Question: unsure on formulas/answers for 3 part for practice exercise Compute the probability weighted expected return of the following stocks Stock A Case Probability Expected Return

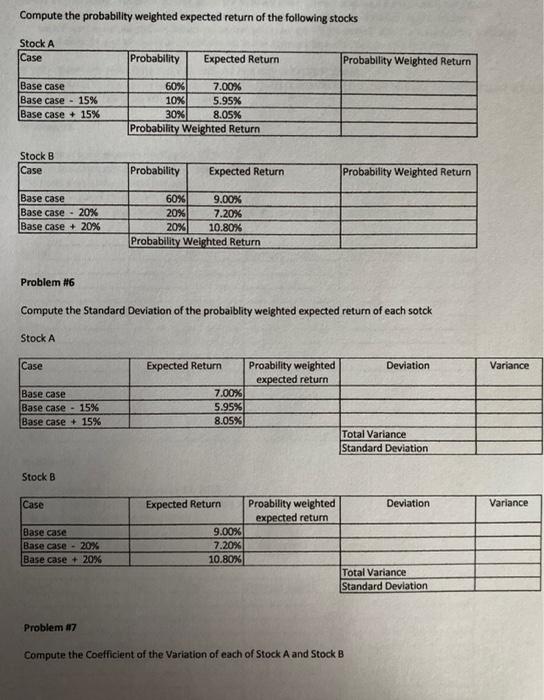

Compute the probability weighted expected return of the following stocks Stock A Case Probability Expected Return Probability Weighted Return Base case Base case - 15% Base case + 15% 60% 7.00% 10% 5.95% 30% 8.05% Probability Weighted Return Stock B Case Probability Expected Return Probability Weighted Return Base case Base case - 20% Base case + 20% 60% 9.00% 20% 7.20% 20% 10.80% Probability Weighted Return Problem #6 Compute the Standard Deviation of the probaiblity welghted expected return of each sotck Stock A Case Expected Return Deviation Variance Proability weighted expected return Base case Base case -15% Base case + 15% 7.00% 5.95% 8.05% Total Variance Standard Deviation Stock B Case Variance Base case Base case - 20% Base case + 20% Expected Return Proability weighted Deviation expected retum 9.00% 7.20% 10.80% Total Variance Standard Deviation Problem #7 Compute the Coefficient of the Variation of each of Stock A and Stock B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts