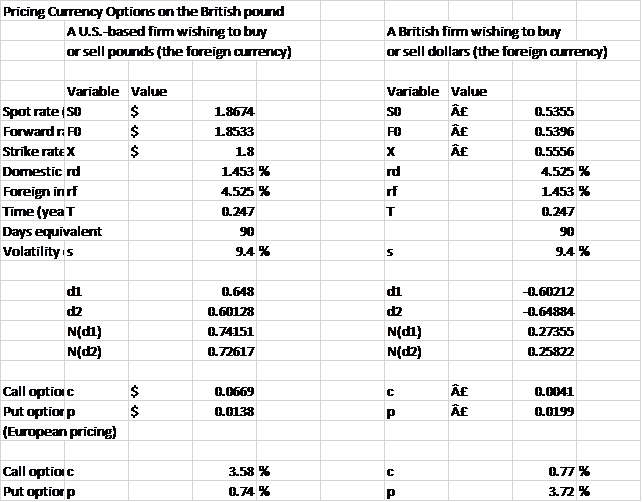

Question: U.S. Dollar/British Pound. Assuming the same initial values for the dollar/pound cross rate in this table how much more would a call option on pounds

U.S. Dollar/British Pound. Assuming the same initial values for the dollar/pound cross rate in this table

how much more would a call option on pounds be if the maturity increases from 90 to 180 days? What percentage increase is this for the length of maturity?

If the maturity increases from 90 to 180 days, a call option on pounds would be $ /. (Round to six decimalplaces.)

Pricing Currency Options on the British pound A U.S.-based firm wishing to buy or sell pounds (the foreign arrency) A British firm wishing to buy or sell dollars (the foreign arrency) Variable Value SO 18674 0.5355 6.5396 1.8533 FO 1.8 0.5556 Variable Value Spot rate (SO $ Forwardr. FO $ Strikerate X $ Domestic rd Foreign inrf Time (yeaT Days equivalent Volatility's X rd 4.525 % 1453 % 4.525 % rf 1453 % 0.247 T 0.247 90 90 9.4 % S 9.4% 6.61712 6.64884 di d2 Ndi) N(2) 6.648 0.60128 0.74151 0.72617 di d2 Ndi) N(2) 0.27655 0.25802 0.0669 c f Call optionc Put optiorp (European pricing) $ $ C.0041 0.0199 0.01139 Af C Call optionc Put optiorp 3.58 % 0.74% 0.77% 3.72 % P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts