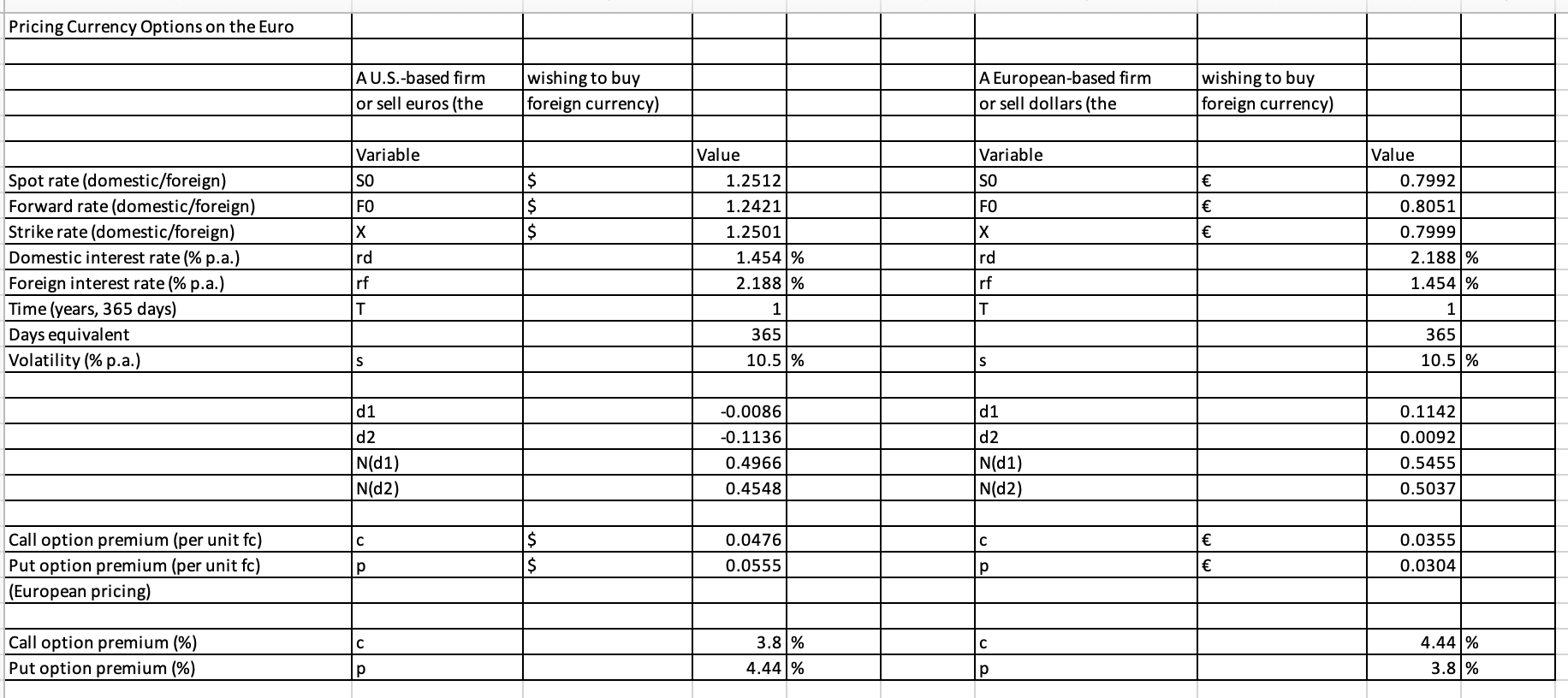

Question: U.S. Dollar/Euro. The table, , indicates that a 1-year call option on euros at a strike rate of $1.2501/ will cost the buyer $0.0476 /

U.S. Dollar/Euro. The table, , indicates that a 1-year call option on euros at a strike rate of $1.2501/ will cost the buyer $0.0476 / , or 3.80%. But that assumed a volatility of 10.500% when the spot rate was $1.2512 / . What would the same call option cost if the volatility reduced to 10.500% when the spot rate fell to $1.2477/? The same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2477/ would be $ I. (Round to four decimal places.) U.S. Dollar/Euro. The table, , indicates that a 1-year call option on euros at a strike rate of $1.2501/ will cost the buyer $0.0476 / , or 3.80%. But that assumed a volatility of 10.500% when the spot rate was $1.2512 / . What would the same call option cost if the volatility reduced to 10.500% when the spot rate fell to $1.2477/? The same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2477/ would be $ I. (Round to four decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts