Question: uip with risk aversion.... I. UIP with Risk Aversion 1. Let the nominal exchange rate at time t denoted by St (i.e., the number of

uip with risk aversion....

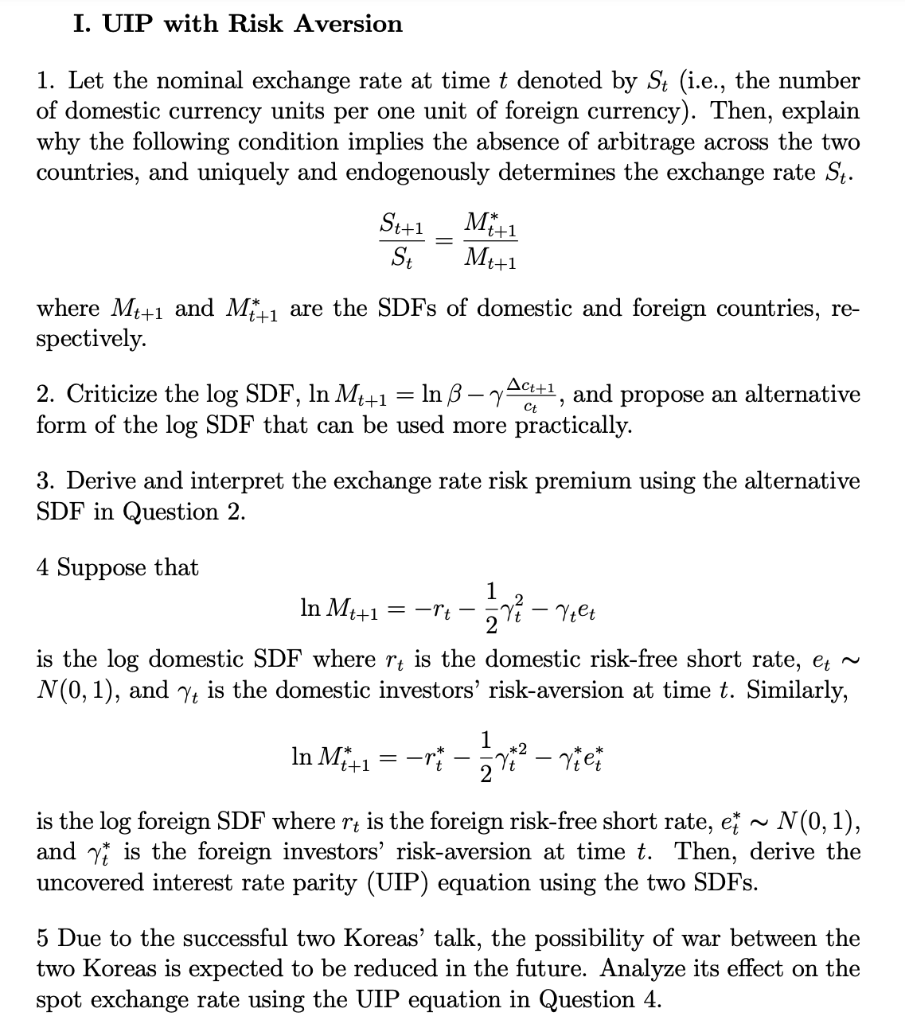

I. UIP with Risk Aversion 1. Let the nominal exchange rate at time t denoted by St (i.e., the number of domestic currency units per one unit of foreign currency). Then, explain why the following condition implies the absence of arbitrage across the two countries, and uniquely and endogenously determines the exchange rate St. M*+1 St+1 St Mt+1 where Mt+1 and Mi-1 are the SDFs of domestic and foreign countries, re- spectively. Act+1 2. Criticize the log SDF, In Mt+1 = In B - and propose an alternative form of the log SDF that can be used more practically. Ct 3. Derive and interpret the exchange rate risk premium using the alternative SDF in Question 2. 2 4 Suppose that 1 In Me+1 = -r1 - avi - Veet is the log domestic SDF where rt is the domestic risk-free short rate, et ~ N(0,1), and Yt is the domestic investors' risk-aversion at time t. Similarly, 2 1 In Miti = 7th - Viet 2 is the log foreign SDF where rt is the foreign risk-free short rate, et ~ N(0,1), and Y* is the foreign investors' risk-aversion at time t. Then, derive the uncovered interest rate parity (UIP) equation using the two SDFs. 5 Due to the successful two Koreas' talk, the possibility of war between the two Koreas is expected to be reduced in the future. Analyze its effect on the spot exchange rate using the UIP equation in Question 4. I. UIP with Risk Aversion 1. Let the nominal exchange rate at time t denoted by St (i.e., the number of domestic currency units per one unit of foreign currency). Then, explain why the following condition implies the absence of arbitrage across the two countries, and uniquely and endogenously determines the exchange rate St. M*+1 St+1 St Mt+1 where Mt+1 and Mi-1 are the SDFs of domestic and foreign countries, re- spectively. Act+1 2. Criticize the log SDF, In Mt+1 = In B - and propose an alternative form of the log SDF that can be used more practically. Ct 3. Derive and interpret the exchange rate risk premium using the alternative SDF in Question 2. 2 4 Suppose that 1 In Me+1 = -r1 - avi - Veet is the log domestic SDF where rt is the domestic risk-free short rate, et ~ N(0,1), and Yt is the domestic investors' risk-aversion at time t. Similarly, 2 1 In Miti = 7th - Viet 2 is the log foreign SDF where rt is the foreign risk-free short rate, et ~ N(0,1), and Y* is the foreign investors' risk-aversion at time t. Then, derive the uncovered interest rate parity (UIP) equation using the two SDFs. 5 Due to the successful two Koreas' talk, the possibility of war between the two Koreas is expected to be reduced in the future. Analyze its effect on the spot exchange rate using the UIP equation in Question 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts