Question: Unsure if the first question is correct or not. Please show work. Thanks. 27. Imp entered into the first forward contract to hedge a purchase

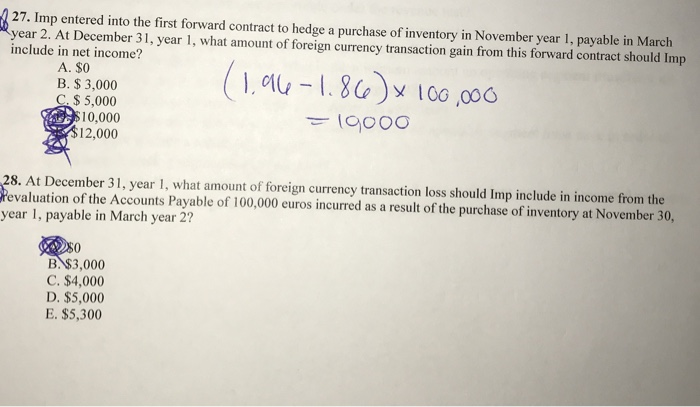

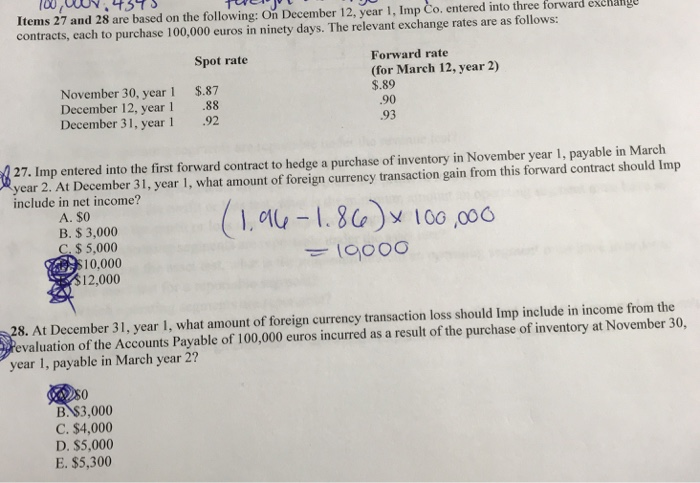

27. Imp entered into the first forward contract to hedge a purchase of inventory in November year 1, payable in March year 2. At December 31, year 1, what amount of foreign currency transaction gain from this forward contract should Imp include in net income? u-1.8 100 ,006 A.$0 B. $ 3,000 C$ 5,000 10,000 12,000 28. At December 31, year 1, what amount of foreign currency transaction loss should Imp include in income from the valuation of the Accounts Payable of 100,000 euros incurred as a result of the purchase of inventory at November 30, year 1, payable in March year 2? B. $3,000 C. $4,000 D. $5,000 E. $5,300 contracts, each to purchase 100,000 euros in ninety days. The relevant exchange rates are as follows: Forward rate Spot rate (for March 12, year 2) $.89 .90 .93 November 30, year 1 $.87 December 12, year 1 .88 December 31, year 92 27. Imp entered into the first forward contract to hedge a purchase of inventory in November year 1, payable in March year 2. At December 31, year 1, what amount of foreign currency transaction gain from this forward contract should Imp include in net income? (l.4 _ l. 86)x 100,000 A. $0 B. $3,000 C. $ 5,000 10,000 12,000 28. At December 31, year 1, what amount of foreign currency transaction loss should Imp include in income from the valuation of the Accounts Payable of 100,000 euros incurred as a result of the purchase of inventory at November 30, year 1, payable in March year 2? B. $3,000 C. $4,000 D. $5,000 E. $5,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts