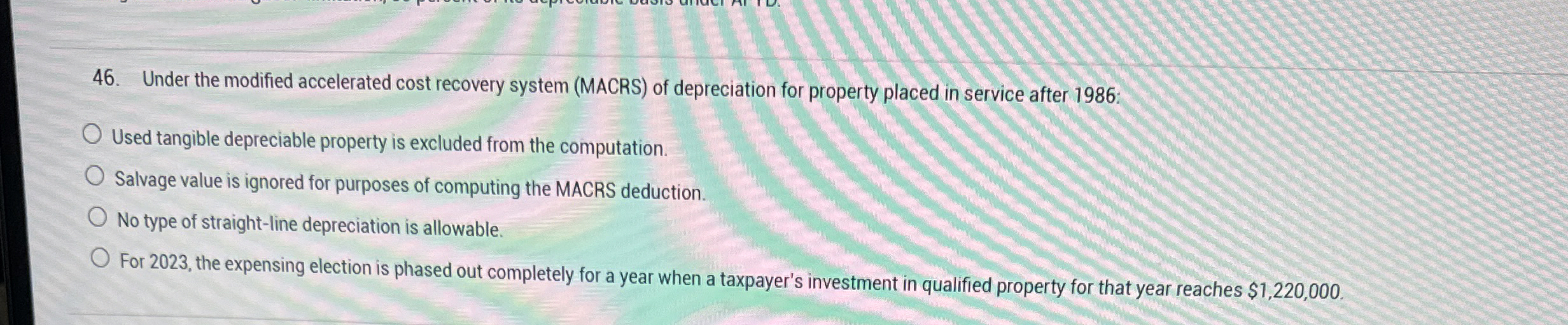

Question: Under the modified accelerated cost recovery system ( MACRS ) of depreciation for property placed in service after 1 9 8 6 : Used tangible

Under the modified accelerated cost recovery system MACRS of depreciation for property placed in service after :

Used tangible depreciable property is excluded from the computation.

Salvage value is ignored for purposes of computing the MACRS deduction.

No type of straightline depreciation is allowable.

For the expensing election is phased out completely for a year when a taxpayer's investment in qualified property for that year reaches $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock