Question: Upvote will be given for your useful help! Question 1 (12 marks) Denise has just set up an investment plan that would fulfill her life-long

| Upvote will be given for your useful help! |

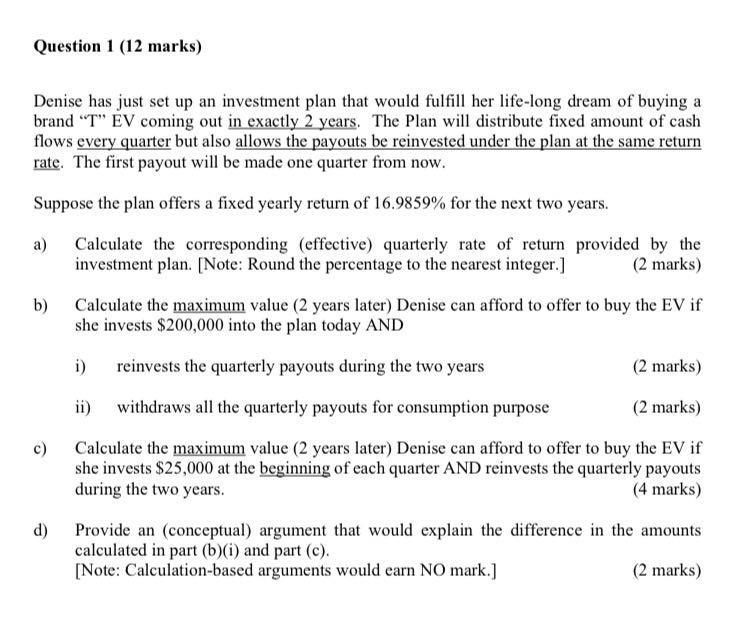

Question 1 (12 marks) Denise has just set up an investment plan that would fulfill her life-long dream of buying a brand "T" EV coming out in exactly 2 years. The Plan will distribute fixed amount of cash flows every quarter but also allows the payouts be reinvested under the plan at the same return rate. The first payout will be made one quarter from now. Suppose the plan offers a fixed yearly return of 16.9859% for the next two years. a) Calculate the corresponding (effective) quarterly rate of return provided by the investment plan. [Note: Round the percentage to the nearest integer.] (2 marks) b) Calculate the maximum value (2 years later) Denise can afford to offer to buy the EV if she invests $200,000 into the plan today AND i) reinvests the quarterly payouts during the two years (2 marks) ii) withdraws all the quarterly payouts for consumption purpose (2 marks) c) Calculate the maximum value (2 years later) Denise can afford to offer to buy the EV if she invests $25,000 at the beginning of each quarter AND reinvests the quarterly payouts during the two years. (4 marks) d) Provide an (conceptual) argument that would explain the difference in the amounts calculated in part (b)(i) and part (c). [Note: Calculation-based arguments would earn NO mark.] (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts