Question: use A/P, A/F Question 1. A large food-processing corporation is considering using laser technology to speed up and eliminate waste in the potato-peeling process. To

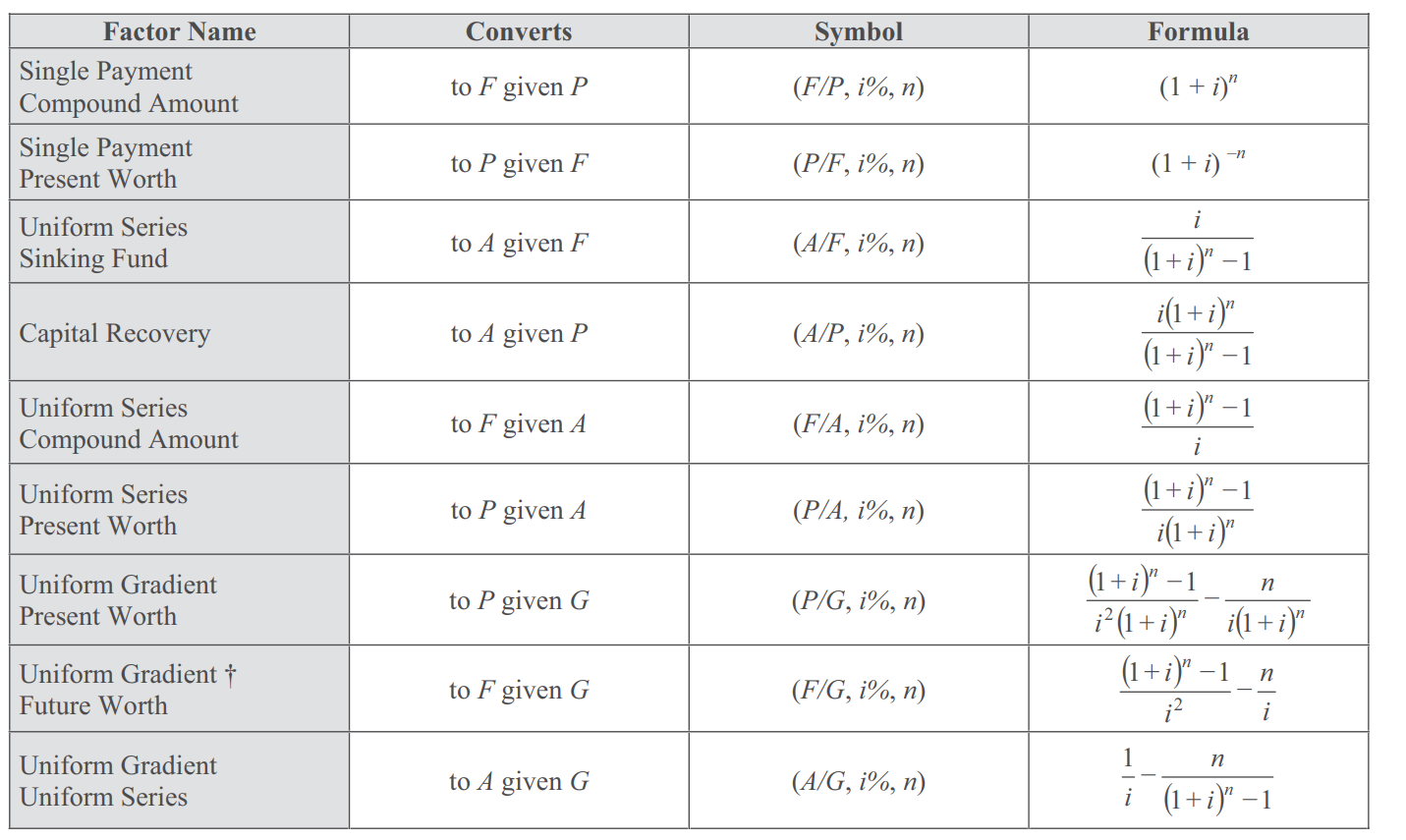

use A/P, A/F

use A/P, A/F

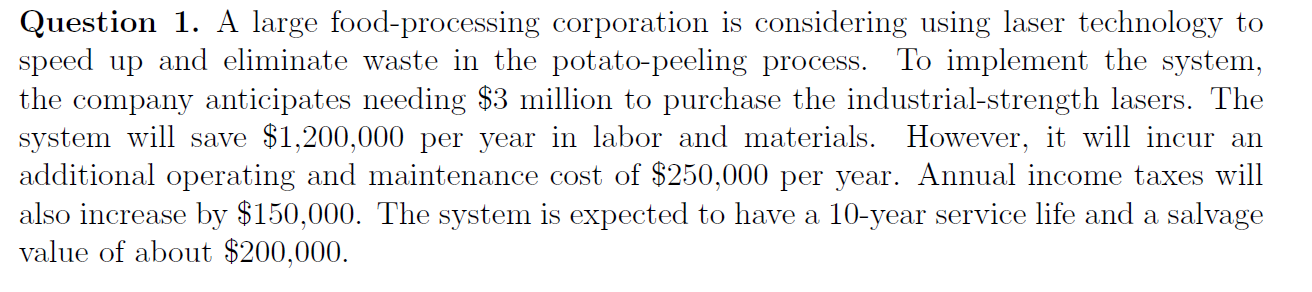

Question 1. A large food-processing corporation is considering using laser technology to speed up and eliminate waste in the potato-peeling process. To implement the system, the company anticipates needing $3 million to purchase the industrial-strength lasers. The system will save $1,200,000 per year in labor and materials. However, it will incur an additional operating and maintenance cost of $250,000 per year. Annual income taxes will also increase by $150,000. The system is expected to have a 10-year service life and a salvage value of about $200,000. (iii) If the company's MARR is 18%, justify the economics of the project using the NAW method and the company should implement the laser system. Converts Symbol Formula to F given P (F/P, i%, n) (1 + i)" Factor Name Single Payment Compound Amount Single Payment Present Worth to P given F (P/F, i%, n) (1 + i) " i Uniform Series Sinking Fund to A given F (A/F, i%, n) + Capital Recovery to A given P (A/P, i%, n) (1+i)" -1 i(1 + i)" (1+i) 1 (1+i) 1 Uniform Series Compound Amount to F given A (F/A, i%, n) i Uniform Series Present Worth to P given A (P/A, i%, n) n Uniform Gradient Present Worth to P given G (P/G, i%, n) (1+i) 1 i(1+i)" (1+i)" -1 i? (1+i)" i(1+i)" (1+i) 1 i2 i + n Uniform Gradient Future Worth to F given G (F/G, i%, n) 1 n Uniform Gradient Uniform Series to A given G (A/G, i%, n) i (1+i)" 1 Question 1. A large food-processing corporation is considering using laser technology to speed up and eliminate waste in the potato-peeling process. To implement the system, the company anticipates needing $3 million to purchase the industrial-strength lasers. The system will save $1,200,000 per year in labor and materials. However, it will incur an additional operating and maintenance cost of $250,000 per year. Annual income taxes will also increase by $150,000. The system is expected to have a 10-year service life and a salvage value of about $200,000. (iii) If the company's MARR is 18%, justify the economics of the project using the NAW method and the company should implement the laser system. Converts Symbol Formula to F given P (F/P, i%, n) (1 + i)" Factor Name Single Payment Compound Amount Single Payment Present Worth to P given F (P/F, i%, n) (1 + i) " i Uniform Series Sinking Fund to A given F (A/F, i%, n) + Capital Recovery to A given P (A/P, i%, n) (1+i)" -1 i(1 + i)" (1+i) 1 (1+i) 1 Uniform Series Compound Amount to F given A (F/A, i%, n) i Uniform Series Present Worth to P given A (P/A, i%, n) n Uniform Gradient Present Worth to P given G (P/G, i%, n) (1+i) 1 i(1+i)" (1+i)" -1 i? (1+i)" i(1+i)" (1+i) 1 i2 i + n Uniform Gradient Future Worth to F given G (F/G, i%, n) 1 n Uniform Gradient Uniform Series to A given G (A/G, i%, n) i (1+i)" 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts