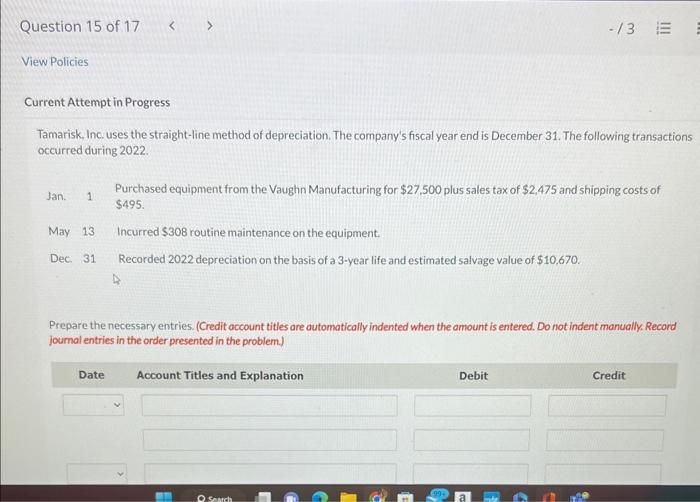

Question: urrent Attempt in Progress Tamarisk, Inc. uses the straight-line method of depreciation. The company's fiscal year end is December 31 . The following transactions occurred

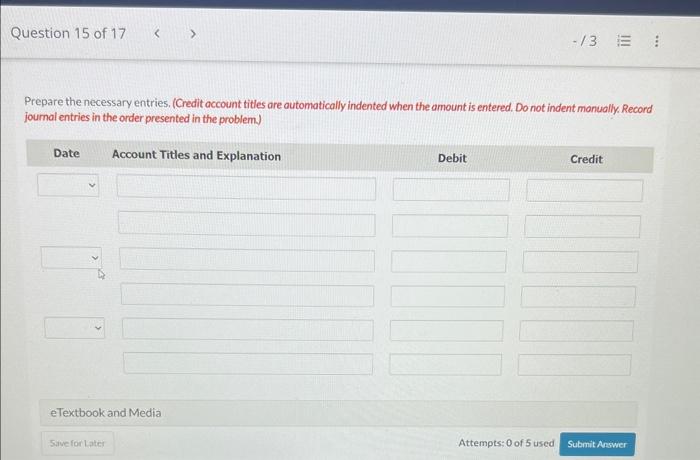

urrent Attempt in Progress Tamarisk, Inc. uses the straight-line method of depreciation. The company's fiscal year end is December 31 . The following transactions occurred during 2022. Jan. 1 Purchased equipment from the Vaughn Manufacturing for $27,500 plus sales tax of $2,475 and shipping costs of $495 May 13 Incurred $308 routine maintenance on the equipment. Dec. 31 Recorded 2022 depreciation on the basis of a 3-year life and estimated salvage value of $10,670. Prepare the necessary entries. (Credit account titles are outomatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Prepare the necessary entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) eTextbook and Media Attempts: 0 of 5 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts