Question: URGENT Answer the following using an excel sheet: Year Machine 1 Machine 2 Initial Investment -5,000.00 $ Annual Cost -3,500.00 $ Salvage Value 500.00 $

URGENT Answer the following using an excel sheet:

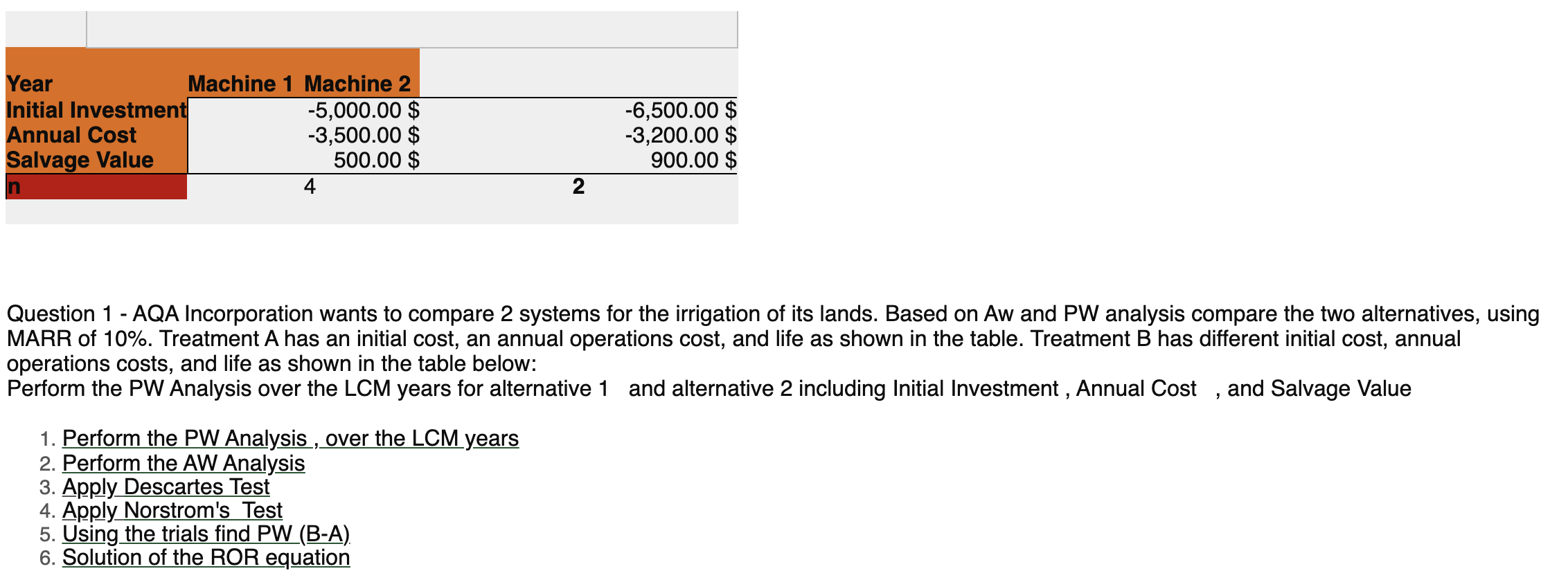

Year Machine 1 Machine 2 Initial Investment -5,000.00 $ Annual Cost -3,500.00 $ Salvage Value 500.00 $ 4 -6,500.00 $ -3,200.00 $ 900.00 $ N Question 1 - AQA Incorporation wants to compare 2 systems for the irrigation of its lands. Based on Aw and PW analysis compare the two alternatives, using MARR of 10%. Treatment A has an initial cost, an annual operations cost, and life as shown in the table. Treatment B has different initial cost, annual operations costs, and life as shown in the table below: Perform the PW Analysis over the LCM years for alternative 1 and alternative 2 including Initial Investment , Annual Cost , and Salvage Value 1. Perform the PW Analysis , over the LCM years 2. Perform the AW Analysis 3. Apply Descartes Test 4. Apply Norstrom's Test 5. Using the trials find PW (B-A) 6. Solution of the ROR equation Year Machine 1 Machine 2 Initial Investment -5,000.00 $ Annual Cost -3,500.00 $ Salvage Value 500.00 $ 4 -6,500.00 $ -3,200.00 $ 900.00 $ N Question 1 - AQA Incorporation wants to compare 2 systems for the irrigation of its lands. Based on Aw and PW analysis compare the two alternatives, using MARR of 10%. Treatment A has an initial cost, an annual operations cost, and life as shown in the table. Treatment B has different initial cost, annual operations costs, and life as shown in the table below: Perform the PW Analysis over the LCM years for alternative 1 and alternative 2 including Initial Investment , Annual Cost , and Salvage Value 1. Perform the PW Analysis , over the LCM years 2. Perform the AW Analysis 3. Apply Descartes Test 4. Apply Norstrom's Test 5. Using the trials find PW (B-A) 6. Solution of the ROR equation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts