Question: urrent Attempt in Progress Which of the following temporary differences results in a future taxable amount? Subscriptions received in advance. Sales accounted for on the

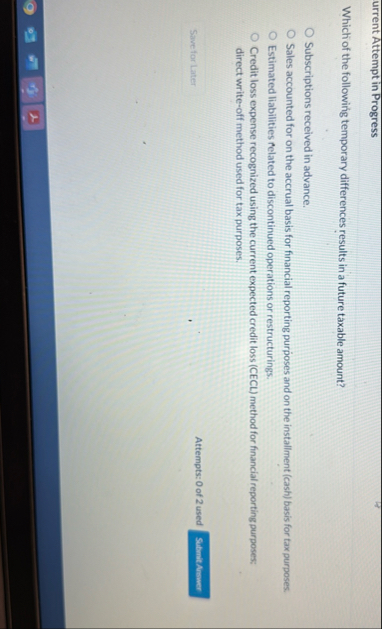

urrent Attempt in Progress

Which of the following temporary differences results in a future taxable amount?

Subscriptions received in advance.

Sales accounted for on the accrual basis for financial reporting purposes and on the installment cash basis for tax purposes.

Estimated liabilities felated to discontinued operations or restructurings.

Credit loss expense recognized using the current expected credit loss CECL method for financial reporting purposes: direct writeoff method used for tax purposes.

Attempts: of used

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock