Question: Urgent: Basic Question! Please answer as soon as possible.. I just want to ask if you can provide more details steps on how to find

Urgent: Basic Question! Please answer as soon as possible..

I just want to ask if you can provide more details steps on how to find each weight. Because I am bad at math, I just want to know if we cancel out values such dividing or multiplying each side. It is basic maths.

The examples I need help with are below. Please response as soon as you can .. thank you

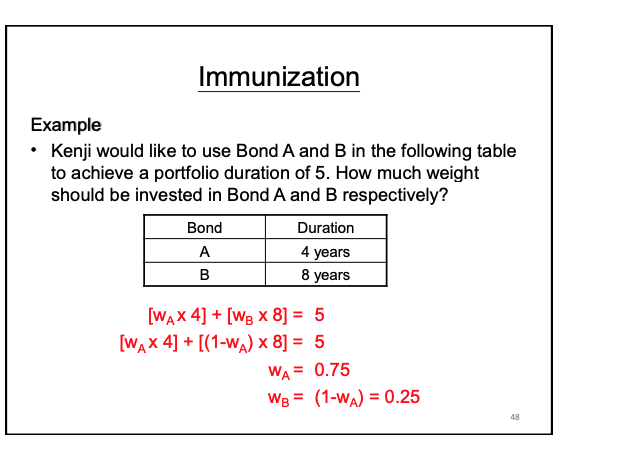

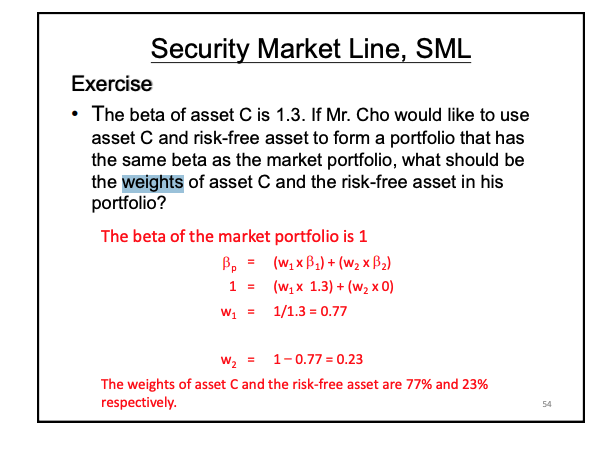

Immunization Example Kenji would like to use Bond A and B in the following table to achieve a portfolio duration of 5. How much weight should be invested in Bond A and B respectively? Bond Duration A 4 years B 8 years [WAX 4] + [Wg x 8] = 5 [WAX 4] + [(1-w) x 8] = 5 WA= 0.75 Wg = (1-wa) = 0.25 48 Security Market Line, SML Exercise The beta of asset C is 1.3. If Mr. Cho would like to use asset C and risk-free asset to form a portfolio that has the same beta as the market portfolio, what should be the weights of asset C and the risk-free asset in his portfolio? The beta of the market portfolio is 1 B = (w2xBx) + (w2 x B2) (w2 x 1.3) + (w2x0) 1/1.3 = 0.77 1 = W = W2 = 1 -0.77 = 0.23 The weights of asset C and the risk-free asset are 77% and 23% respectively. 54

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts