Question: V. UIP with Risk Aversion 1. Let the nominal exchange rate at time t denoted by St (i.e., the number of domestic currency units per

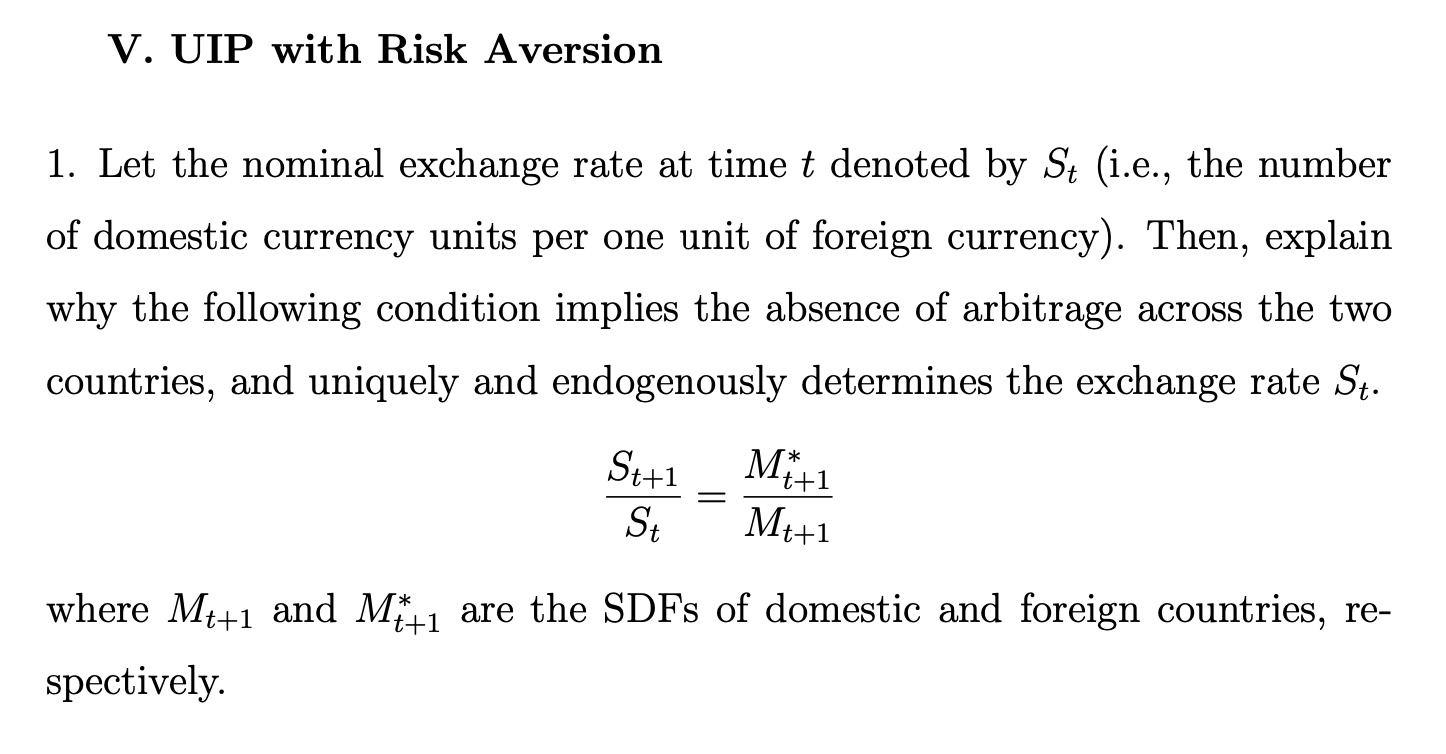

V. UIP with Risk Aversion 1. Let the nominal exchange rate at time t denoted by St (i.e., the number of domestic currency units per one unit of foreign currency). Then, explain why the following condition implies the absence of arbitrage across the two countries, and uniquely and endogenously determines the exchange rate St. St+1 = Mt*+1 St Mt+1 where Mt+1 and Mf+1 are the SDFs of domestic and foreign countries, re spectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts