Question: undefined You are given the following three assets: Assets Return Volatility 1 2% 0% 2 8% 6% 3 12% 8% a. (2 points) Assume only

undefined

undefined

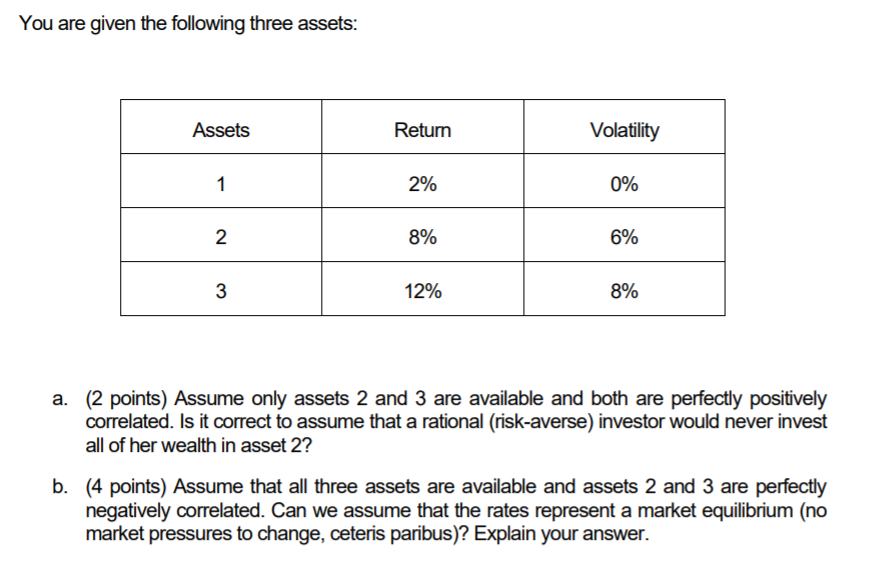

You are given the following three assets: Assets Return Volatility 1 2% 0% 2 8% 6% 3 12% 8% a. (2 points) Assume only assets 2 and 3 are available and both are perfectly positively correlated. Is it correct to assume that a rational (risk-averse) investor would never invest all of her wealth in asset 2? b. (4 points) Assume that all three assets are available and assets 2 and 3 are perfectly negatively correlated. Can we assume that the rates represent a market equilibrium (no market pressures to change, ceteris paribus)? Explain your answer. You are given the following three assets: Assets Return Volatility 1 2% 0% 2 8% 6% 3 12% 8% a. (2 points) Assume only assets 2 and 3 are available and both are perfectly positively correlated. Is it correct to assume that a rational (risk-averse) investor would never invest all of her wealth in asset 2? b. (4 points) Assume that all three assets are available and assets 2 and 3 are perfectly negatively correlated. Can we assume that the rates represent a market equilibrium (no market pressures to change, ceteris paribus)? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts