Question: Uniscale develops high-spec components for use in scaling up the manufacture of commercial-grade graphene for use in a variety of applications. The business is

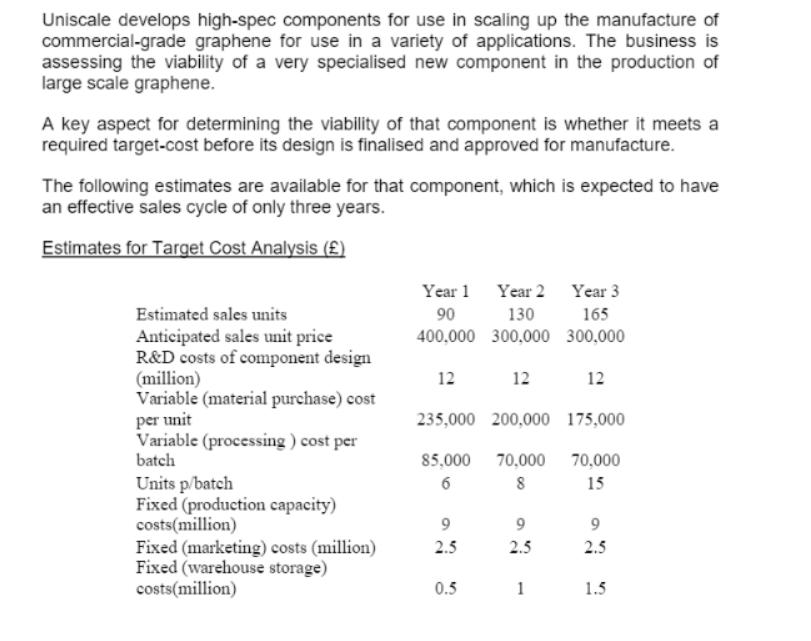

Uniscale develops high-spec components for use in scaling up the manufacture of commercial-grade graphene for use in a variety of applications. The business is assessing the viability of a very specialised new component in the production of large scale graphene. A key aspect for determining the viability of that component is whether it meets a required target-cost before its design is finalised and approved for manufacture. The following estimates are available for that component, which is expected to have an effective sales cycle of only three years. Estimates for Target Cost Analysis () Estimated sales units Anticipated sales unit price R&D costs of component design (million) Variable (material purchase) cost per unit Variable (processing) cost per batch Units p/batch Fixed (production capacity) costs(million) Fixed (marketing) costs (million) Fixed (warehouse storage) costs(million) Year 1 Year 2 Year 3 130 90 165 400,000 300.000 300.000 12 235,000 200,000 85,000 70,000 6 8 9 2.5 0.5 12 9 2.5 1 12 175,000 70,000 15 9 2.5 1.5 The firm's policy is that a new product should realize a target net operating income of 14% of sales revenue during the three year period. It is a target based on past levels of achievement by the firm itself and on benchmarks of performance throughout the industry. In general, failure to meet the target will indicate a need to re-design the product and/or the means of producing and marketing it. Half of the variable (material purchase) cost per unit relates to generic materials that are commodities bought on world markets, and the remainder to specialized components made by selected suppliers. All of the variable (processing) cost per batch relates to proprietary manufacturing techniques that are crucial to the effectiveness of the component as judged by the end customers. The fixed production, marketing and warehouse costs comprise shares of the total cost of providing these resources that are attributed to the new product. Page 4 of 9 REQUIRED: a) b) Establish whether the proposed component meets or fails to meet the allowable costs. In this, you should indicate clearly three pieces of information i) the total allowable costs ii) the total anticipated life-cycle costs of the current design and iii) by how much the component as currently designed either meets or fails the allowable costs. Explain how you believe the firm's managers should respond to the findings and discuss the issues that should be considered when deciding which types of costs to cut, and which ones not to cut whilst attempting to reach target requirements.

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

a IThe total allowable costs are 40000085000700006561000 2The total anticipated lifecycle costs of t... View full answer

Get step-by-step solutions from verified subject matter experts