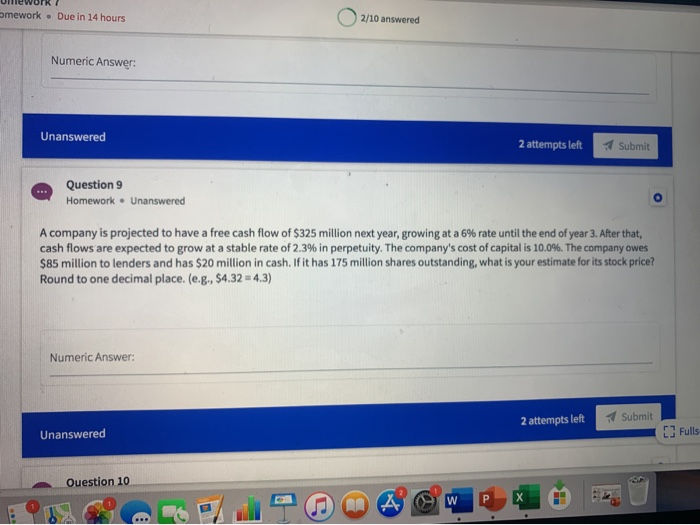

Question: Ulework ? amework . Due in 14 hours 0 2/10 answered Numeric Answer: Unanswered 2 attempts left 7 Submit Question 9 Homework . Unanswered A

Ulework ? amework . Due in 14 hours 0 2/10 answered Numeric Answer: Unanswered 2 attempts left 7 Submit Question 9 Homework . Unanswered A company is projected to have a free cash flow of $325 million next year, growing at a 6% rate until the end of year 3. After that, cash flows are expected to grow at a stable rate of 2.3% in perpetuity. The company's cost of capital is 10.0%. The company owes $85 million to lenders and has $20 million in cash. If it has 175 million shares outstanding, what is your estimate for its stock price? Round to one decimal place. (e.g., $4.32 = 4.3) Numeric Answer: 2 attempts left Submit Unanswered [] Fulls Ouestion 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts