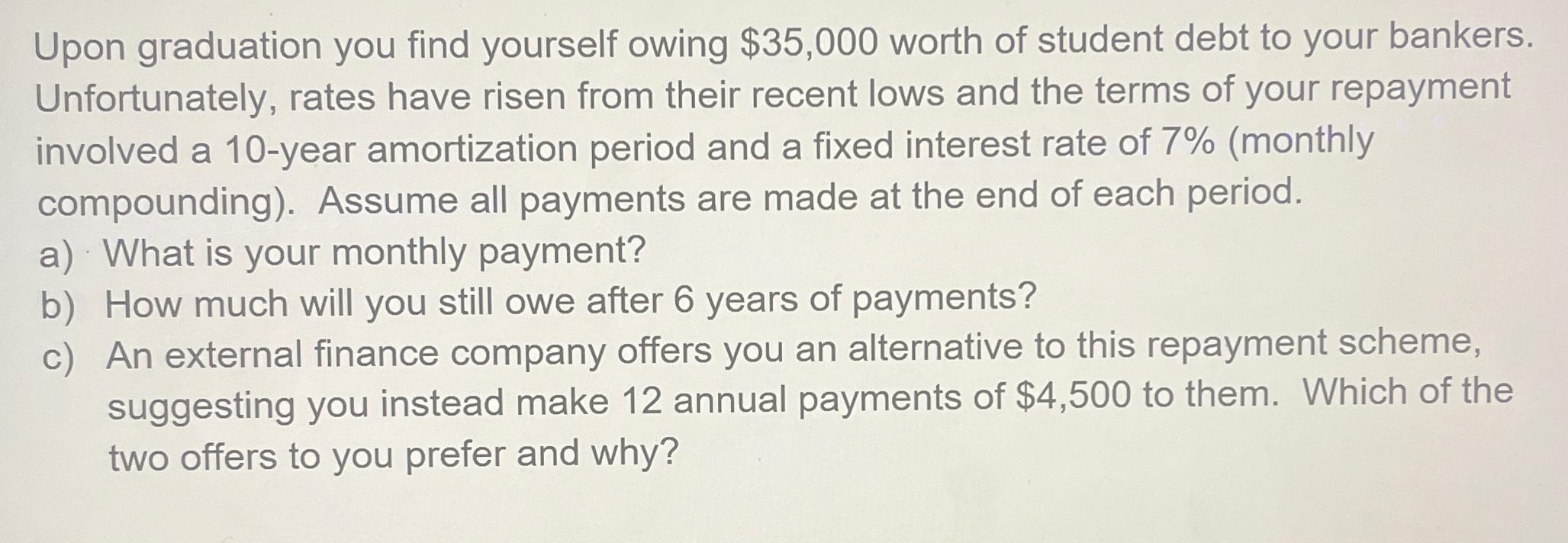

Question: Upon graduation you find yourself owing $ 3 5 , 0 0 0 worth of student debt to your bankers. Unfortunately, rates have risen from

Upon graduation you find yourself owing $ worth of student debt to your bankers. Unfortunately, rates have risen from their recent lows and the terms of your repayment involved a year amortization period and a fixed interest rate of monthly compounding Assume all payments are made at the end of each period.

a What is your monthly payment?

b How much will you still owe after years of payments?

c An external finance company offers you an alternative to this repayment scheme, suggesting you instead make annual payments of $ to them. Which of the two offers to you prefer and why?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock