Question: up-to-date with security updates, fixes, and improvements, choose Check for Updates. 8. Assume that relative Purchasing Power Parity holds and that the: U.S. inflation rate

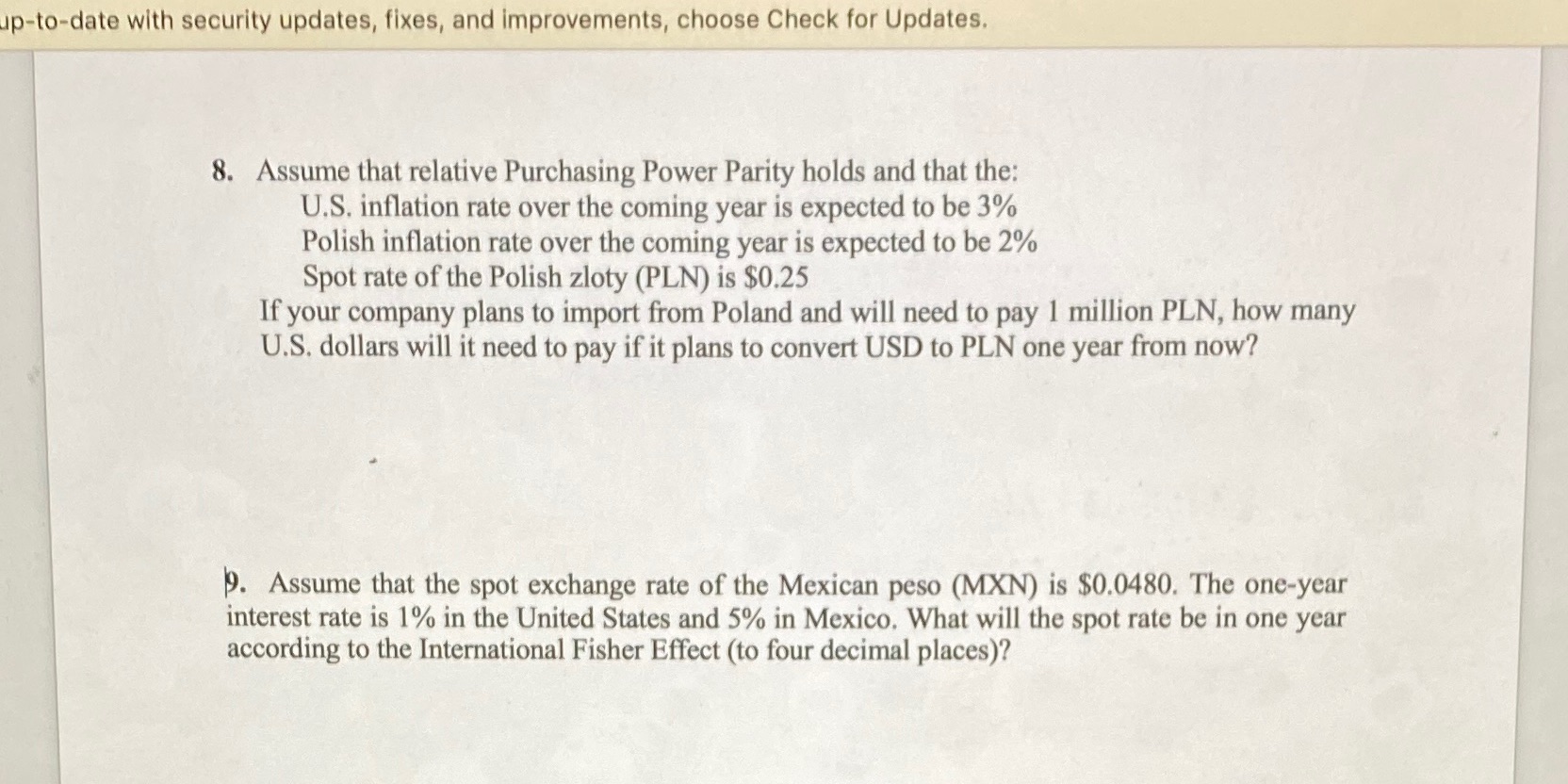

up-to-date with security updates, fixes, and improvements, choose Check for Updates. 8. Assume that relative Purchasing Power Parity holds and that the: U.S. inflation rate over the coming year is expected to be 3% Polish inflation rate over the coming year is expected to be 2% Spot rate of the Polish zloty (PLN) is $0.25 If your company plans to import from Poland and will need to pay 1 million PLN, how many U.S. dollars will it need to pay if it plans to convert USD to PLN one year from now? 9. Assume that the spot exchange rate of the Mexican peso (MXN) is $0.0480. The one-year interest rate is 1% in the United States and 5% in Mexico. What will the spot rate be in one year according to the International Fisher Effect (to four decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts