Question: URGENT HELP PLEASE Answer all please The network flows into and out of demand nodes are what makes the production and inventory application modeled is

URGENT HELP PLEASE Answer all please

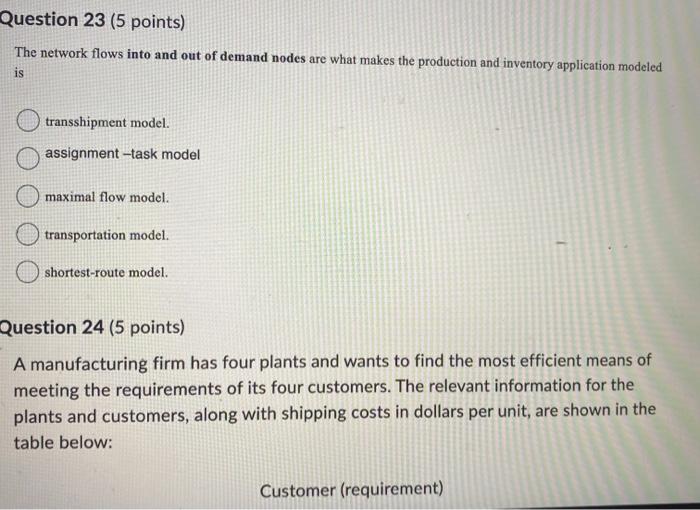

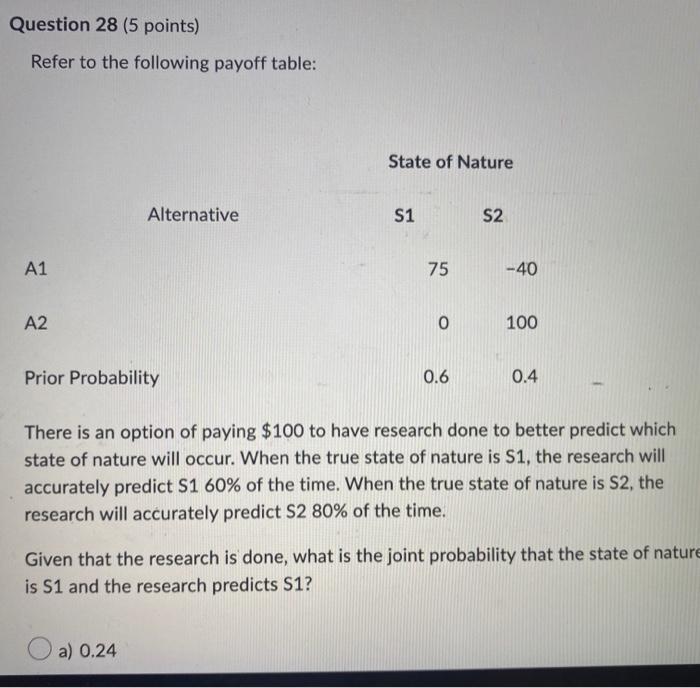

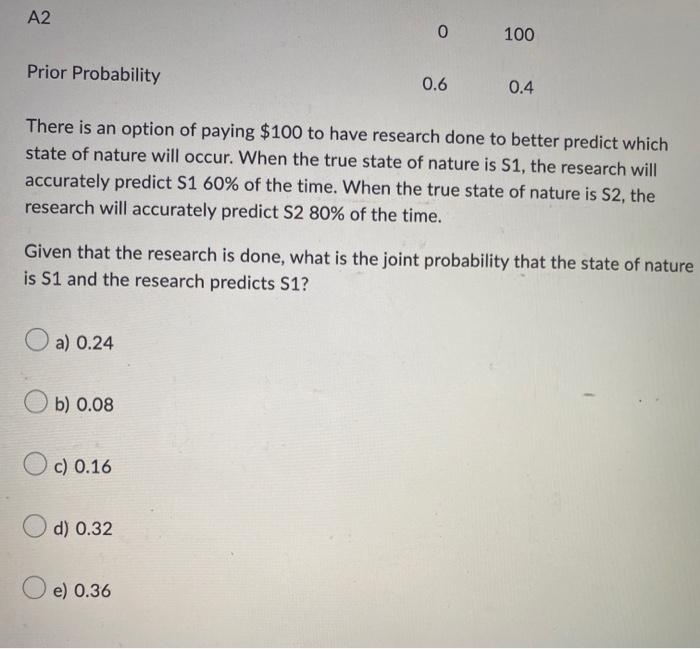

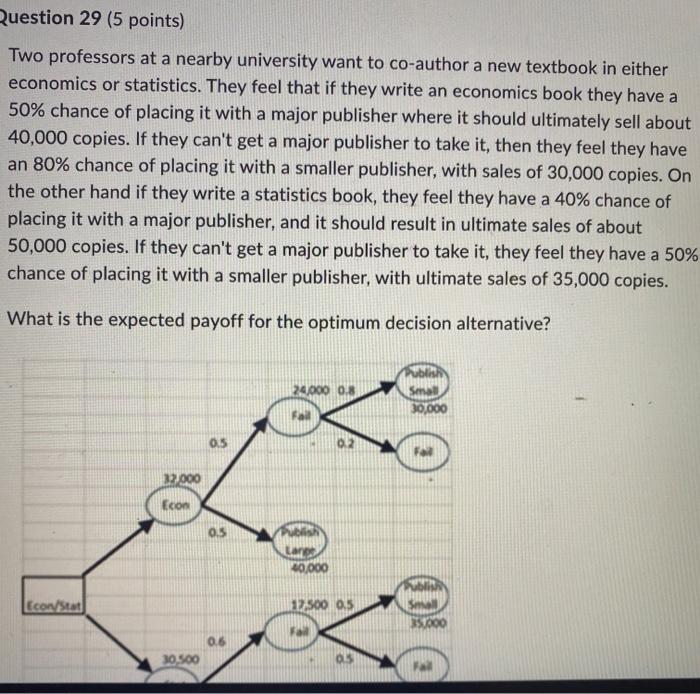

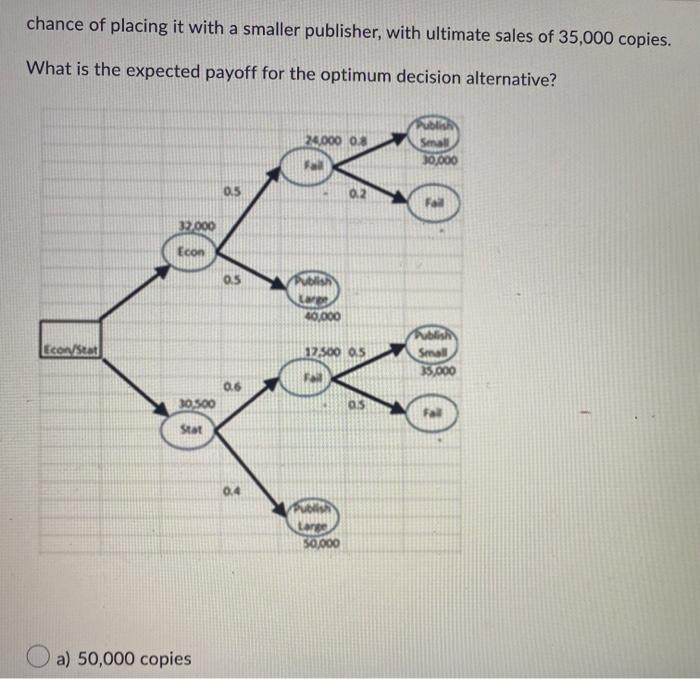

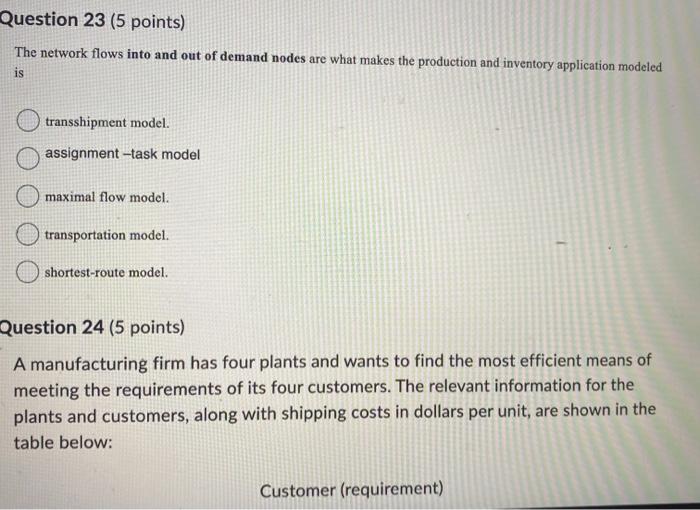

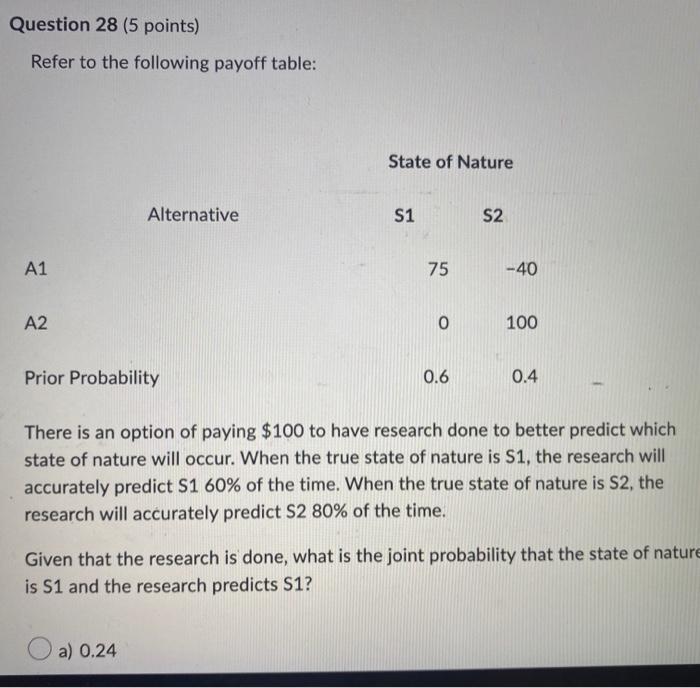

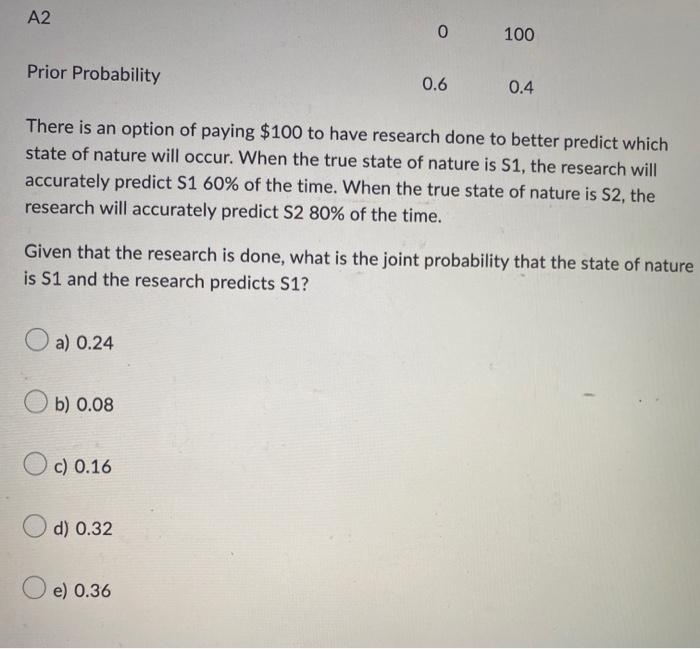

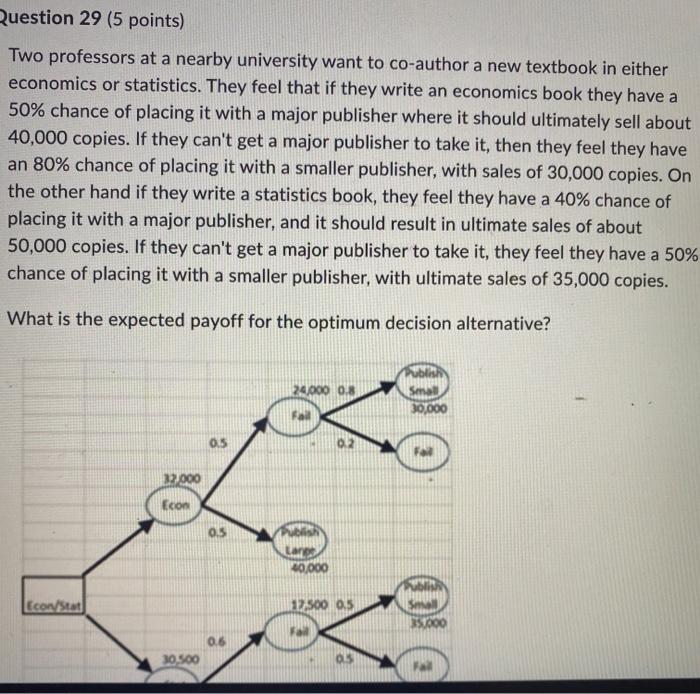

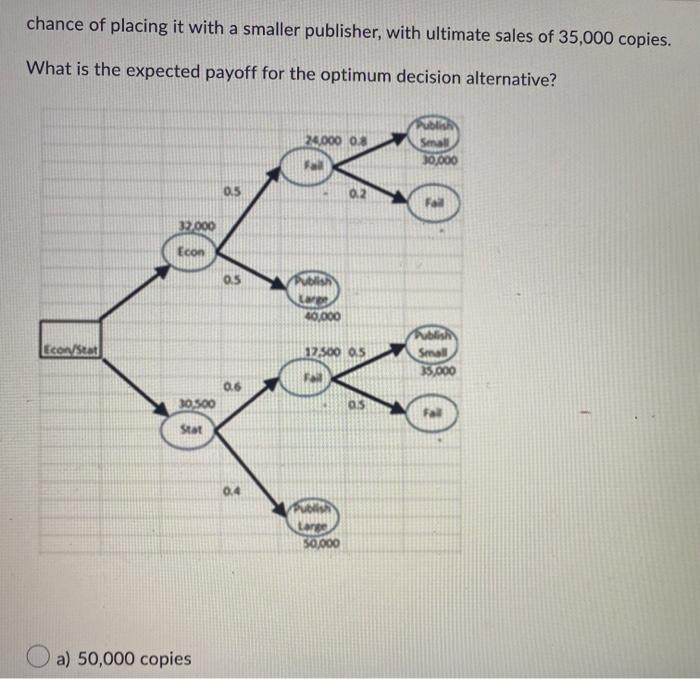

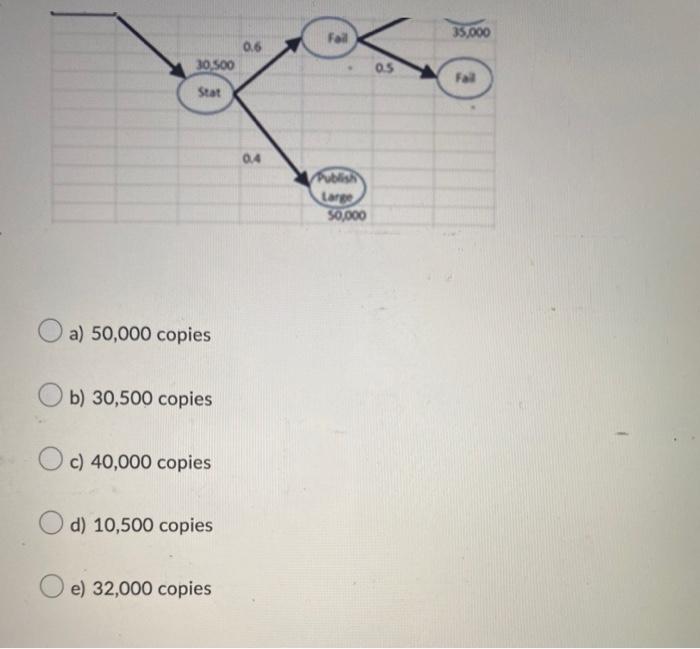

The network flows into and out of demand nodes are what makes the production and inventory application modeled is transshipment model. assignment -task model maximal flow model. transportation model. shortest-route model. Question 24 ( 5 points) A manufacturing firm has four plants and wants to find the most efficient means of meeting the requirements of its four customers. The relevant information for the plants and customers, along with shipping costs in dollars per unit, are shown in the table below: Refer to the following payoff table: There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S, the research will accurately predict S160% of the time. When the true state of nature is S2, the research will accurately predict S280% of the time. Given that the research is done, what is the joint probability that the state of natur is S1 and the research predicts S1 ? a) 0.24 There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time. Given that the research is done, what is the joint probability that the state of nature is S1 and the research predicts S1 ? a) 0.24 b) 0.08 c) 0.16 d) 0.32 e) 0.36 Two professors at a nearby university want to co-author a new textbook in either economics or statistics. They feel that if they write an economics book they have a 50% chance of placing it with a major publisher where it should ultimately sell about 40,000 copies. If they can't get a major publisher to take it, then they feel they have an 80% chance of placing it with a smaller publisher, with sales of 30,000 copies. On the other hand if they write a statistics book, they feel they have a 40% chance of placing it with a major publisher, and it should result in ultimate sales of about 50,000 copies. If they can't get a major publisher to take it, they feel they have a 50% chance of placing it with a smaller publisher, with ultimate sales of 35,000 copies. What is the expected payoff for the optimum decision alternative? chance of placing it with a smaller publisher, with ultimate sales of 35,000 copies. What is the expected payoff for the optimum decision alternative? a) 50,000 copies a) 50,000 copies b) 30,500 copies c) 40,000 copies d) 10,500 copies e) 32,000 copies

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock