Question: Use computer spread sheet to solve the following questions please 7. You are planning to retire in 40 years and want to have enough money

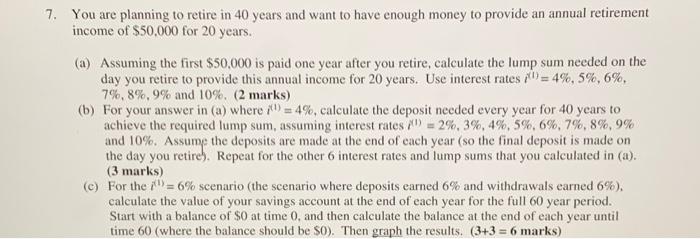

7. You are planning to retire in 40 years and want to have enough money to provide an annual retirement income of $50,000 for 20 years. (a) Assuming the first $50,000 is paid one year after you retire, calculate the lump sum needed on the day you retire to provide this annual income for 20 years. Use interest rates 10) = 4%, 5%, 6%, 7%, 8% 9% and 10%. (2 marks) (b) For your answer in (a) where ) = 4%, calculate the deposit needed every year for 40 years to achieve the required lump sum, assuming interest rates!) - 2%,3%, 4%, 5%, 6%, 7%, 8%, 9% and 10%. Assume the deposits are made at the end of each year (so the final deposit is made on the day you retire). Repeat for the other o interest rates and lump sums that you calculated in (a). (3 marks) (c) For the it!) = 6% scenario (the scenario where deposits earned 6% and withdrawals earned 6%). calculate the value of your savings account at the end of each year for the full 60 year period. Start with a balance of SO at time 0, and then calculate the balance at the end of each year until time 60 (where the balance should be SO). Then graph the results. (3+3 = 6 marks) 7. You are planning to retire in 40 years and want to have enough money to provide an annual retirement income of $50,000 for 20 years. (a) Assuming the first $50,000 is paid one year after you retire, calculate the lump sum needed on the day you retire to provide this annual income for 20 years. Use interest rates 10) = 4%, 5%, 6%, 7%, 8% 9% and 10%. (2 marks) (b) For your answer in (a) where ) = 4%, calculate the deposit needed every year for 40 years to achieve the required lump sum, assuming interest rates!) - 2%,3%, 4%, 5%, 6%, 7%, 8%, 9% and 10%. Assume the deposits are made at the end of each year (so the final deposit is made on the day you retire). Repeat for the other o interest rates and lump sums that you calculated in (a). (3 marks) (c) For the it!) = 6% scenario (the scenario where deposits earned 6% and withdrawals earned 6%). calculate the value of your savings account at the end of each year for the full 60 year period. Start with a balance of SO at time 0, and then calculate the balance at the end of each year until time 60 (where the balance should be SO). Then graph the results. (3+3 = 6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts