Question: UQ is considering developing a solar farm in Warwick to enable the university to have 100% renewable electricty. Terrain solar led the project's initial

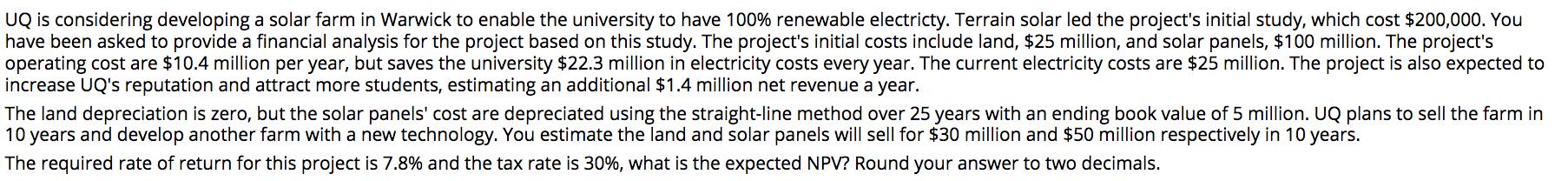

UQ is considering developing a solar farm in Warwick to enable the university to have 100% renewable electricty. Terrain solar led the project's initial study, which cost $200,000. You have been asked to provide a financial analysis for the project based on this study. The project's initial costs include land, $25 million, and solar panels, $100 million. The project's operating cost are $10.4 million per year, but saves the university $22.3 million in electricity costs every year. The current electricity costs are $25 million. The project is also expected to increase UQ's reputation and attract more students, estimating an additional $1.4 million net revenue a year. The land depreciation is zero, but the solar panels' cost are depreciated using the straight-line method over 25 years with an ending book value of 5 million. UQ plans to sell the farm in 10 years and develop another farm with a new technology. You estimate the land and solar panels will sell for $30 million and $50 million respectively in 10 years. The required rate of return for this project is 7.8% and the tax rate is 30%, what is the expected NPV? Round your answer to two decimals.

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

To calculate the expected NPV we need to calculate the cash flows for each year of the projects life ... View full answer

Get step-by-step solutions from verified subject matter experts