Question: Use Eigure 23.7 Suppose the LIBOR rate when the first listed Eurodollar contract matures in January 2019 is 3,1%. What will be the profit or

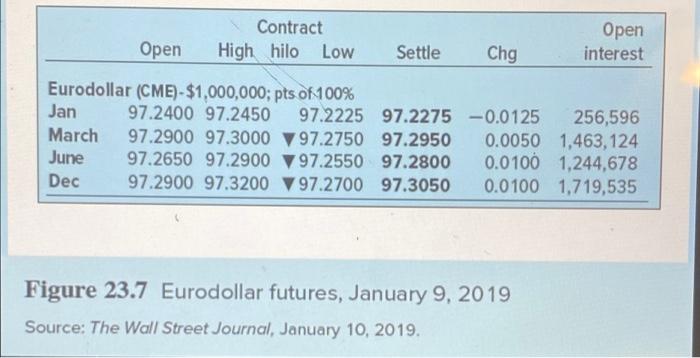

Use Eigure 23.7 Suppose the LIBOR rate when the first listed Eurodollar contract matures in January 2019 is 3,1%. What will be the profit or loss to each side of the Eurodollar contract? (Do not round Intermediate calculations and round final answer to 2 decimal places. Enter the amount as positive value.) Gain Open Contract High hilo Low Open interest Settle Chg Eurodollar (CME)-$1,000,000; pts of 100% Jan 97.2400 97.2450 97.2225 97.2275 -0.0125 256,596 March 97.2900 97.3000 97.2750 97.2950 0.0050 1,463,124 June 97.2650 97.2900 7 97.2550 97.2800 0.0100 1,244,678 Dec 97.2900 97.3200 97.2700 97.3050 0.0100 1,719,535 Figure 23.7 Eurodollar futures, January 9, 2019 Source: The Wall Street Journal, January 10, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts