Question: urgently(15 mins) need the correct Solution for this or surely get 10 downvotes. Employee was in receipt of salary of 10 lacs (After deduction u/s

urgently(15 mins) need the correct Solution for this or surely get 10 downvotes.

urgently(15 mins) need the correct Solution for this or surely get 10 downvotes.

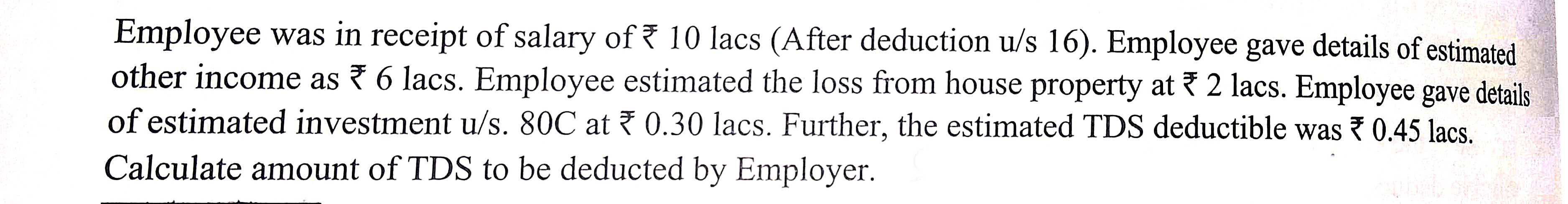

Employee was in receipt of salary of 10 lacs (After deduction u/s 16). Employee gave details of estimated other income as 6 lacs. Employee estimated the loss from house property at * 2 lacs. Employee gave details of estimated investment u/s. 80C at 0.30 lacs. Further, the estimated TDS deductible was 0.45 lacs. Calculate amount of TDS to be deducted by Employer. Employee was in receipt of salary of 10 lacs (After deduction u/s 16). Employee gave details of estimated other income as 6 lacs. Employee estimated the loss from house property at * 2 lacs. Employee gave details of estimated investment u/s. 80C at 0.30 lacs. Further, the estimated TDS deductible was 0.45 lacs. Calculate amount of TDS to be deducted by Employer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts