Question: Understanding risks that affect projects and the impact of risk consideration Yatta Net International has manufacturing, distribution, retail, and consulting divisions. Projects undertaken by the

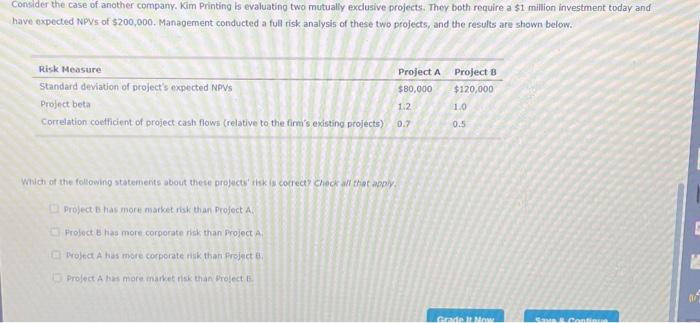

Understanding risks that affect projects and the impact of risk consideration Yatta Net International has manufacturing, distribution, retail, and consulting divisions. Projects undertaken by the manufacturing and distribution divisions tend to be low-risk projects, because these divisions are well established and have predictable demand. The company started its ratail and consulting divisions within the last year, and it is unknown if these divisions will be profitable. The company knew that opening these new divisions would be risky, but its management beleves the divisions have the potential to be extremely profitable under favorable market conditions. The compary is currently using its WACC to evaluate new projects for all divisions. If Yatta Net International does not risk-adjust its discount rate for specific projects properly, which of the following is likely to occur over time? Check all that apply. The firm will accept too many relatively fisky projects. The firm will accept too many relatively safe projects. The firm will become less vaiuable. Generally, a positive correlation exists between a project's returns and the returns on the firm's other assets. If this correlation i stand-alone isk with be a geod groxy for within-firm tisk. Consder the case of another cempany. kim Printing is evaluating two mutualiy exdusive projects. They both reauire a $1 million investrrient today and thave expected Nevs of s200,000, Management conducted a full riskranalysts of these two prolects, and the results are shown below. Check all that apply. The firm will accept too many relatively risky projects. The firm will accept too many relatively safe projects. The firm will become less vatuable: Generally, a positive correlation exists between a project's returns and the returns on the firm's other assets. if this correlation is risk will be a pood proxy for within-firm risk. Consider the case of another company. Kim Printing is evaluating two mutually exclusive grofects. They both require a s1 million have expected NPvs of $200,000. Management conducted a full risk analysis of these two projects, and the results are shown bel Consider the case of another company. Kim Printing is evaluating two mutually exclusive projects. Ther both require a $1 milion investment today and have expected Npys of $200,000. Managernent conducted a ful risk analysis of these two projects, and the results are shown below. Which of the following statements about thete profucts' itsk is corect? check an that apmy. Project 8 has more market risk than Project A Froject b has more corporate risk than Project A Brojed a has moie corperate hik, thari frojget b. 4 Prolect A has mare market ilse than Prolect 1 . Understanding risks that affect projects and the impact of risk consideration Yatta Net International has manufacturing, distribution, retail, and consulting divisions. Projects undertaken by the manufacturing and distribution divisions tend to be low-risk projects, because these divisions are well established and have predictable demand. The company started its ratail and consulting divisions within the last year, and it is unknown if these divisions will be profitable. The company knew that opening these new divisions would be risky, but its management beleves the divisions have the potential to be extremely profitable under favorable market conditions. The compary is currently using its WACC to evaluate new projects for all divisions. If Yatta Net International does not risk-adjust its discount rate for specific projects properly, which of the following is likely to occur over time? Check all that apply. The firm will accept too many relatively fisky projects. The firm will accept too many relatively safe projects. The firm will become less vaiuable. Generally, a positive correlation exists between a project's returns and the returns on the firm's other assets. If this correlation i stand-alone isk with be a geod groxy for within-firm tisk. Consder the case of another cempany. kim Printing is evaluating two mutualiy exdusive projects. They both reauire a $1 million investrrient today and thave expected Nevs of s200,000, Management conducted a full riskranalysts of these two prolects, and the results are shown below. Check all that apply. The firm will accept too many relatively risky projects. The firm will accept too many relatively safe projects. The firm will become less vatuable: Generally, a positive correlation exists between a project's returns and the returns on the firm's other assets. if this correlation is risk will be a pood proxy for within-firm risk. Consider the case of another company. Kim Printing is evaluating two mutually exclusive grofects. They both require a s1 million have expected NPvs of $200,000. Management conducted a full risk analysis of these two projects, and the results are shown bel Consider the case of another company. Kim Printing is evaluating two mutually exclusive projects. Ther both require a $1 milion investment today and have expected Npys of $200,000. Managernent conducted a ful risk analysis of these two projects, and the results are shown below. Which of the following statements about thete profucts' itsk is corect? check an that apmy. Project 8 has more market risk than Project A Froject b has more corporate risk than Project A Brojed a has moie corperate hik, thari frojget b. 4 Prolect A has mare market ilse than Prolect 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts