Question: unsure if what ive put so far is correct or incorredt and could use help on the rest of the problems as well Based on

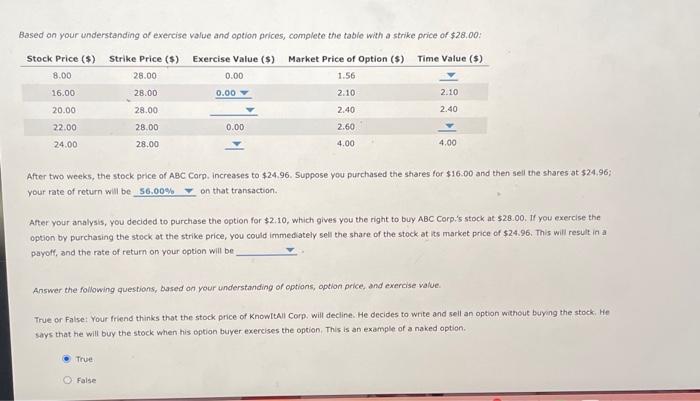

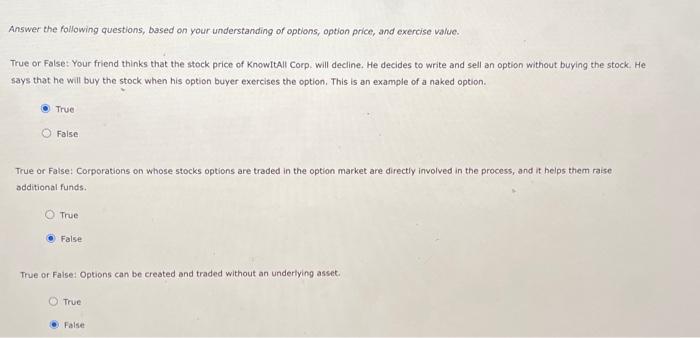

Based on your understanding of exercise value and option prices, complete the table with a strike price of $28,00 : After two weeks, the stock price of ABC Corp. increases to $24.96. 5uppose you purchased the shares for $16.00 and then sell the shares at $24.96; your rate of return will be on that transaction. After your analysis, you decided to purchase the option for $2:10, which gives you the right to bury ABC Corp,'5 stock at $2.8.00. If you exercise the option by purchasing the stock of the strike price, you could immediately sell the share of the stock at its market price of $24.96. This will result in a payoff, and the rate of return on your option will be Answer the following questions, based on your understanding of options, aption price, and exercise value. True or False: Your friend thinks that the stock price of KnowItAll Corp. will decline. He decides to wnte and sell an option without buying the stock. He says that he will buy the stock when his option buyer exereises the option. This is an example of a naked option. True False Answer the rollowing questions, based on your understanding of options, option price, and exercise value. True or False: Your friend thinks that the stock price of KnowItAll Corp. Will decline. He decides to write and sell an option without buying the stock. He says that he will buy the stock when his option buyer exercises the option. This is an example of a naked option. True Faise True or Faise: Corporations on whose stocks options are traded in the option market are directly involved in the process, and it helps them raise additional funds. True False True or False: Options can be created and traded without an underlying asset. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts