Question: U.S. If a return's due date is extended, a taxpayer has 30 days following the original due date to pay estimated taxes without penalty. is

U.S.

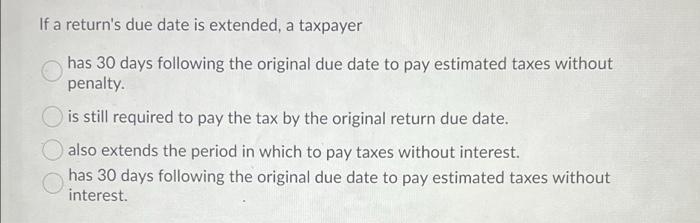

If a return's due date is extended, a taxpayer has 30 days following the original due date to pay estimated taxes without penalty. is still required to pay the tax by the original return due date. also extends the period in which to pay taxes without interest. has 30 days following the original due date to pay estimated taxes without interest

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock