Question: URGENT!!! please answer this question less than an hour.Thanks A B Holly, whose regular rate of pay is $15, with time and a half for

URGENT!!! please answer this question less than an hour.Thanks

A

B

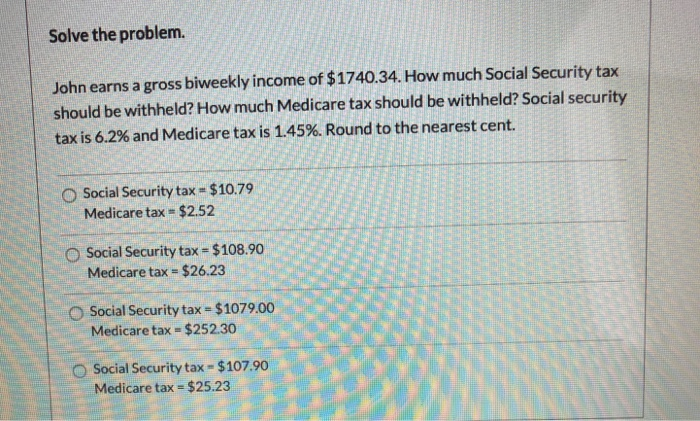

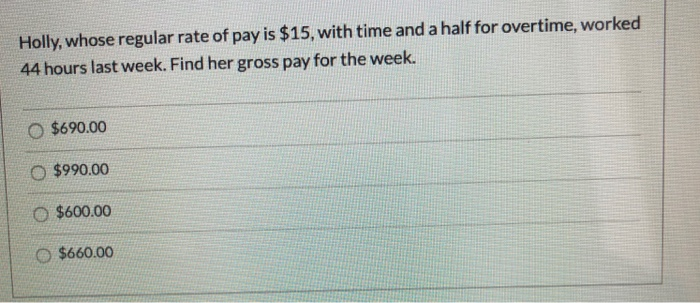

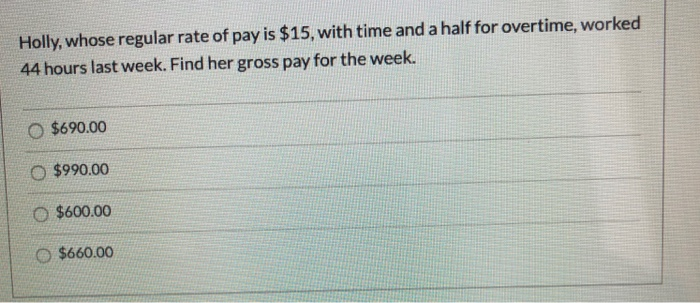

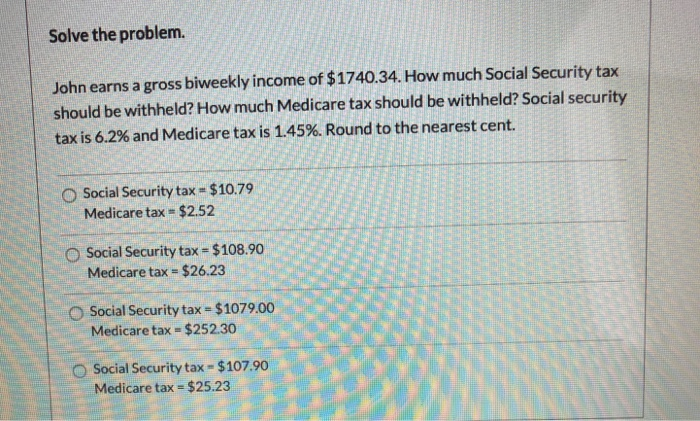

Holly, whose regular rate of pay is $15, with time and a half for overtime, worked 44 hours last week. Find her gross pay for the week $690.00 O $990.00 $600.00 $660.00 Solve the problem. John earns a gross biweekly income of $1740.34. How much Social Security tax should be withheld? How much Medicare tax should be withheld? Social security tax is 6.2% and Medicare tax is 1.45%. Round to the nearest cent O Social Security tax $10.79 Medicare tax-$2.52 OSocial Security tax $108.90 Medicare tax =$26.23 OSocial Security tax = $1079.00 Medicare tax -$252.30 Social Security tax- $107.90 Medicare tax=$25.23

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock