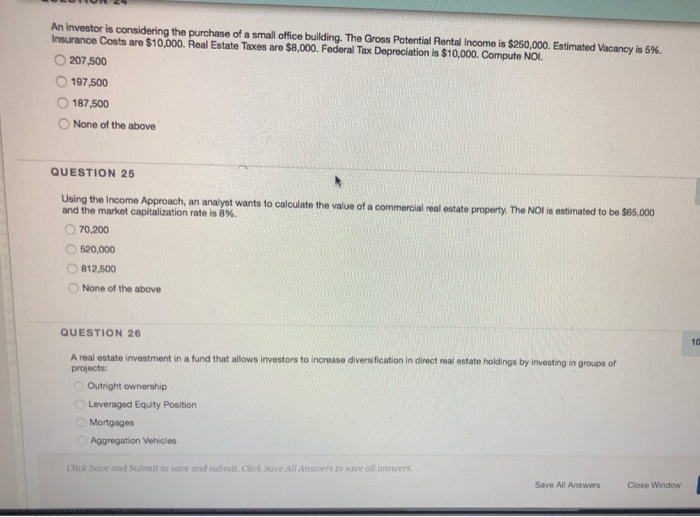

uestion Completion Status: True or False: The Volatility Risk Pattern of High Yield Bonds has historically been similar to that of Small Cap Equities. True False QUESTION 2 Select the reasons why Institutional Investors may find High Yield Debt Attractive Diversification Theory Low Cyclicality Capital Gain Potential High Interest Coupons Lower Refinancing Risk QUESTION 3 Select the correct answers:Key features of High Yield Debt include which of the following Incurrence Covenants (not Maintenance Covenants) Longer maturities than bank debt. Senior in priority to the firms Bank Debt. Secured. Carries a higher rate than Bank Debt. QUESTION 4 Save All Answers QUESTION 4 Match the following term with the correct statement or definition Limits the amount of criticized, highly leveraged loans, that banks can make Allows a borrower to negotiate loan terms once, yet access multiple Binders. - - - - - - - Syndication Arranger Underwriting Market Flex Credit Agreement Assignment Agreement Participation Leveraged Lending Guidelines Guarantee that an offering (e. a bond or loan) will be placed with the bank taking on the risk. D. Legal agreement where final loan terms are documented. Buyer of a loan receives right of repayment but the original lender remains lender of record. 5 Buyer of a loan becomes the lender of record When borrowers give arrangers the flexibility to adjust loan terms G. and pricing H. Typically a commercial or investment bank that leads a syndication QUESTION 5 True or False Credit Culture is the idea that some lending institutions have better underwriting checks and balances and corporate governance mechanisms that result in superior credit structuring, Investing, management and performance. True False QUESTION 6 Fill in the blank: The Thas been found in numerous studies to be the single most important determinant of the likelihood of of a mortgage Click Save and submit to save and submit. Click Save All Anterto Santo antes Save All Answers Close Window Question Completion Status: QUESTION 27 Match the following terms with the correct statement: A. Right to sell at a fixed price over a period, or at a point in time Selling the right to sell at a fixed price over a period, or at a point, in Bine - - - - Long Call Option Long Put Option Short Call Option Short Put Option Selling the right to acquire at a fixed price over a period, or at a point in time. D. Right to acquire at a fixed price over a period, or at a point in time. QUESTION 28 Select the correct answer: A Long position in a Cattle Futures Contract: Glves the buyer the right to acquire cattle at a fixed price over a period of time in the future Gives the buyer the right to sell cattle at a fixed price over a period of time in the future Requires that the buyer acquire cattle at a fixed price at a period of time in the future. Requires that the buyer selcattle at a fixed price at a period of time in the future QUESTION 29 True or False In a Plain Vanilla Single Currency Interest Rate Swap, one party to the Swap wil typicaly a Fixed interest Rate while the counterparty will pay an interest Rate index to a variable Rate la Spread True False Save All Answers Close Window False QUESTION 30 Match the term with the correct statement. - - Delta Gamma Vega Implied Volatility The additional change in a convertible bonds value for a larger A. change in the price of the underlying stock (rate of change of the rate of change) Obtained from backing it out of the observed market price for options. Sensitivity of an options price to a change in the price of the underlying Sensitivity of an options price to a change in expected volatility for the underlying - Click Save and Submit to save and submit. Click Save All Answers to sau Save All Answers Close Windo An investor is considering the purchase of a small office building. The Gross Potential Rental Income is $250,000. Estimated Vacancy is 5% Insurance Costs are $10,000. Real Estate Taxes are $8,000. Federal Tax Depreciation is $10,000. Compute NOI. 207,500 197,500 187,500 None of the above QUESTION 25 Using the Income Approach, an analyst wants to calculate the value of a commercial real estate property. The NOI is estimated to be $65.000 and the market capitalization rate is 8%. 70,200 520,000 812,500 None of the above QUESTION 26 A real estate investment in a fund that allows investors to increase diversification in direct real estate holdings by investing in groups of projects Outright ownership Leveraged Equity Position Mortgages Aggregation Vehicles Chick Save and submit to see and submit Chick Se All Answers to save all answers Save All Answers Close Window

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts