Question: undefined (20 pt) 1-) Determine whether the following is a par bond, discount bond or premium bond. a. A bond's fair present value is less

undefined

undefined

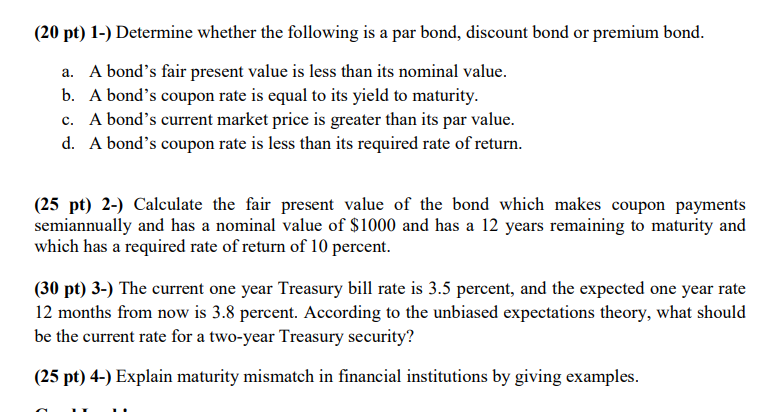

(20 pt) 1-) Determine whether the following is a par bond, discount bond or premium bond. a. A bond's fair present value is less than its nominal value. b. A bond's coupon rate is equal to its yield to maturity. c. A bond's current market price is greater than its par value. d. A bond's coupon rate is less than its required rate of return. (25 pt) 2-) Calculate the fair present value of the bond which makes coupon payments semiannually and has a nominal value of $1000 and has a 12 years remaining to maturity and which has a required rate of return of 10 percent. (30 pt) 3-) The current one year Treasury bill rate is 3.5 percent, and the expected one year rate 12 months from now is 3.8 percent. According to the unbiased expectations theory, what should be the current rate for a two-year Treasury security? (25 pt) 4-) Explain maturity mismatch in financial institutions by giving examples

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts