Question: undefined A small business must make a decision about how to finance the purchase of their new facility. There are three alternative mortgage options available:

undefined

undefined

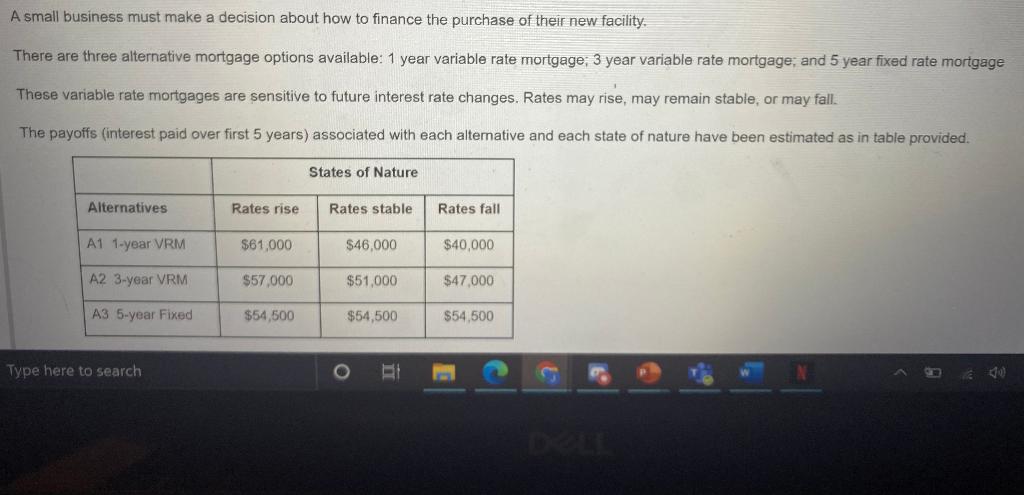

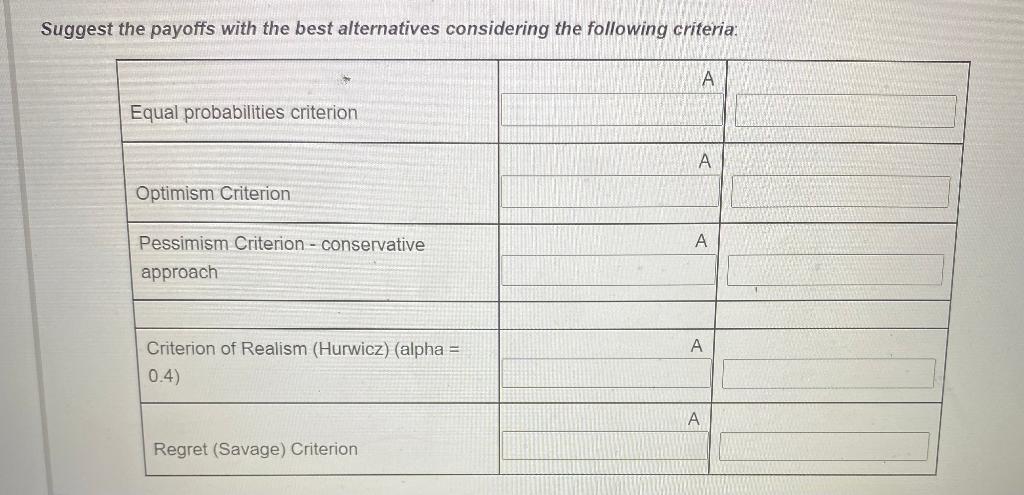

A small business must make a decision about how to finance the purchase of their new facility. There are three alternative mortgage options available: 1 year variable rate mortgage; 3 year variable rate mortgage; and 5 year fixed rate mortgage These variable rate mortgages are sensitive to future interest rate changes. Rates may rise, may remain stable, or may fall. The payoffs (interest paid over first 5 years) associated with each alternative and each state of nature have been estimated as in table provided. States of Nature Alternatives Rates rise Rates stable Rates fall A1 1-year VRM $61,000 $46,000 $40,000 A2 3-year VRM $57,000 $51,000 $47.000 A3 5-year Fixed $54,500 $54,500 $54,500 Type here to search Suggest the payoffs with the best alternatives considering the following criteria: Equal probabilities criterion A Optimism Criterion Pessimism Criterion - conservative approach Criterion of Realism (Hurwicz) (alpha = 0.4) A Regret (Savage) Criterion A small business must make a decision about how to finance the purchase of their new facility. There are three alternative mortgage options available: 1 year variable rate mortgage; 3 year variable rate mortgage; and 5 year fixed rate mortgage These variable rate mortgages are sensitive to future interest rate changes. Rates may rise, may remain stable, or may fall. The payoffs (interest paid over first 5 years) associated with each alternative and each state of nature have been estimated as in table provided. States of Nature Alternatives Rates rise Rates stable Rates fall A1 1-year VRM $61,000 $46,000 $40,000 A2 3-year VRM $57,000 $51,000 $47.000 A3 5-year Fixed $54,500 $54,500 $54,500 Type here to search Suggest the payoffs with the best alternatives considering the following criteria: Equal probabilities criterion A Optimism Criterion Pessimism Criterion - conservative approach Criterion of Realism (Hurwicz) (alpha = 0.4) A Regret (Savage) Criterion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts