Question: undefined Rank firms preference for financing in decreasing order. Select one O a Internal Funds > Debt > Equity O b.Internal Funds Equity > Debt

undefined

undefined

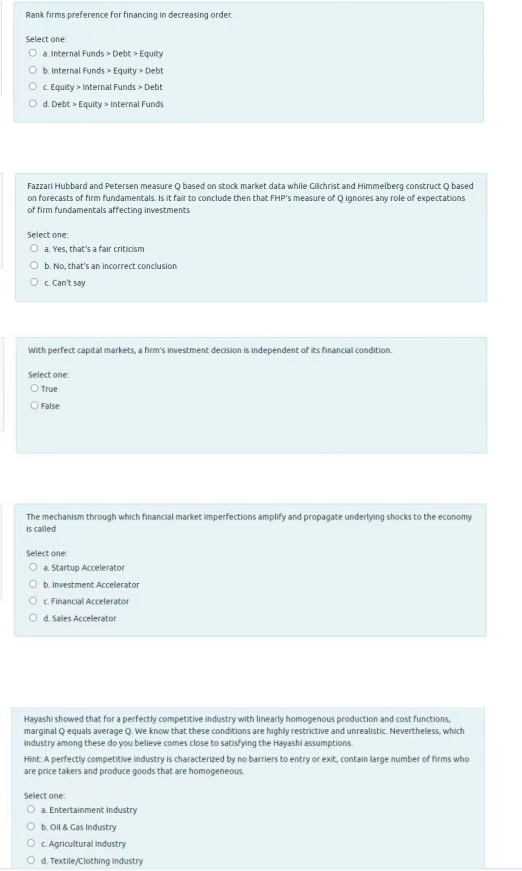

Rank firms preference for financing in decreasing order. Select one O a Internal Funds > Debt > Equity O b.Internal Funds Equity > Debt O cEquity > Internal Funds > Debt O d. Debt > Equity > Internal Funds Fazzari Hubbard and Petersen measure Q based on stock market data while Gilchrist and Himmelberg construct Q based on forecasts of firm fundamentals. Is it fair to conclude then that FHP's measure of Qignores any role of expectations of firm fundamentals affecting investments Select one: O a. Yes, that's a fair criticism O b. No, that's an incorrect conclusion O c. Can't say with perfect capital markets, a firm's investment decision is independent of its financial condition. Select one True False The mechanism through which financial market imperfections amplify and propagate underlying shocks to the economy is called Select one: 2. Startup Accelerator b. Investment Accelerator O c. Financial Accelerator O d. Sales Accelerator Hayashi showed that for a perfectly competitive industry with linearly homogenous production and cost functions. marginal Q equals average Q. We know that these conditions are highly restrictive and unrealistic. Nevertheless, which industry among these do you believe comes close to satisfying the Hayashi assumptions Hint: A perfectly competitive industry is characterized by no barriers to entry or exit, contain large number of firms who are price takers and produce goods that are homogeneous, Select one: a. Entertainment Industry b. Oil & Gas Industry c. Agricultural Industry O d. Textile/Clothing Industry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts