Question: Unit 5 Assignment 4 Dividend in Arrears This assessment addresses the following course objective(s): Analyze balance sheet equity entries. Account for various transactions using industry-standard

this all the information that i got for this assignment

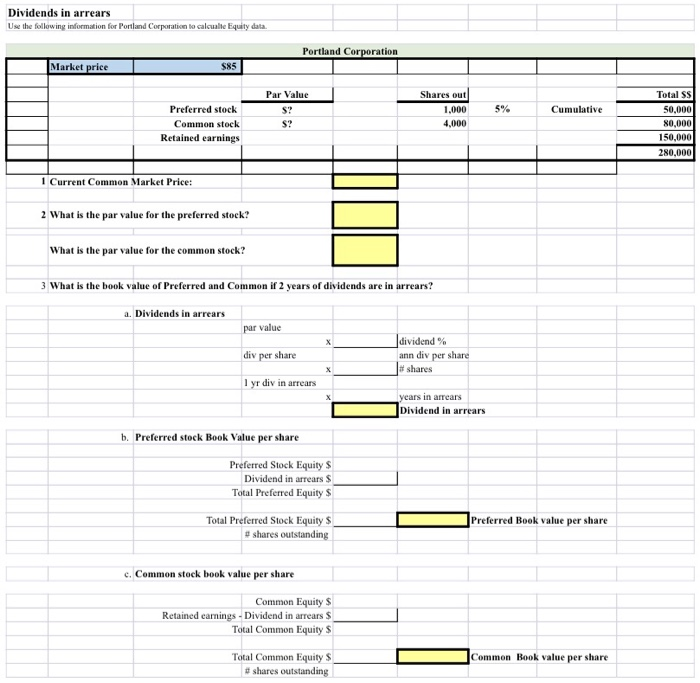

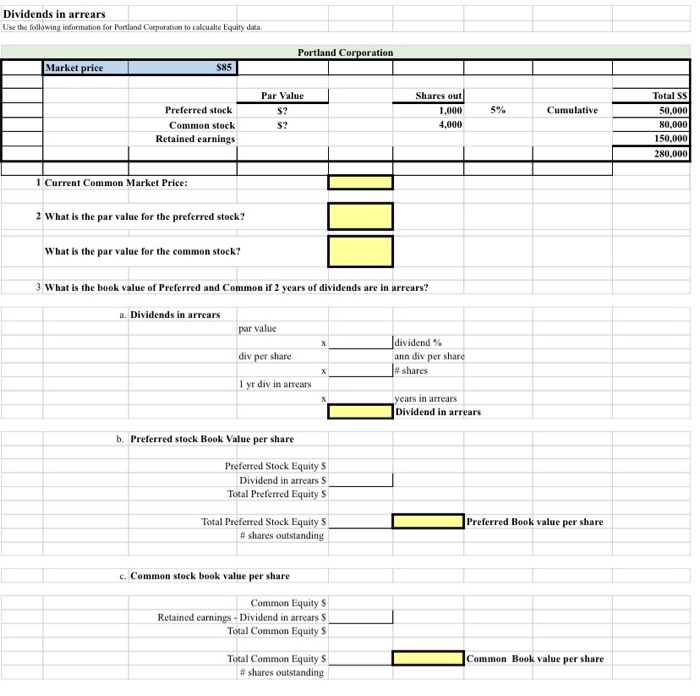

this all the information that i got for this assignment Dividends in arrears Use the following information for Portland Corporation to calcuate Equity data Portland Corporation Market price $85 Par Value Shares out 1,000 4,000 5% Preferred stock Common stock Retained earnings Cumulative S? Total SS 50,000 80,000 150,000 280,000 1 Current Common Market Price: 2 What is the par value for the preferred stock? What is the par value for the common stock? 3 What is the book value of Preferred and Common if 2 years of dividends are in arrears? a. Dividends in arrears par value div per share dividend % ann div per share shares 1 yr div in arrears years in arrears Dividend in arrears b. Preferred stock Book Value per share Preferred Stock Equity Dividend in arrears $ Total Preferred Equity $ Preferred Book value per share Total Preferred Stock Equity #shares outstanding c. Common stock book value per share Common Equity $ Retained earnings - Dividend in arrears $ Total Common Equity $ Common Book value per share Total Common Equity #shares outstanding Dividends in arrears Use the following information for Portland Corporation to calcualte Equity data. Portland Corporation Market price $85 Par Value S? S? Shares out 1.000 4.000 Preferred stock Common stock Retained earnings 5% Cumulative Total SS 50,000 80,000 150,000 280,000 1 Current Common Market Price: 2 What is the par value for the preferred stock? What is the par value for the common stock? 3 What is the book value of Preferred and Common if 2 years of dividends are in arrears? a. Dividends in arrears par value div per share dividend % ann div per share #shares 1 yr div in arrears years in arrears Dividend in arrears b. Preferred stock Book Value per share Preferred Stock Equity s Dividend in arrears $ Total Preferred Equity Preferred Book value per share Total Preferred Stock Equity S # shares outstanding c. Common stock book value per share Common Equity S Retained earnings - Dividend in arrears S Total Common Equity S Common Book value per share Total Common Equity S # shares outstanding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts