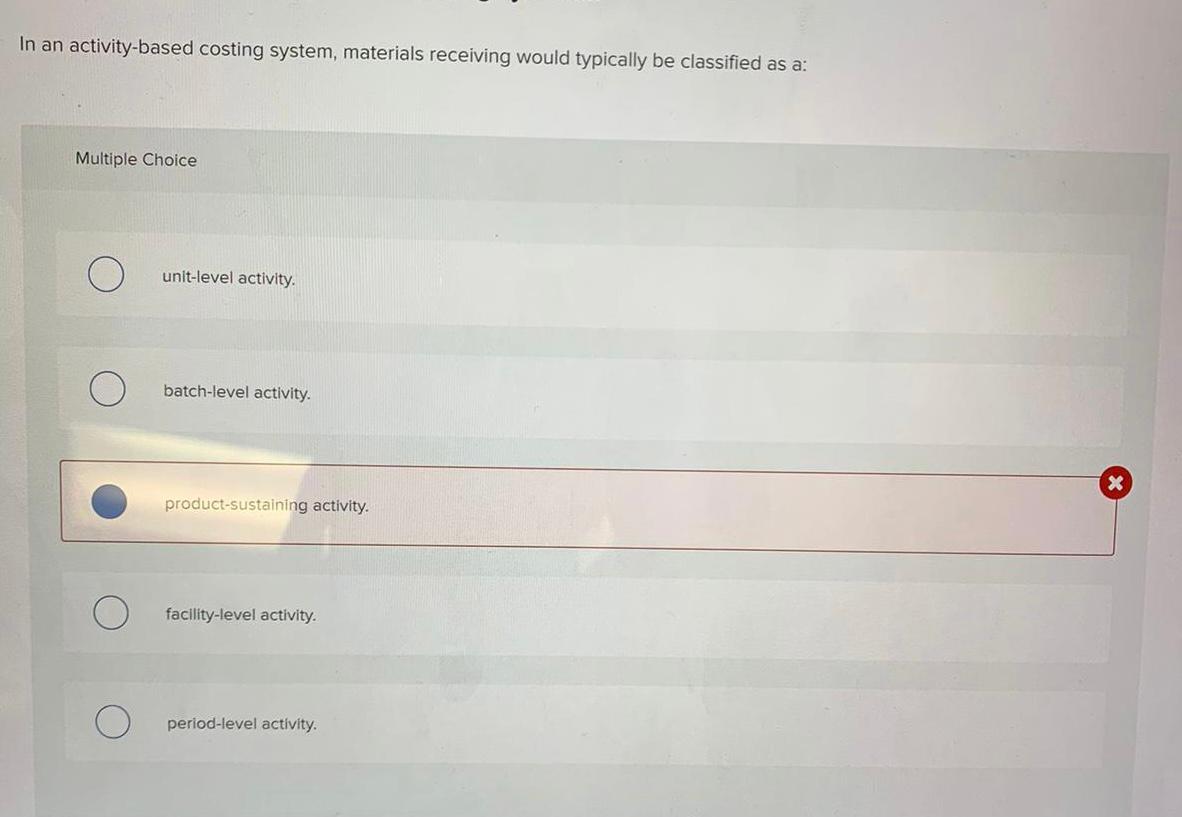

Question: undefined In an activity-based costing system, materials receiving would typically be classified as a: Multiple Choice unit-level activity batch-level activity. product-sustaining activity. facility-level activity. period-level

undefined

undefined

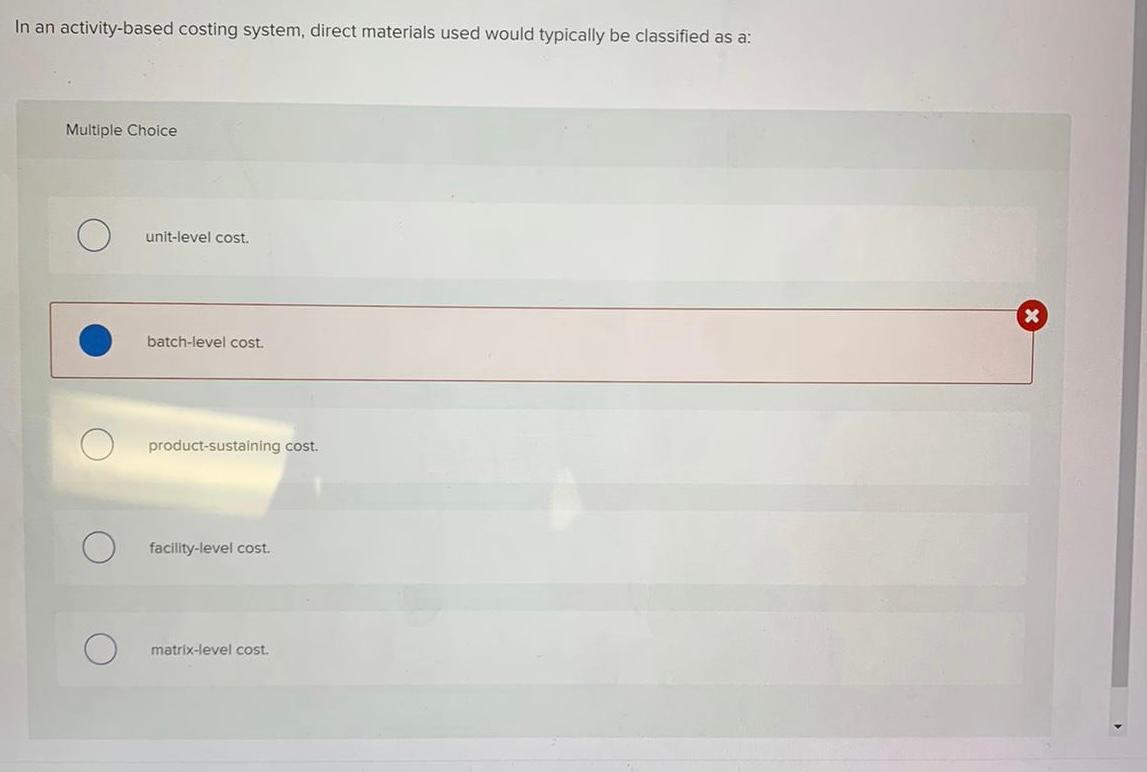

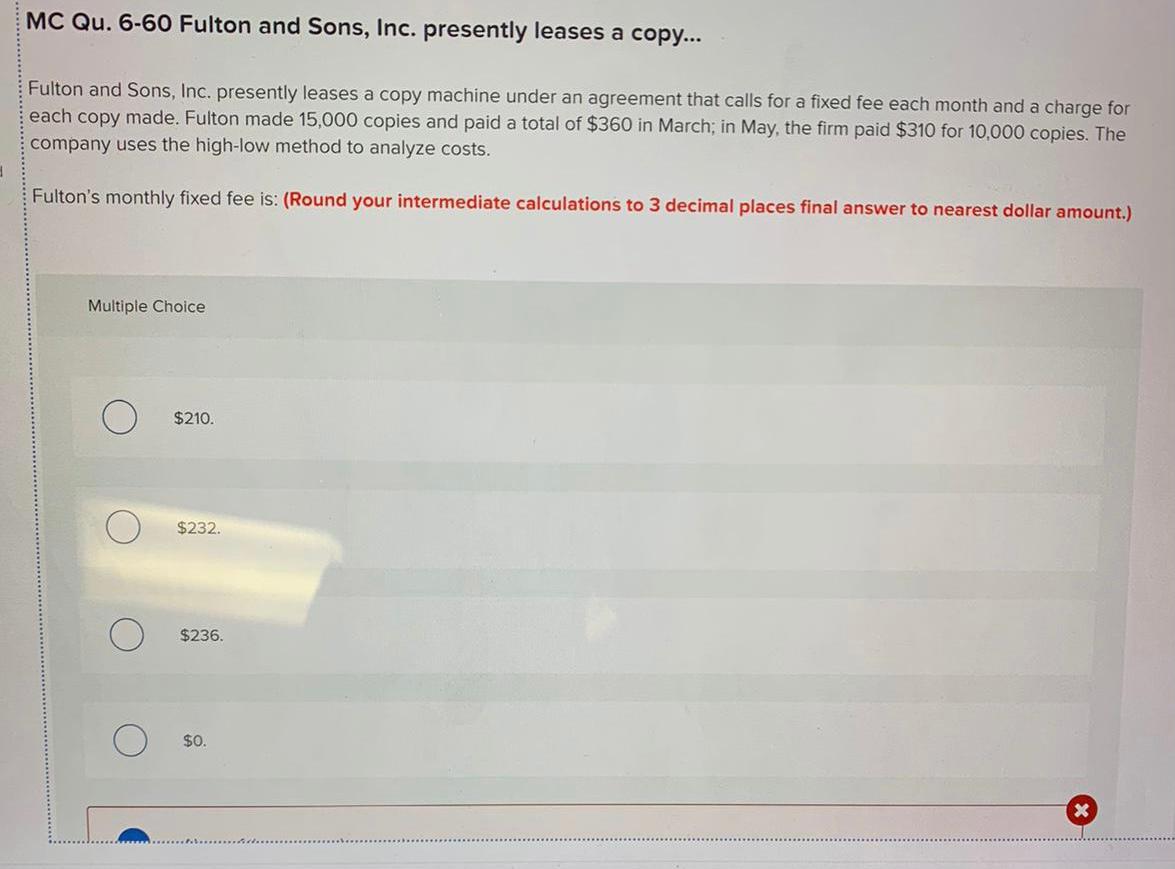

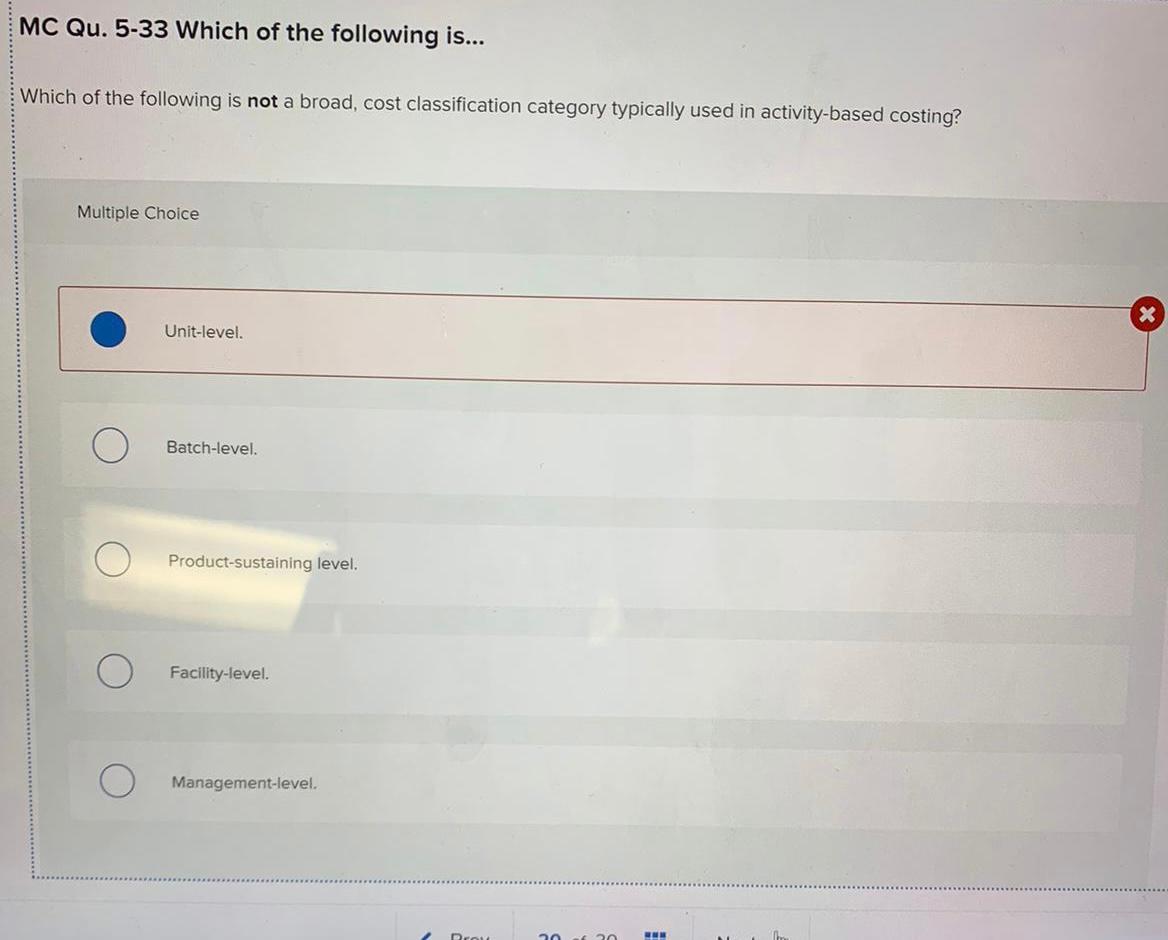

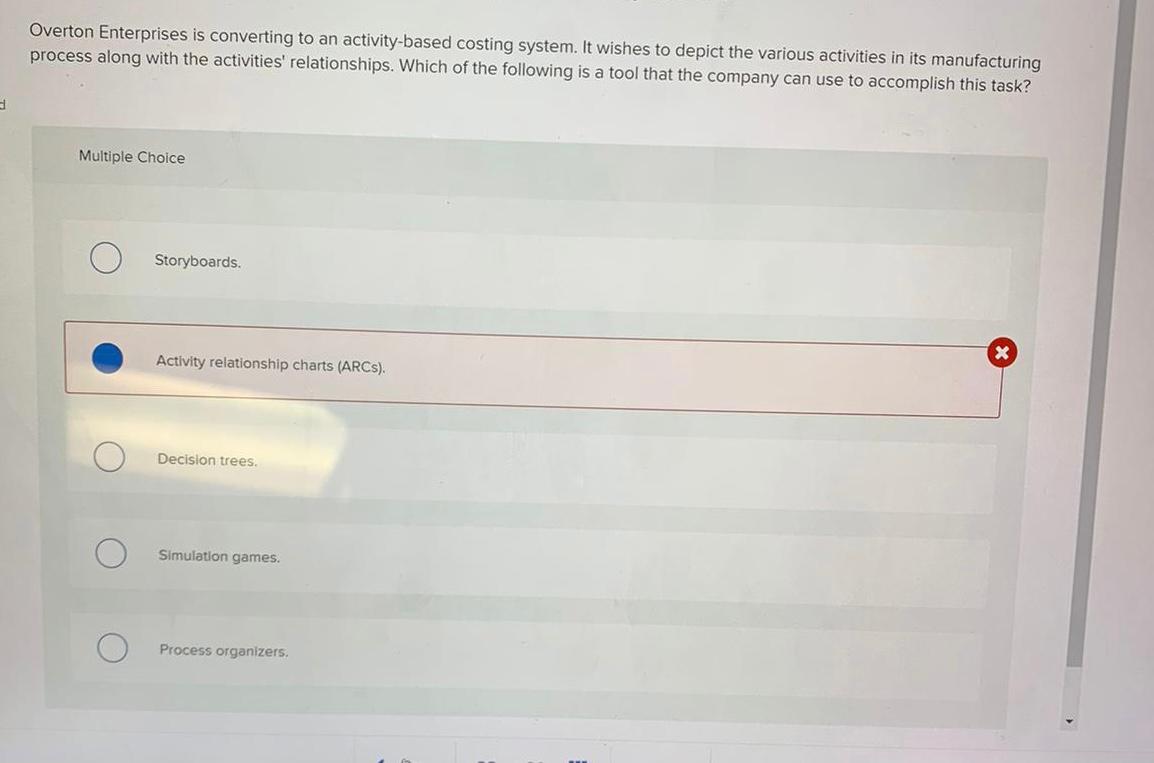

In an activity-based costing system, materials receiving would typically be classified as a: Multiple Choice unit-level activity batch-level activity. product-sustaining activity. facility-level activity. period-level activity. In an activity-based costing system, direct materials used would typically be classified as a: Multiple Choice unit-level cost. X batch-level cost. product-sustaining cost. facility-level cost. matrix-level cost. MC Qu. 6-60 Fulton and Sons, Inc. presently leases a copy... Fulton and Sons, Inc. presently leases a copy machine under an agreement that calls for a fixed fee each month and a charge for each copy made. Fulton made 15,000 copies and paid a total of $360 in March; in May, the firm paid $310 for 10,000 copies. The company uses the high-low method to analyze costs. Fulton's monthly fixed fee is: (Round your intermediate calculations to 3 decimal places final answer to nearest dollar amount.) Multiple Choice $210. O $232. O O $236. $0. MC Qu. 5-33 Which of the following is... Which of the following is not a broad, cost classification category typically used in activity-based costing? Multiple Choice x Unit-level. Batch-level. Product-sustaining level. Facility-level. Management-level Pero 2020 WM Overton Enterprises is converting to an activity-based costing system. It wishes to depict the various activities in its manufacturing process along with the activities' relationships. Which of the following is a tool that the company can use to accomplish this task? Multiple Choice Storyboards. X Activity relationship charts (ARCs). Decision trees Simulation games. Process organizers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts