Question: undefined 2. Currently, the term structure is as follows: 1-year zero-coupon bonds yield 9%, 2-year bonds yield 10%, 3-year bonds and longer-maturity bonds all yield

undefined

undefined

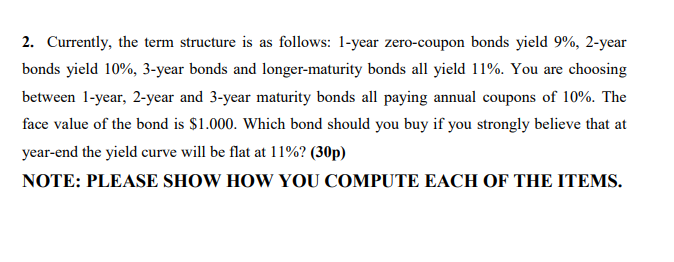

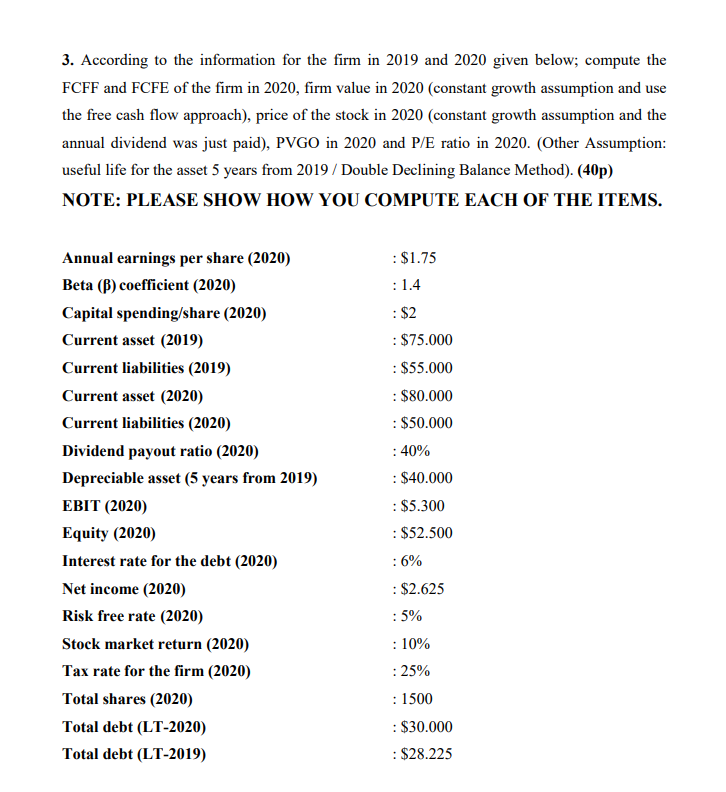

2. Currently, the term structure is as follows: 1-year zero-coupon bonds yield 9%, 2-year bonds yield 10%, 3-year bonds and longer-maturity bonds all yield 11%. You are choosing between 1-year, 2-year and 3-year maturity bonds all paying annual coupons of 10%. The face value of the bond is $1.000. Which bond should you buy if you strongly believe that at year-end the yield curve will be flat at 11%? (30p) NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS. 3. According to the information for the firm in 2019 and 2020 given below; compute the FCFF and FCFE of the firm in 2020, firm value in 2020 (constant growth assumption and use the free cash flow approach), price of the stock in 2020 (constant growth assumption and the annual dividend was just paid), PVGO in 2020 and P/E ratio in 2020. (Other Assumption: useful life for the asset 5 years from 2019/ Double Declining Balance Method). (40p) NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS. : $1.75 : 1.4 Annual earnings per share (2020) Beta (B) coefficient (2020) Capital spending/share (2020) Current asset (2019) Current liabilities (2019) Current asset (2020) Current liabilities (2020) Dividend payout ratio (2020) Depreciable asset (5 years from 2019) EBIT (2020) Equity (2020) Interest rate for the debt (2020) Net income (2020) Risk free rate (2020) Stock market return (2020) Tax rate for the firm (2020) Total shares (2020) Total debt (LT-2020) Total debt (LT-2019) : $2 : $75.000 : $55.000 : $80.000 : $50.000 : 40% : $40.000 : $5.300 : $52.500 : 6% : $2.625 : 5% : 10% : 25% : 1500 : $30.000 : $28.225 2. Currently, the term structure is as follows: 1-year zero-coupon bonds yield 9%, 2-year bonds yield 10%, 3-year bonds and longer-maturity bonds all yield 11%. You are choosing between 1-year, 2-year and 3-year maturity bonds all paying annual coupons of 10%. The face value of the bond is $1.000. Which bond should you buy if you strongly believe that at year-end the yield curve will be flat at 11%? (30p) NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS. 3. According to the information for the firm in 2019 and 2020 given below; compute the FCFF and FCFE of the firm in 2020, firm value in 2020 (constant growth assumption and use the free cash flow approach), price of the stock in 2020 (constant growth assumption and the annual dividend was just paid), PVGO in 2020 and P/E ratio in 2020. (Other Assumption: useful life for the asset 5 years from 2019/ Double Declining Balance Method). (40p) NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS. : $1.75 : 1.4 Annual earnings per share (2020) Beta (B) coefficient (2020) Capital spending/share (2020) Current asset (2019) Current liabilities (2019) Current asset (2020) Current liabilities (2020) Dividend payout ratio (2020) Depreciable asset (5 years from 2019) EBIT (2020) Equity (2020) Interest rate for the debt (2020) Net income (2020) Risk free rate (2020) Stock market return (2020) Tax rate for the firm (2020) Total shares (2020) Total debt (LT-2020) Total debt (LT-2019) : $2 : $75.000 : $55.000 : $80.000 : $50.000 : 40% : $40.000 : $5.300 : $52.500 : 6% : $2.625 : 5% : 10% : 25% : 1500 : $30.000 : $28.225

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts