Question: URGENR HELP PLEASE PLEASE ANSWER ALL!!!!!!! 19 On June 1, 2020, the Crocus Company began construction of a new manufacturing plant. The plant was completed

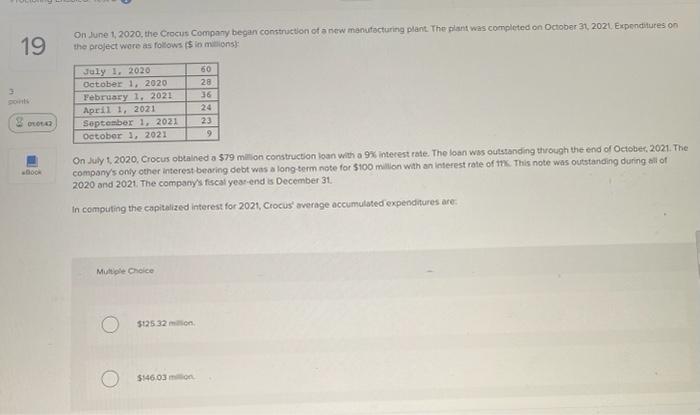

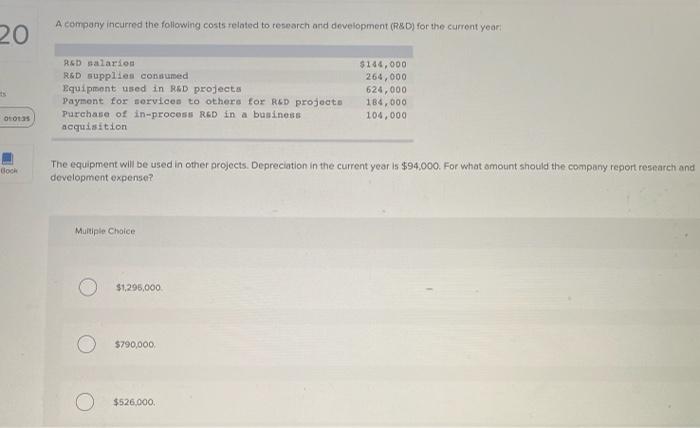

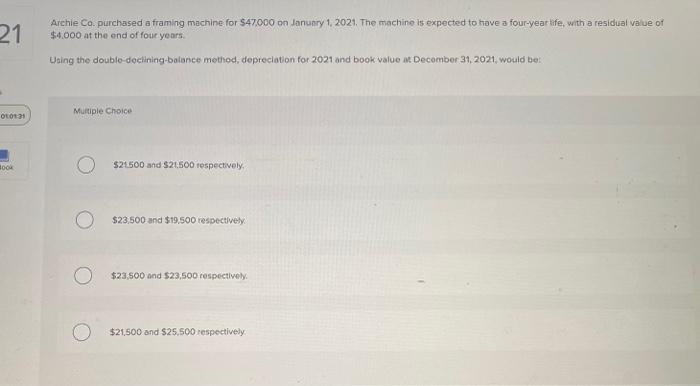

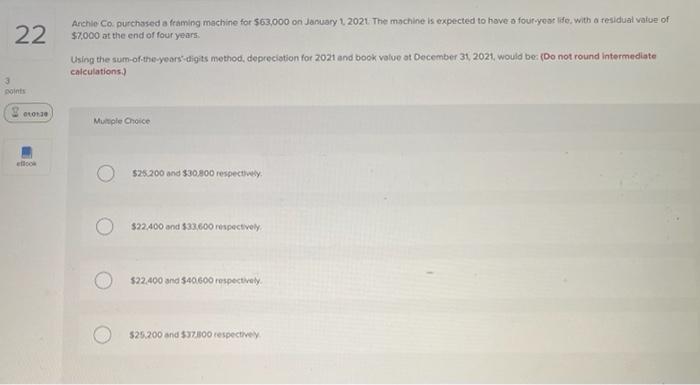

19 On June 1, 2020, the Crocus Company began construction of a new manufacturing plant. The plant was completed on October 31, 2021 Expenditures on the project ware as follows ($ in mions: July 1, 2020 October 1, 2020 February 1, 2021 April 1, 2021 September 1, 2021 October 1, 2021 60 28 36 24 23 9 note 000 On July 1 2020. Crocus obtained a $79 million construction loan with a 9% interest rate. The loan was outstanding through the end of October, 2021. The company's only other interest bearing debt was a long term note for $100 million with an interest rate of this note was outstanding during all of 2020 and 2021 The company's fiscal year-endis December 31 in computing the capitalized interest for 2021, Crocus average accumulated expenditures are: Multiple Choice O $125 32min $146.03 mon A company incurred the following costs related to research and development (R&D) for the current year 20 Rab salarios R&D supplies consumed Equipment used in R&D projects Payment for services to others for RED projects Purchase of in-process RED in a business acquisition $144,000 264,000 624,000 184,000 104,000 Olot Goch The equipment will be used in other projects. Depreciation in the current year is $94,000. For what amount should the company report research and development expense? Multiple Choice $1,295,000 $790,000 $526.000 21 Archie Co. purchased a framing machine for $47000 on January 1, 2021. The machine is expected to have a four-year life, with a residual value of $4.000 at the end of four years Using the doublo declining balance method, depreciation for 2021 and book value at December 31, 2021 would be OTO Multiple Choice ook $24500 and $21.500 respectively, $23.500 and $19,500 respectively. $23,500 and $23,500 respectively $21.500 and $25.500 respectively 22 Archio Co purchased a framing machine for $63,000 on January 1, 2021 The machine is expected to have a four-year fe, with a residual value of $7.000 at the end of four years. Using the sum-of-the-years-digits method, depreciation for 2021 and book value at December 31 2021, would be: (Do not round intermediate calculations.) Doints one Murple Choice $25.200 and $30.000 respectively $22.400 and $33,600 respectively $22.400 and $40.600 respectively $25.200 and $37800 respective

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts