Question: undefined Question 2 You are considering acquiring Augustine, a cosmetic firm that has seen its stock price fall and its earnings decline in the last

undefined

undefined

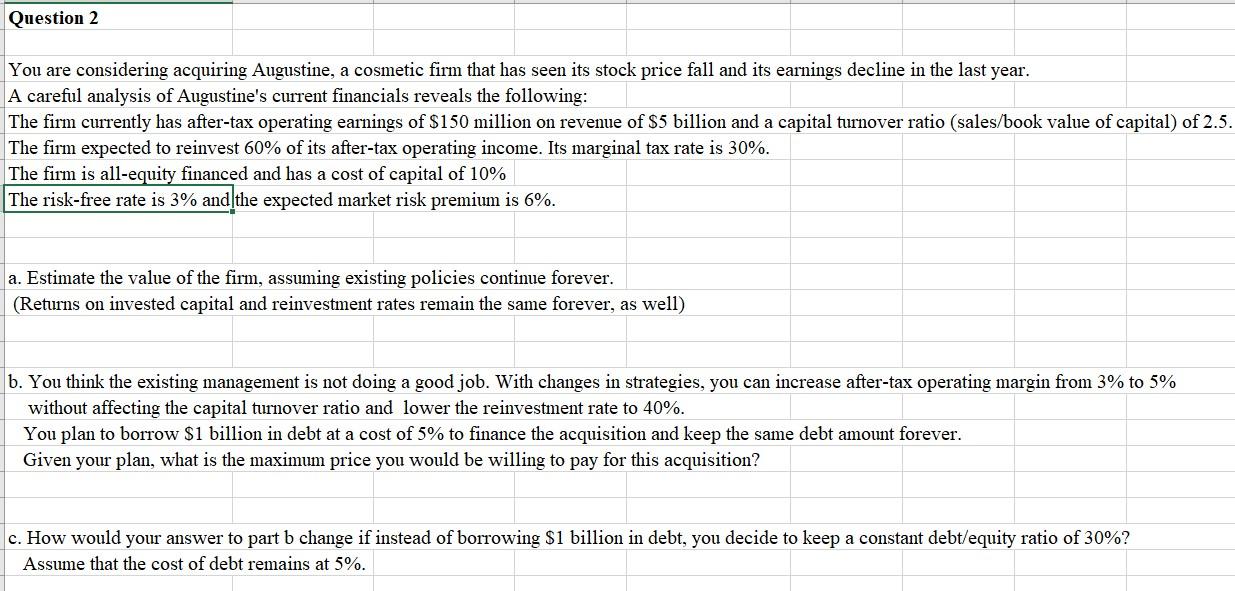

Question 2 You are considering acquiring Augustine, a cosmetic firm that has seen its stock price fall and its earnings decline in the last year. A careful analysis of Augustine's current financials reveals the following: The firm currently has after-tax operating earnings of $150 million on revenue of $5 billion and a capital turnover ratio (sales/book value of capital) of 2.5. The firm expected to reinvest 60% of its after-tax operating income. Its marginal tax rate is 30%. The firm is all-equity financed and has a cost of capital of 10% The risk-free rate is 3% and the expected market risk premium is 6%. a. Estimate the value of the firm, assuming existing policies continue forever. (Returns on invested capital and reinvestment rates remain the same forever, as well) b. You think the existing management is not doing a good job. With changes in strategies, you can increase after-tax operating margin from 3% to 5% without affecting the capital turnover ratio and lower the reinvestment rate to 40%. You plan to borrow $1 billion in debt at a cost of 5% to finance the acquisition and keep the same debt amount forever. Given your plan, what is the maximum price you would be willing to pay for this acquisition? c. How would your answer to part b change if instead of borrowing $1 billion in debt, you decide to keep a constant debt/equity ratio of 30%? Assume that the cost of debt remains at 5%. Question 2 You are considering acquiring Augustine, a cosmetic firm that has seen its stock price fall and its earnings decline in the last year. A careful analysis of Augustine's current financials reveals the following: The firm currently has after-tax operating earnings of $150 million on revenue of $5 billion and a capital turnover ratio (sales/book value of capital) of 2.5. The firm expected to reinvest 60% of its after-tax operating income. Its marginal tax rate is 30%. The firm is all-equity financed and has a cost of capital of 10% The risk-free rate is 3% and the expected market risk premium is 6%. a. Estimate the value of the firm, assuming existing policies continue forever. (Returns on invested capital and reinvestment rates remain the same forever, as well) b. You think the existing management is not doing a good job. With changes in strategies, you can increase after-tax operating margin from 3% to 5% without affecting the capital turnover ratio and lower the reinvestment rate to 40%. You plan to borrow $1 billion in debt at a cost of 5% to finance the acquisition and keep the same debt amount forever. Given your plan, what is the maximum price you would be willing to pay for this acquisition? c. How would your answer to part b change if instead of borrowing $1 billion in debt, you decide to keep a constant debt/equity ratio of 30%? Assume that the cost of debt remains at 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts