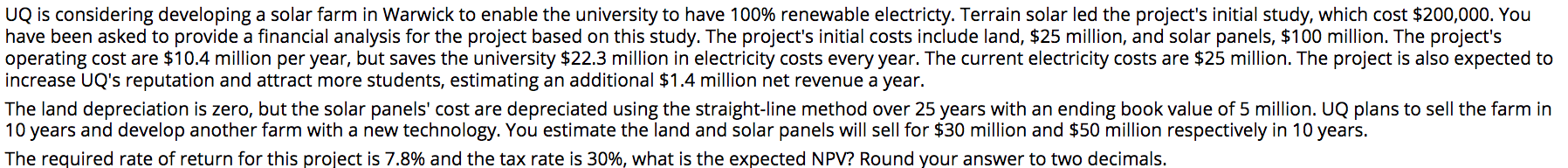

Question: UQ is considering developing a solar farm in Warwick to enable the university to have 100% renewable electricty. Terrain solar led the project's initial study,

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts