Question: Unit 7 - Spring 2021 - OLB/Fin Stmt Analysis (ACCT-311-01W) Question 3.11 - Using the information provided in the problem on page 145, calculate/answer the

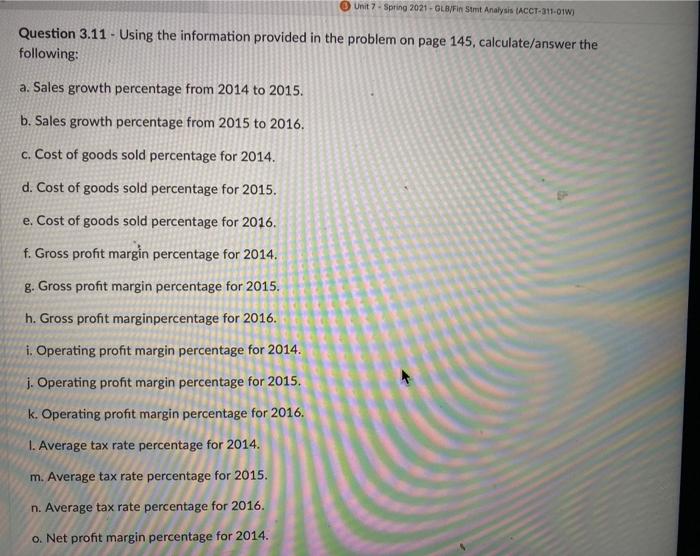

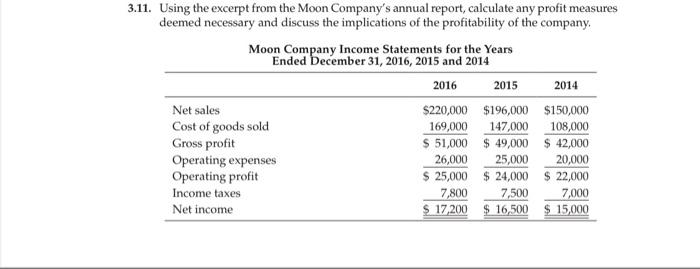

Unit 7 - Spring 2021 - OLB/Fin Stmt Analysis (ACCT-311-01W) Question 3.11 - Using the information provided in the problem on page 145, calculate/answer the following: a. Sales growth percentage from 2014 to 2015. b. Sales growth percentage from 2015 to 2016. c. Cost of goods sold percentage for 2014. d. Cost of goods sold percentage for 2015. e. Cost of goods sold percentage for 2016. f. Gross profit margin percentage for 2014. g. Gross profit margin percentage for 2015. h. Gross profit marginpercentage for 2016. i. Operating profit margin percentage for 2014. j. Operating profit margin percentage for 2015. k. Operating profit margin percentage for 2016. 1. Average tax rate percentage for 2014. m. Average tax rate percentage for 2015. n. Average tax rate percentage for 2016. o. Net profit margin percentage for 2014. 3.11. Using the excerpt from the Moon Company's annual report, calculate any profit measures deemed necessary and discuss the implications of the profitability of the company. Moon Company Income Statements for the Years Ended December 31, 2016, 2015 and 2014 2016 2015 2014 Net sales $220,000 $196,000 $150,000 Cost of goods sold 169,000 147,000 108,000 Gross profit $ 51,000 $ 49,000 $ 42,000 Operating expenses 26,000 25,000 20,000 Operating profit $ 25,000 $ 24,000 $ 22,000 Income taxes 7,800 7,000 Net income $ 17,200 $ 16,500 $ 15,000 7,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts