Question: undefined QUESTION 17 Bonds have different yields (the % the expect to earn) because bonds have different risks. Imagine a risky security, an Investor will

undefined

undefined

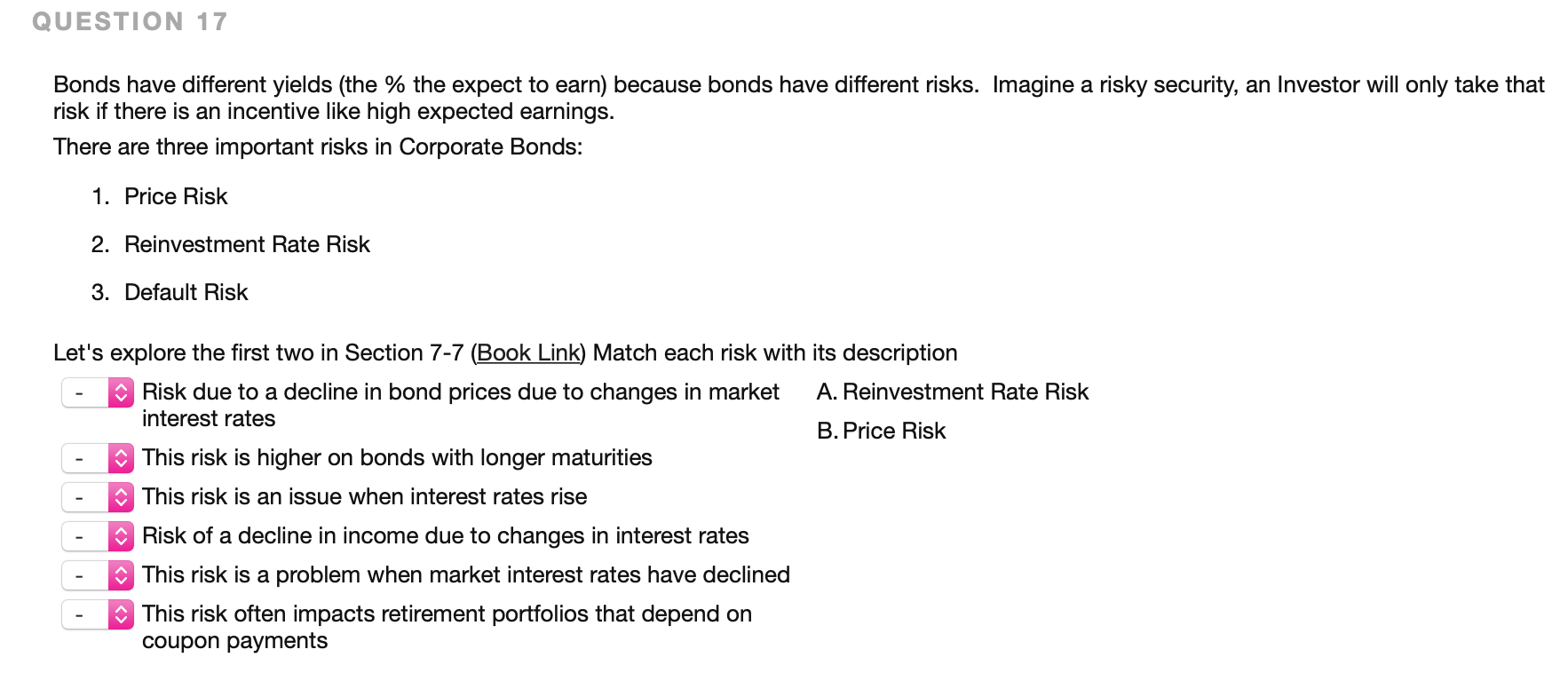

QUESTION 17 Bonds have different yields (the % the expect to earn) because bonds have different risks. Imagine a risky security, an Investor will only take that risk if there is an incentive like high expected earnings. There are three important risks in Corporate Bonds: 1. Price Risk 2. Reinvestment Rate Risk 3. Default Risk Let's explore the first two in Section 7-7 (Book Link) Match each risk with its description Risk due to a decline in bond prices due to changes in market A. Reinvestment Rate Risk interest rates B. Price Risk This risk is higher on bonds with longer maturities This risk is an issue when interest rates rise Risk of a decline in income due to changes in interest rates This risk is a problem when market interest rates have declined This risk often impacts retirement portfolios that depend on coupon payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts