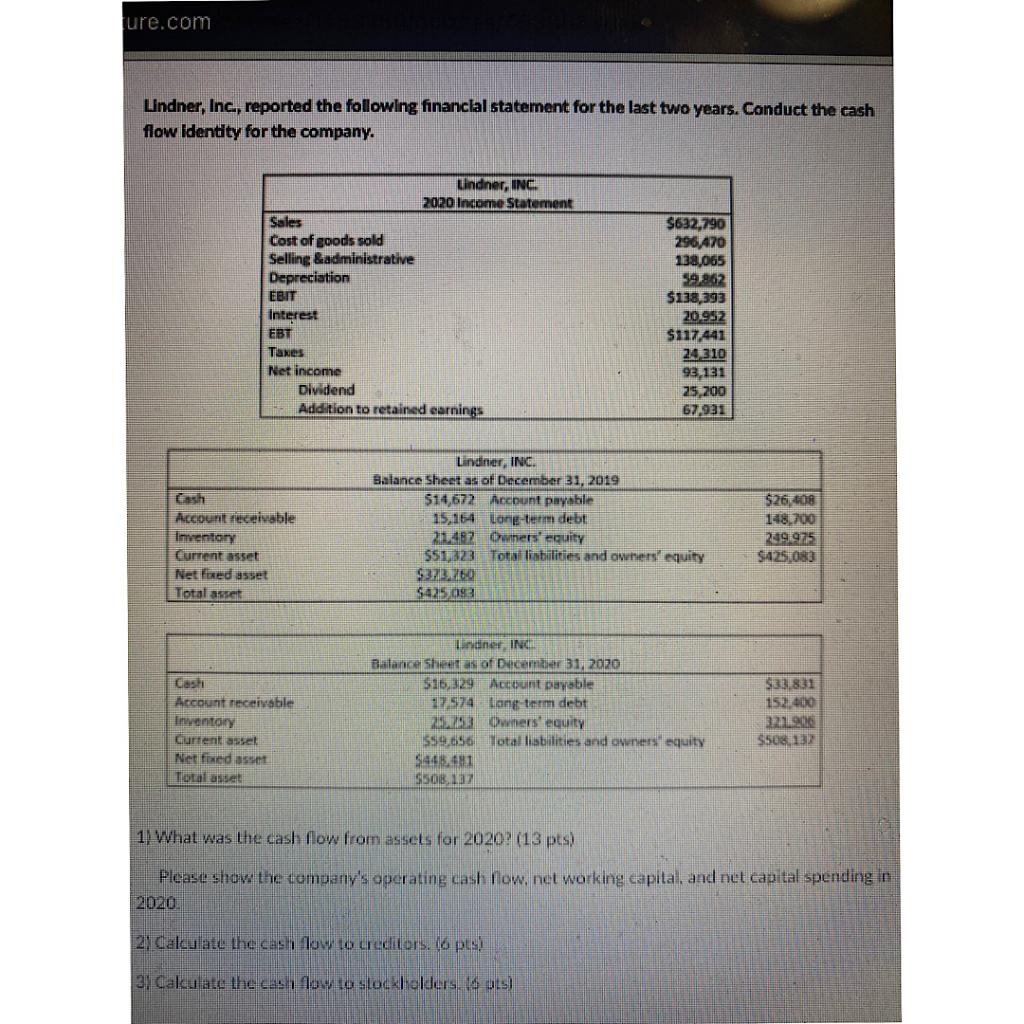

Question: ure.com Lindner, Inc., reported the following financial statement for the last two years. Conduct the cash flow identity for the company. Undner, INC. 2020 Income

ure.com Lindner, Inc., reported the following financial statement for the last two years. Conduct the cash flow identity for the company. Undner, INC. 2020 Income Statement Sales Cost of goods sold Selling &administrative Depreciation EBIT Interest EBT Taxes Net income Dividend Addition to retained earnings $632,790 290,470 138,055 19.862 $138,393 20.932 $117,441 20310 93,131 25,200 67 931 Cash Account Receivable Inventory Current asset Net fixed asset Total asset Ling INCH Balance Sheet as of December 31, 2019 $14,672 Account payable 15,164 Long-term debt 21462 Ownets equity $$1,223 Totallibilities and owner'equity $26408 158,700 209975 $425,082 $425093 Cash Account receivable Inwentary current asset Net fixed asset Lindner, INC Balance sheet of December 31, 2070 $16.329 Account payable 17.574 long term debt 2253 Owners' equity 559.056 lotal liabilities and owners equity $44541 SSO 137 $33,831 152,400 321.2016 $508 132 1. What was the cash flow from assets for 2020? (13 pts) Please show the tempany's operating cash flow, net working capital, and net capital spending in 2020. 2) Calculate the cash low to creditors, lo pus) 3) Cakulate the cash low to stockholders is ots)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts