Question: UNIVERSAL VENTURES, INC. QUESTIONS SPRING 2020 Q. 4. What additional macroeconomic variables should an investor consider when comparing foreign versus domestic investments? Please be specific,

UNIVERSAL VENTURES, INC. QUESTIONS SPRING 2020

Q. 4. What additional macroeconomic variables should an investor consider when comparing foreign versus domestic investments?

Please be specific, and write a paragraph explaining why.

Thank you!

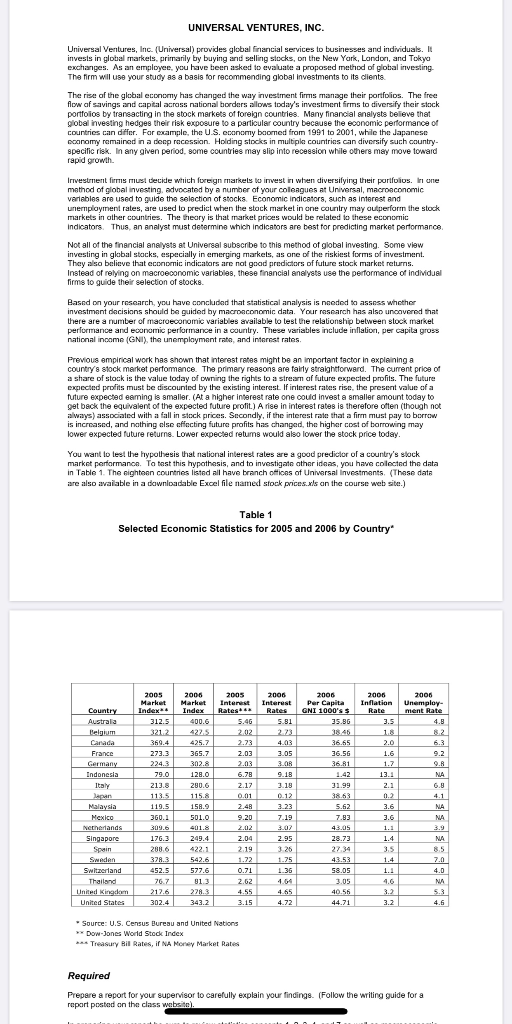

UNIVERSAL VENTURES, INC. Universal Ventures, Inc. (Universal) provides global financial services to businesses and individuals. It invests in global markets, primarily by buying and selling stocks, on the New York, London, and Tokyo exchanges. As an employee, you have been asked to evaluate a proposed method of global investing The firm will use your study as a basis for recommending global investments to its clients The rise of the global economy has changed the way investment firms manage their portfolios. The free flow af savings and capital across national borders allows today's investment firms to diversify their stock portfolios by transacting in the stock markets of foreign countries. Many financial analysts believe that global investing hedges their risk exposure to a particular country because the economic performance of countries can differ. For example, the U.S. economy boomed from 1991 to 2001, while the Japanese economy remained in a deep recession Holding stocks in multiple countries can diversify such country specific risk in any given period, some countries may slip into recession while others may move toward rapid growth Investments must decide which foreign markets to invest in when diversifying their fotosinone method of global investing, advocated by a number of your coloque a Universal, macroeconomic variables are used to guide the selection of stocks Economic indicators, such as interest and unemployment rates, are used to predict when the stock market in one country may outperform the stock markets in other countries. The theory is that market prices would be related to these economic indicators Thus, an analyst must determine which indicators are best for predicting market performance Not all of the financial analysts at Universal subscrbe to this method of global investing some view investing in global stocks, especially in emerging markets, as one of the riskiest forms of investment They also believe that economic indicators are not good predictors of future stock market returns Instead of relying on macroeconomic variables, these financial Analysts the performance of indd ms to guide the selection of stocks U Rased on your research, you have concluded that statistical analysis is needed to assess whether investment decisions should be guided by macroeconomic data, Your research has also vered that re are a number of macroeconomic variables available to test the relationship between stock market performance and economic performance in a country. These variables include inflation, per capila gross national com GNI), the unemployment rate, and interest rates Previous empirical work has shown that interest rates might be an important factor in explaining a country's stock market performance. The primary reasons are tally straightforward. The current price of a share of stock is the value today of owning the rights to a strearn af future expected profits. The future expected profits must be discounted by the existing interest. If interest rates in the present value of a future expected earning is smaller. (At a higher interest rate one could invest a smaller amount today to get back the equivalent of the expected future profit) Arise in interest rates is therefore often though not always) associated with a fall in stock prices. Secondly, if the interest rate that a firm must pay to borrow is increased, and nothing else effecting future profits has changed the higher cost of borrowing may lower expected future returne. Lower expected returns would also lower the stock price today. You want to let the hypothesis that national interest rates are a good predictor of a country's stock market performance. To test this hypothesis, and to investigate other ideas, you have collected the data in Table 1. The nighteen countries listed all have branch otions of Universal Investments. These data are also available in a downloadable Excel file named stock prices.xls on the course website) Table 1 Selected Economic Statistics for 2005 and 2006 by Country 2005 2006 2006 2006 Per capita GNI 1000's 2006 Inflation Rate 2006 Unemploy ment Rate Rates Country Australia Fm 12 France 3.05 36.65 36.55 36 31 31.99 38.53 1158 Mexico 7.19 Singapore 41.8 249.4 422.1 2.95 28.73 27 34 2.19 3.5 Sweden Switzerland Thailand 2886 378.31 4525 1.35 58.05 76.7 0.71 2.62 4.55 3.15 212.6 40.56 228.3 343.2 4.65 4.72 United States Source: U.S. Census Bureau and United Nations Dow Jones World Stock Index Treasury Bill Rates, if NA Money Market Rates Required Prepare a report for your supervisor to carefully explain your findings. (Follow the writing guide for a repart posted on the class website)Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock