Question: undefined From your analysis above, develop a delta neutral strategy for the period 26/02/2021 to 12/03/2021 to speculate/arbitrage on volatility. You must take into account

undefined

undefined

From your analysis above, develop a delta neutral strategy for the period 26/02/2021 to 12/03/2021 to speculate/arbitrage on volatility. You must take into account the dividend payment of the underlying stock. Explain how the strategy will work, and detail all transactions for undertaking the strategy. You can use as much capital as you like, but the cost of capital needs to be considered. Given that the strategy is theoretically risk-free, you should not lose any money anyway! You are required to perform at least one rebalancing.

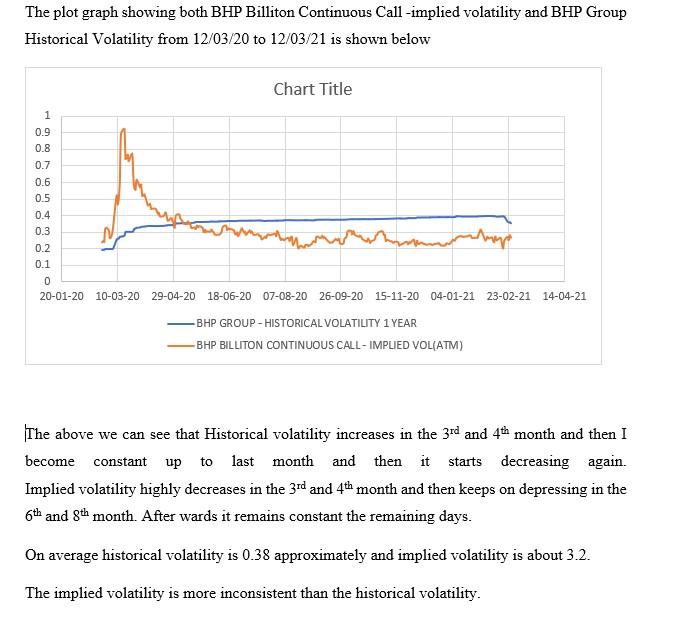

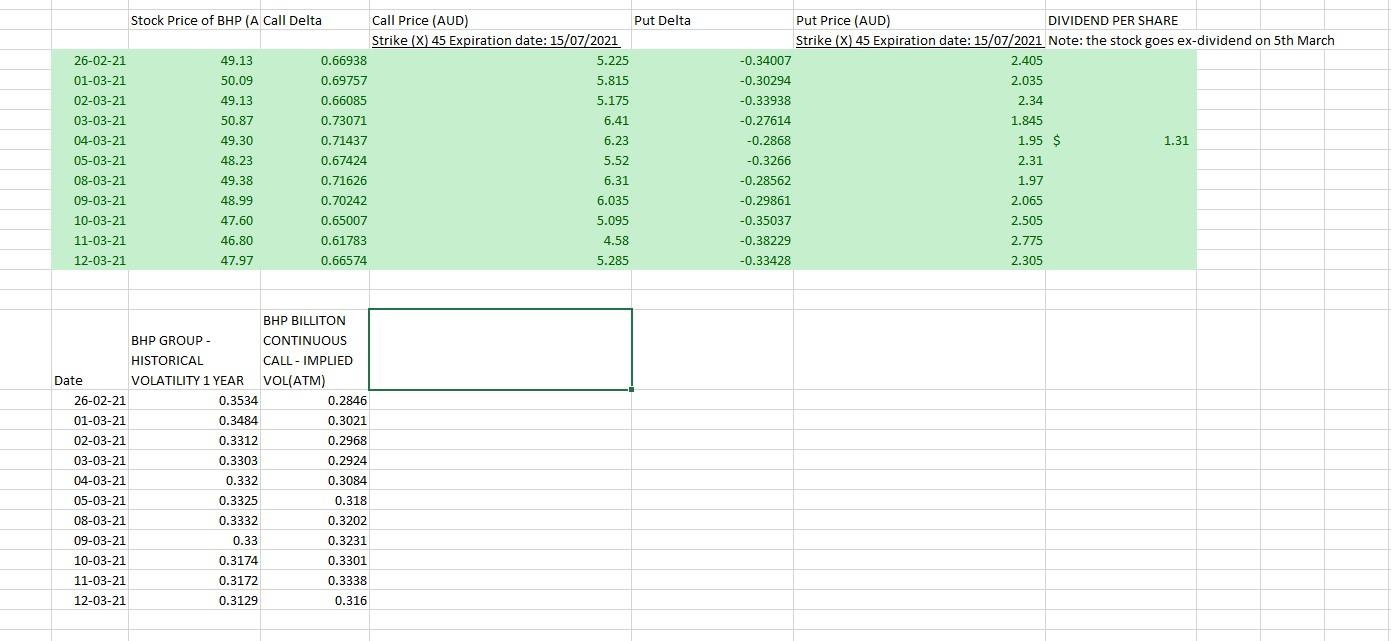

The plot graph showing both BHP Billiton Continuous Call-implied volatility and BHP Group Historical Volatility from 12/03/20 to 12/03/21 is shown below Chart Title 1 0.9 0.8 0.7 0.6 0.5 0.4 0.3 M 0.2 0.1 0 20-01-20 10-03-20 29-04-20 18-06-20 07-08-20 26-09-20 15-11-20 04-01-21 23-02-21 14-04-21 Ameri -BHP GROUP - HISTORICAL VOLATILITY 1 YEAR -BHP BILLITON CONTINUOUS CALL-IMPLIED VOL(ATM) The above we can see that Historical volatility increases in the 3rd and 4th month and then I become constant up to last month and then it starts decreasing again. Implied volatility highly decreases in the 3rd and 4th month and then keeps on depressing in the 6th and 8th month. After wards it remains constant the remaining days. On average historical volatility is 0.38 approximately and implied volatility is about 3.2. The implied volatility is more inconsistent than the historical volatility. 6.41 Stock Price of BHP (A Call Delta Call Price (AUD) Put Delta Strike (X) 45 Expiration date: 15/07/2021 26-02-21 49.13 0.66938 5.225 01-03-21 50.09 0.69757 5.815 02-03-21 49.13 0.66085 5.175 03-03-21 50.87 0.73071 04-03-21 49.30 0.71437 6.23 05-03-21 0.67424 5.52 08-03-21 49.38 0.71626 6.31 09-03-21 48.99 0.70242 6.035 10-03-21 47.60 0.65007 5.095 11-03-21 46.80 0.61783 4.58 12-03-21 47.97 0.66574 5.285 Put Price (AUD) DIVIDEND PER SHARE Strike (X) 45 Expiration date: 15/07/2021 Note: the stock goes ex-dividend on 5th March -0.34007 2.405 -0.30294 2.035 -0.33938 2.34 -0.27614 1.845 -0.2868 1.95 $ 1.31 -0.3266 2.31 -0.28562 1.97 -0.29861 2.065 -0.35037 2.505 -0.38229 2.775 -0.33428 2.305 48.23 BHP BILLITON BHP GROUP CONTINUOUS HISTORICAL CALL - IMPLIED Date VOLATILITY 1 YEAR VOL(ATM) 26-02-21 0.3534 0.2846 01-03-21 0.3484 0.3021 02-03-21 0.3312 0.2968 03-03-21 0.3303 0.2924 04-03-21 0.332 0.3084 05-03-21 0.3325 08-03-21 0.3332 0.3202 09-03-21 0.33 0.3231 10-03-21 0.3174 0.3301 11-03-21 0.3172 0.3338 12-03-21 0.3129 0.316 0.318 The plot graph showing both BHP Billiton Continuous Call-implied volatility and BHP Group Historical Volatility from 12/03/20 to 12/03/21 is shown below Chart Title 1 0.9 0.8 0.7 0.6 0.5 0.4 0.3 M 0.2 0.1 0 20-01-20 10-03-20 29-04-20 18-06-20 07-08-20 26-09-20 15-11-20 04-01-21 23-02-21 14-04-21 Ameri -BHP GROUP - HISTORICAL VOLATILITY 1 YEAR -BHP BILLITON CONTINUOUS CALL-IMPLIED VOL(ATM) The above we can see that Historical volatility increases in the 3rd and 4th month and then I become constant up to last month and then it starts decreasing again. Implied volatility highly decreases in the 3rd and 4th month and then keeps on depressing in the 6th and 8th month. After wards it remains constant the remaining days. On average historical volatility is 0.38 approximately and implied volatility is about 3.2. The implied volatility is more inconsistent than the historical volatility. 6.41 Stock Price of BHP (A Call Delta Call Price (AUD) Put Delta Strike (X) 45 Expiration date: 15/07/2021 26-02-21 49.13 0.66938 5.225 01-03-21 50.09 0.69757 5.815 02-03-21 49.13 0.66085 5.175 03-03-21 50.87 0.73071 04-03-21 49.30 0.71437 6.23 05-03-21 0.67424 5.52 08-03-21 49.38 0.71626 6.31 09-03-21 48.99 0.70242 6.035 10-03-21 47.60 0.65007 5.095 11-03-21 46.80 0.61783 4.58 12-03-21 47.97 0.66574 5.285 Put Price (AUD) DIVIDEND PER SHARE Strike (X) 45 Expiration date: 15/07/2021 Note: the stock goes ex-dividend on 5th March -0.34007 2.405 -0.30294 2.035 -0.33938 2.34 -0.27614 1.845 -0.2868 1.95 $ 1.31 -0.3266 2.31 -0.28562 1.97 -0.29861 2.065 -0.35037 2.505 -0.38229 2.775 -0.33428 2.305 48.23 BHP BILLITON BHP GROUP CONTINUOUS HISTORICAL CALL - IMPLIED Date VOLATILITY 1 YEAR VOL(ATM) 26-02-21 0.3534 0.2846 01-03-21 0.3484 0.3021 02-03-21 0.3312 0.2968 03-03-21 0.3303 0.2924 04-03-21 0.332 0.3084 05-03-21 0.3325 08-03-21 0.3332 0.3202 09-03-21 0.33 0.3231 10-03-21 0.3174 0.3301 11-03-21 0.3172 0.3338 12-03-21 0.3129 0.316 0.318

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts