Question: Unit 5 : MUnit 5 : M Unit 5 : M&A VALUATION Assignment ABC Ltd is a company operating in software industry. It is considering

Unit : MUnit : M

Unit : M&A VALUATION

Assignment

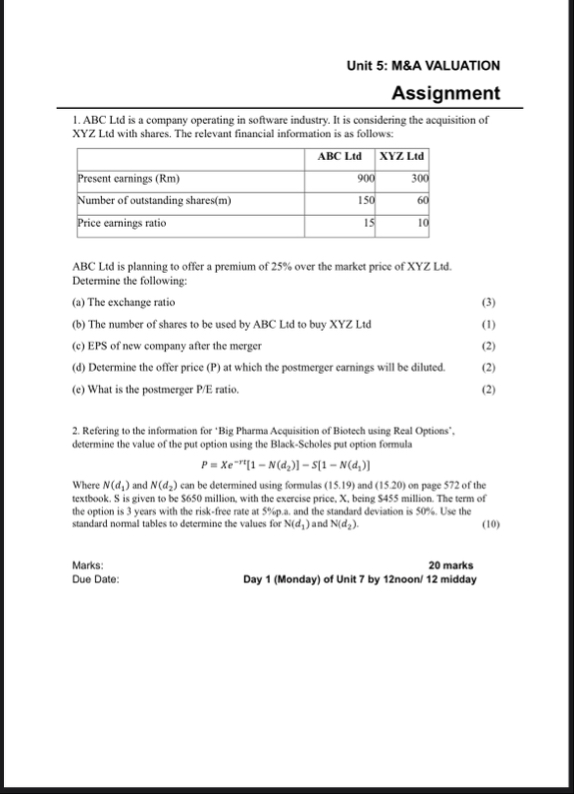

ABC Ltd is a company operating in software industry. It is considering the acquisition of XYZ Ltd with shares. The relevant financial information is as follows:

tableABC LtdXYZ LtdPresent carnings RmNumber of outstanding sharesmPrice carnings ratio,

ABC Ltd is planning to offer a premium of over the market price of XYZ Ltd Determine the following:

a The exchange ratio

b The number of shares to be used by ABC Ltd to buy XYZ Ltd

c EPS of new company after the merger

d Determine the offer price P at which the postmerger earnings will be diluted.

c What is the postmerger PE ratio.

Refering to the information for 'Big Pharma Acquisition of Biotech using Real Options', determine the value of the put option using the BlackScholes put option formula

Where and can be determined using formulas and on page of the textbook. S is given to be $ million, with the exercise price, X being $ million. The term of the option is years with the riskfree rate at and the standard deviation is Use the standard normal tables to determine the values for and

Marks:

marks

Due Date:

Day Monday of Unit by noon midday

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock