Question: use 2nd pic for numbers. answer ASAP PLEASE will give thumbs up CB Solutions. Heather O'Reily, the treasurer of CB Solutions, believes interest rates are

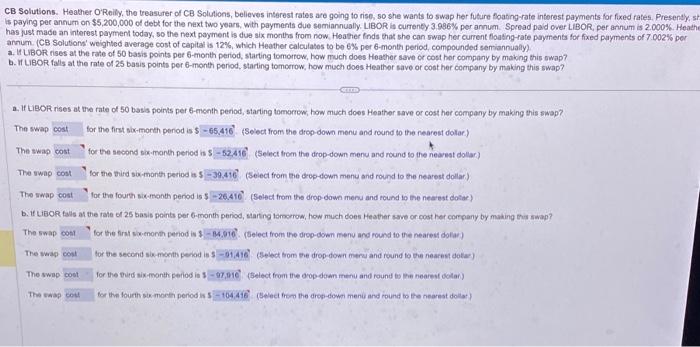

CB Solutions. Heather O'Reily, the treasurer of CB Solutions, believes interest rates are going to rise, so she wants to swap her future foating-rate interest payments for fixed fates. Presenty, sh is paying per annum on $5,200,000 of debt for the next two years, with payments due somiannually. LieOR is currentey 3 . 9S6\% per annum. Spread pad over LiBOR; per annum is 2.000%. Heathe has just made an interest payment today, so the next payment is due six months from now. Heather tnds that she can swap her current foating-rate payments for fixed payments of 7.002% per annum. (CB Solutions' weighted average cost of capitar is 12%, which Heather calculatos to be 6% per 6 -month period, compounded seniannually) a. 11 LBOR rises at the rate of 50 basis points per 6-month period, starting tomorrow, how much does Heather save or cost her oompany by makng this owap? b. If LieOR falls at the rate of 25 basis points per 6-month period, starting tomorrow, how much does Heathor save or cost her company by making this swap? a. If LiBOR rises at the rate of 50 basls points per 6 -micnth penod, staring tomorrow, how much does Heather save or cost her company by making this swap? The swap for the first six-month penod is: (Select from the drop-down menu and round to the nearest dolac) The swap for the second sow-morth penod is 1 (Seiect from the drop-down meny and round to the neareat dollar.) The swap for the third six-month period is ? (Felect from the drop-down meny and round to the nearest dollar.). The swap Iot the fourth sivemanth penod is 5 (Select from the drop-down mens and round io the nearest dotac) b. If LiBOR tals at the tate of 25 basis peints per 6-month period, sarting lomorow, how much does theather seve or cost her corpany by making tha swap? The swap for the first swenonth penod is : (fielect from the drop-down meny and round to the nearest dofar) The swap tor the second so.menth period is: (Felect bom the drop-down meres and round to the nearest dotes) The swap for the pird aix-month period is 1 (Select from the oropdown menu and round bs the nearest oolan) The ewap tor the fourth su-month penod is ! (Eenct trop the drop-dewn menu and round to the nearest dollar) CB Solutions. Heather OReilly, the treasurer of CB Solufions, beleves interest rates are going to rise, so she wants to swap her future floating-rate interest payments for fixed rates. Presently, sh is paying per annum on $5,200,000 of debt for the next two years, with payments due semiannually. LIBOR is currently 4,001%% por annum. $ ppread paid over LIBOR, per annum is 2.000\%. Heathe has just made an interest payment today, so the next payment is due six months from now. Heather finds that she can swap her current floating-rate payments for fixed payments of 7.006% annum. (CB Solutions' weightod average cost of capital is 12%, which Heather calculates to be 6% per 6 -month period, compounded semiannually). a. If LBOR rises at the rate of 50 basis points per 6 -month period, starting tomorrow, how much does Heather save or cost hor company by making this swap? b. If LIBOR fals at the rate of 25 basis points per 6-month period, starting lomorow, how much doos Heather save or cost her company by making this swap? a. If LBOR rises at the rate of 50 basis points por 6-month penod, starting tomorrow, how much does Heather save or cost her company by making thss swap? The swap for the first six-month period is 9 (Select from the drop-down menu and round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts