Question: URGNT, PLEASE KINDLY help me with these questions, will give great thumbs up!` Here are data on two stocks, both of which have discount rates

URGNT, PLEASE KINDLY help me with these questions, will give great thumbs up!`

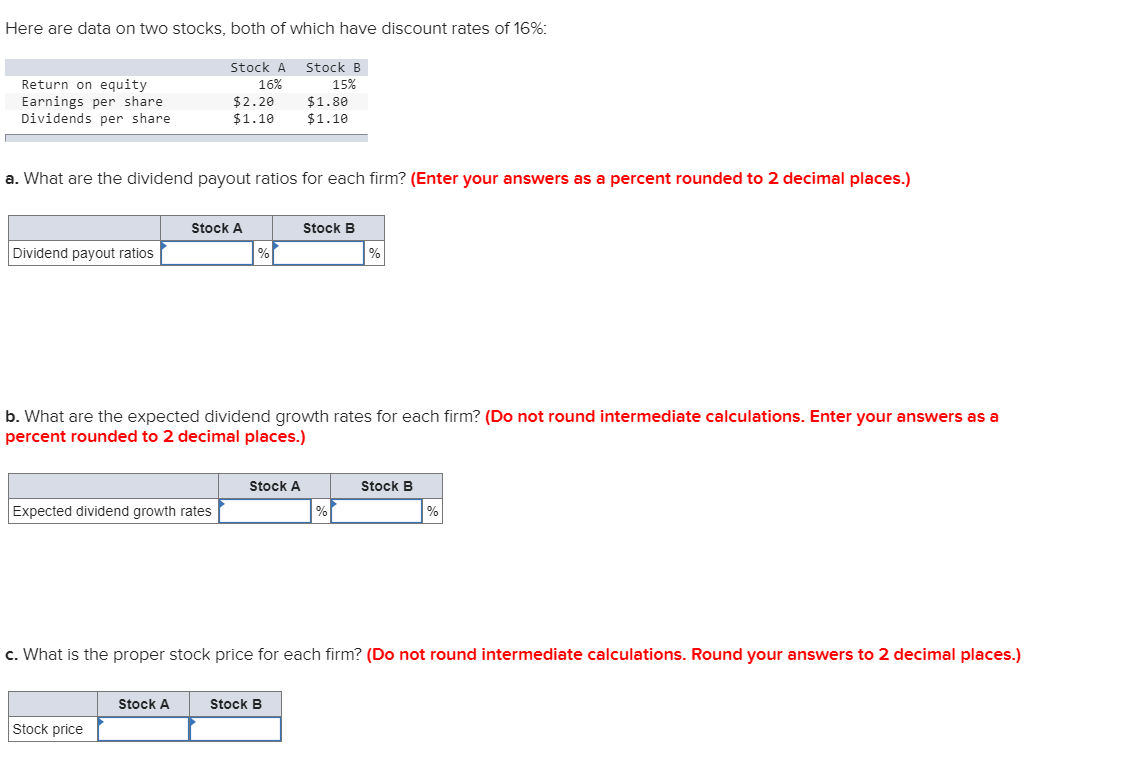

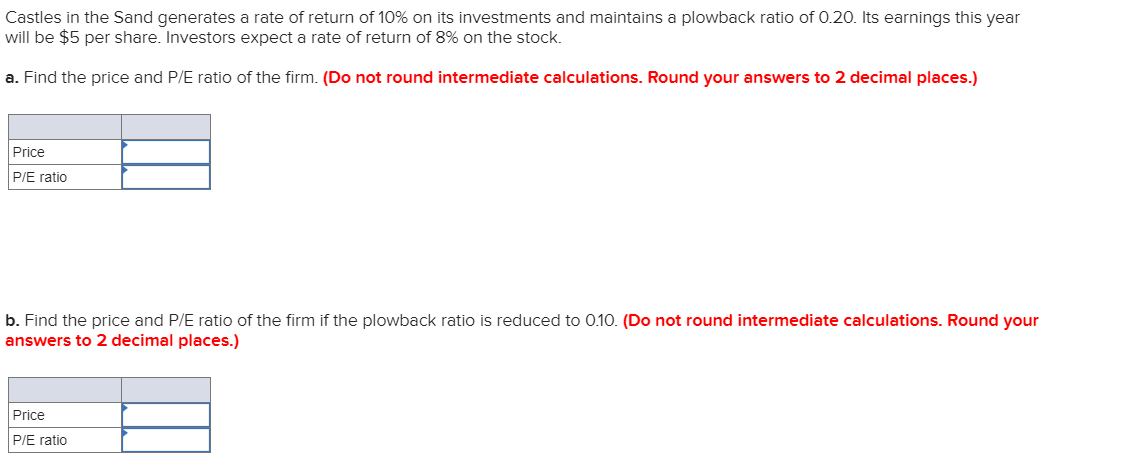

Here are data on two stocks, both of which have discount rates of 16%: Return on equity Earnings per share Dividends per share Stock A 16% $2.20 $1.10 Stock B 15% $1.80 $1.10 a. What are the dividend payout ratios for each firm? (Enter your answers as a percent rounded to 2 decimal places.) Stock A Stock B Dividend payout ratios b. What are the expected dividend growth rates for each firm? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Stock A Stock B Expected dividend growth rates c. What is the proper stock price for each firm? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Stock A Stock B Cooking Stock A ste Stock price Castles in the Sand generates a rate of return of 10% on its investments and maintains a plowback ratio of 0.20. Its earnings this year will be $5 per share. Investors expect a rate of return of 8% on the stock. a. Find the price and P/E ratio of the firm. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Price P/E ratio b. Find the price and P/E ratio of the firm if the plowback ratio is reduced to 0.10. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Price P/E ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts